In honor of Ethereum’s 10-year anniversary, BeInCrypto is taking a complete have a look at the ten most crucial contributions of this revolutionary blockchain to the crypto business.

These embrace its sensible contracts, ERC-20, EVM, and different essential requirements, Layer-2 protocols, DAO governance, and the way they influenced DeFi, ICOs, NFTs, meme cash, ETFs, and extra. Ethereum’s completed rather a lot for us.

Ten Years of Ethereum

Since Vitalik Buterin first launched Ethereum ten years in the past, sensible contracts have been a key function of its blockchain. Bitcoin, the primary cryptocurrency, permits sensible contracts, however Satoshi Nakamoto primarily targeted on its trustless and decentralized construction.

Ethereum, however, launched Solidity, a programming language particularly tailor-made to sensible contracts.

Ten years later, it’s troublesome to quantify how influential Ethereum’s sensible contracts have been. They’re nonetheless one of many blockchain’s strongest options, and different protocols have closely diversified the sector.

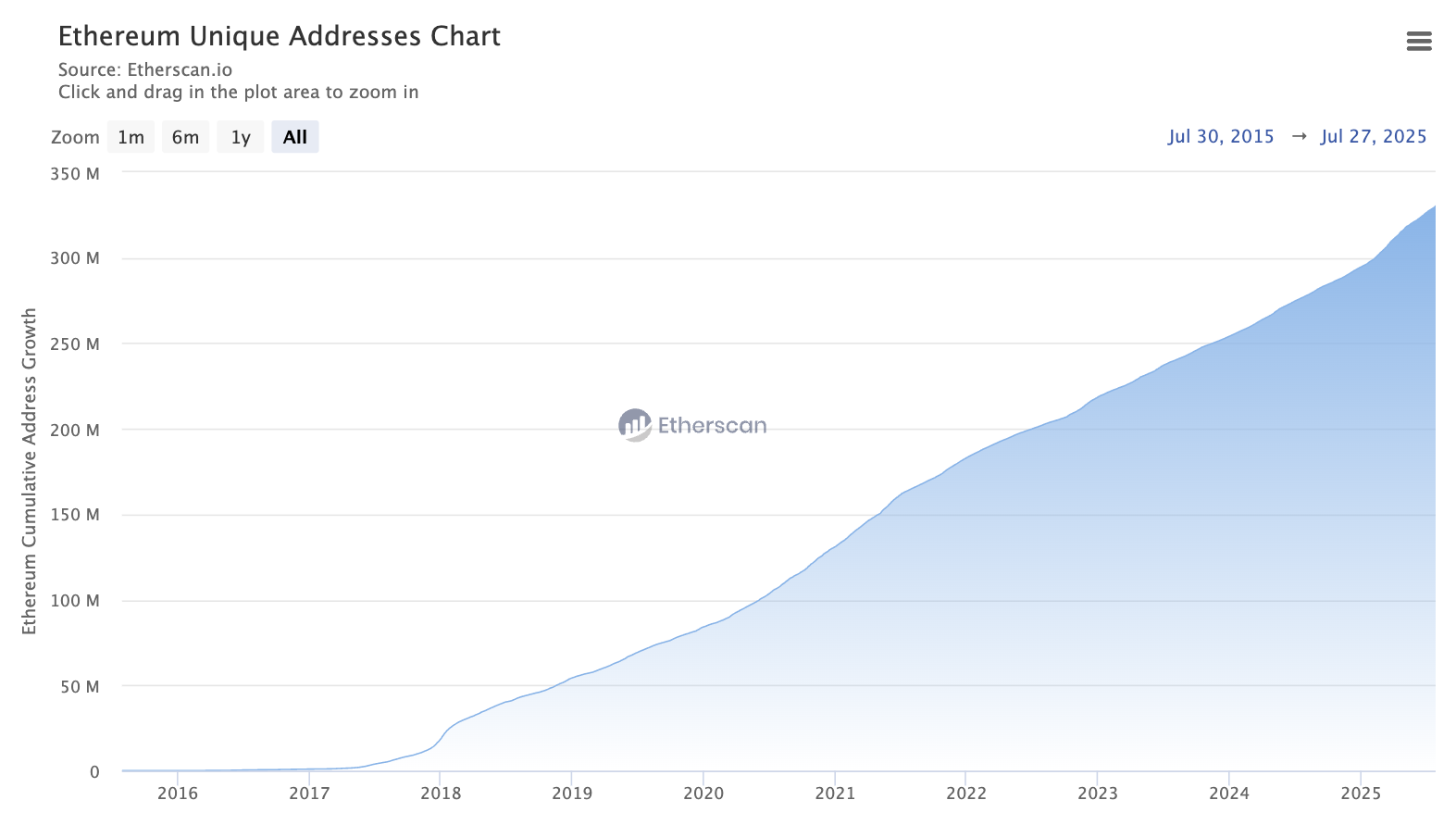

Though we will’t inform what number of ETH sensible contracts presently exist, the explosive progress in distinctive addresses ought to communicate for itself.

Ethereum Distinctive Addresses. Supply: Etherscan

The EVM (Ethereum Digital Machine) Normal additional empowered the rise of sensible contracts. EVM governs how these protocols work, processes transactions, screens the worldwide ETH ecosystem, and extra.

This normal helps energy Ethereum for customers all over the world, opening new prospects for decentralized finance.

Ethereum Revolutionizes Token Minting and Blockchain Use

The ERC-20 Normal is one other one in every of Ethereum’s vital contributions during the last ten years. Earlier than ERC-20, creating tokens on a blockchain was a extremely fragmented and inconsistent course of.

By standardizing new guidelines between tokens, Ethereum opened a solution to make over one million property uniform, fungible, and interoperable amongst themselves.

Due to ERC-20, Ethereum is Tether’s most popular blockchain for minting USDT tokens. USDT is the world’s hottest stablecoin, so that is notably spectacular.

Educational papers have tried to quantify this normal’s impression on the crypto business, nevertheless it’s been unequivocally constructive.

Moreover, Ethereum’s capacity to host Layer-2 protocols has revolutionized the business over ten years. These protocols can construct options to many points, particularly the scalability downside, inside the framework of classical blockchains.

Right this moment, even Bitcoin has a number of L2 protocols, however Ethereum specialised in them first.

ICO Increase and the Birthplace of DeFi

One explicit good thing about ERC-20 is the ICO Increase of the late 2010s. With this new normal, protocols like ChainLink and Primary Consideration Token used it to launch their LINK and BAT tokens, respectively.

Right this moment, a few of these protocols have surpassed Ethereum in developer exercise, highlighting their relevance over the previous ten years.

Between these technological enhancements, the energetic neighborhood, and its capacity to host decentralized exchanges, Ethereum is arguably the birthplace of DeFi.

Its instruments and infrastructure have enabled a neighborhood to develop a trustless financial infrastructure in observe. Its DAO governance mannequin has additional enabled monetary democracy on an unprecedented scale.

Hart Lambur, Co-founder of Danger Labs, shared some ideas on Ethereum’s affect over DeFi in an unique remark to BeInCrypto:

“The true endgame is easy: An enormous funds and alternate community that connects each blockchain. If most property turn out to be tokenized – cash, equities, bonds, real-world property – Ethereum turns into the settlement and cost layer for all issues of worth on the web,” Lambur claimed.

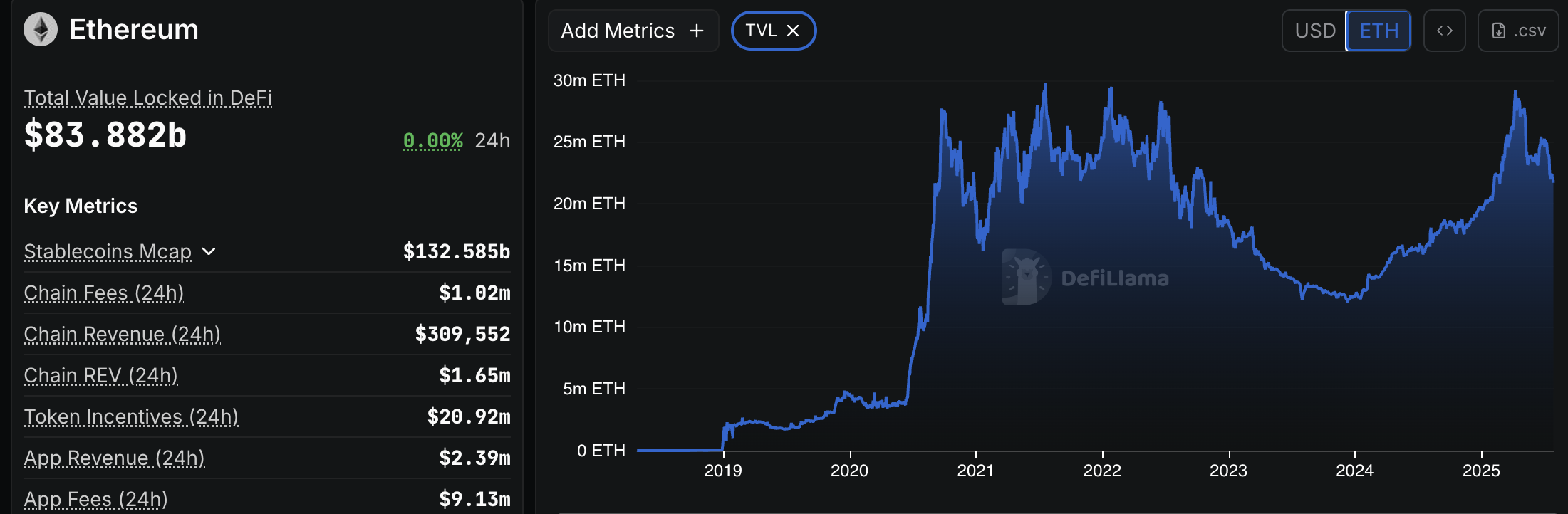

The overall worth locked on Ethereum’s blockchain has risen dramatically during the last ten years:

Ethereum Whole Worth Locked. Supply: DefiLlama

NFTs, Memes, ETFs, and Extra

These components got here collectively to make Ethereum the unquestionable residence of NFTs, which have been completely unprecedented ten years in the past.

By combining self-executing sensible contracts, a DeFi-oriented neighborhood, and some new token requirements, ETH grew to become the center of 2021’s NFT increase. These merchandise are nonetheless related right now, additional exhibiting Ethereum’s affect.

Though Dogecoin was the primary meme coin, launched over ten years in the past, Ethereum’s Shiba Inu invigorated the sector. The 2 cash have been superficially comparable, however Ethereum’s DeFi infrastructure and neighborhood launched a wave.

Ethereum builders didn’t immediately create meme cash, but their work was instrumental to the meme-filled sector we all know and love right now.

Lastly, Ethereum was an essential second place in one other key space. Bitcoin had the primary US-approved spot ETF, however ETH adopted just a few months later.

This approval confirmed that the SEC below Gary Gensler would allow extra altcoin merchandise, and a wave of energetic functions is now sweeping by way of. Additional, ETH ETFs are surpassing BTC ones proper now.

In abstract, Ethereum has completed rather a lot for crypto within the final ten years. It proved to be a radical departure from Bitcoin, with an entire host of options that enabled a brand new world.

Ethereum has influenced each facet of the crypto neighborhood, each current and previous. Given its present adoption, blockchain’s contribution to the crypto economic system will doubtless stay important for years or a long time to return.