XRP ETF purposes have now formally begun, as Franklin Templeton has simply filed for a spot XRP ETF with CBOE. That is, surely, a major growth within the cryptocurrency area, coming proper after spot Bitcoin and Ethereum ETFs have been authorized within the U.S.

JUST IN: $1.5 trillion Franklin Templeton information for spot $XRP ETF with CBOE.

— Watcher.Guru (@WatcherGuru) March 13, 2025

Learn extra: BRICS: Prime Financial institution Predicts US Greenback May Lose International Standing

Franklin Templeton’s $1.5 Trillion XRP ETF Submitting Amid Crypto Dangers

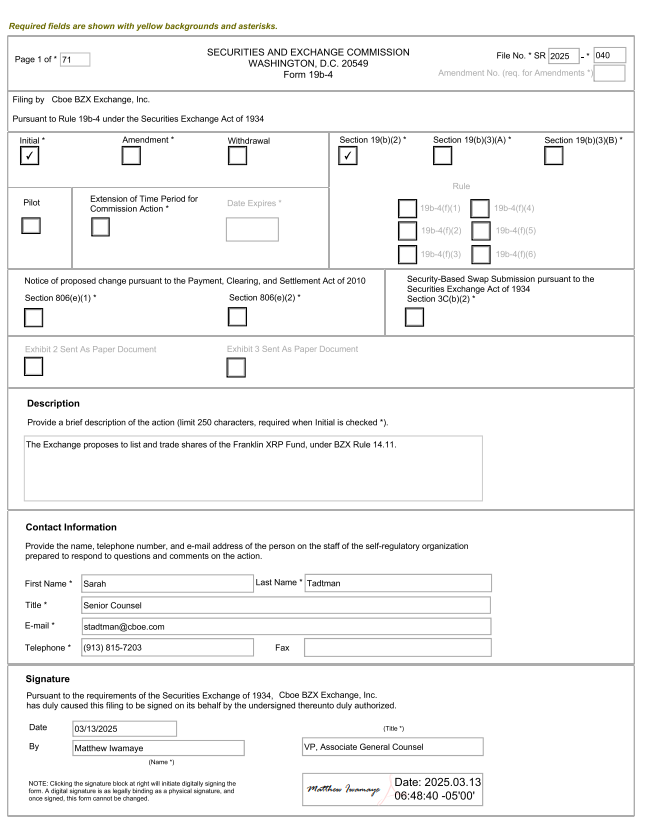

Franklin Templeton, which at the moment manages roughly $1.5 trillion in property, has simply submitted a submitting with the Securities and Trade Fee (SEC) to checklist and commerce shares of the Franklin XRP ETF underneath BZX Rule 14.11(e)(4), Commodity-Primarily based Belief Shares. The appliance was filed on March 13, 2025, and is true now underneath assessment by regulators.

SEC Submitting Particulars

In keeping with the SEC Kind 19b-4 filed by Cboe BZX Trade, the proposed ETF would monitor the worth of XRP by the CME CF XRP-Greenback Reference Price. The doc explicitly states: “The Trade proposes to checklist and commerce shares of the Franklin XRP Fund, underneath BZX Rule 14.11.”

The submitting signifies that CSC Delaware Belief Firm would function the trustee, whereas Coinbase Custody Belief Firm, LLC could be chargeable for custody of the fund’s XRP. The construction, on the time of writing, intently resembles that of beforehand authorized spot Bitcoin and Ethereum ETFs.

Market Response

The information has triggered important pleasure within the XRP neighborhood. A number of crypto customers have already commented on this growth.

Rizirto posted “bullish for XRP” whereas different customers corresponding to Chris FlipZ talked about “XRP to 10$”. Moreover, Vladyslav Dimov famous that “Monetary markets fell to provide a possibility to purchase at an excellent value. Now it’s time to go up, with such excellent news.”

Learn Extra: Binance Founder Urging President Trump to Grant Him a Pardon

What May Occur To XRP’s Value

If authorized, a spot XRP ETF may additionally present conventional buyers with regulated publicity to XRP with out immediately proudly owning the cryptocurrency. This might, in flip, additionally deliver important institutional capital into the XRP markets.

The submitting comes at a very attention-grabbing time, following the July 2023 partial victory for Ripple Labs in its case towards the SEC, the place the court docket dominated that XRP, as a digital token, shouldn’t be in itself a contract that embodies the Howey necessities of an funding contract.

Regardless of the newest submitting, the approval course of might face some extra regulatory hurdles. The SEC submitting acknowledges these challenges, noting: “The Sponsor believes that it’s making use of the right authorized requirements in making an excellent religion willpower that it believes that XRP shouldn’t be underneath these circumstances a safety underneath federal legislation.”

Distinctive Options of XRP Highlighted in Submitting

The SEC doc emphasizes a number of distinguishing options of XRP and the XRP Ledger:

- In contrast to Bitcoin’s proof-of-work system, XRP makes use of a consensus-based algorithm that can also be extra energy-efficient

- The XRP Ledger can deal with as much as 1,500 transactions per second

- Transaction charges are extraordinarily low, sometimes only a fraction of a cent

- The 100 billion XRP tokens have been created at launch in 2012, not mined over time like another cryptocurrencies

What This Means for Buyers

An XRP ETF would symbolize a vital milestone within the mainstream acceptance of XRP as an investable asset class. The submitting additionally signifies some rising confidence within the regulatory readability round XRP following the newest and biggest Ripple SEC case.

For retail buyers, an ETF would additionally supply a recent and helpful approach to achieve publicity to XRP by conventional brokerage accounts with out coping with cryptocurrency exchanges or wallets.

Learn Extra: Is The Ripple SEC Case Ending Quickly? If Sure, Then This Is How XRP Might React

Franklin Templeton’s transfer follows the profitable launches of spot Bitcoin ETFs in January 2024 and spot Ethereum ETFs in Might 2024, which have seen billions in inflows since their inception.

Throughout varied main monetary sectors, the XRP neighborhood is, at this time limit, actively monitoring whether or not regulators will approve this newest crypto ETF utility, with quite a few important market contributors expressing optimism concerning the potential end result of this vital regulatory choice. A number of important funding stakeholders have additionally, proper now, catalyzed a number of key discussions concerning the implications of such regulatory developments, and varied business specialists are at the moment leveraging their skilled insights to evaluate how this example would possibly evolve within the coming weeks and months.