Metrics reveal that since Jan. 1, 2025, roughly 121,000 BTC ($10.46B) and $1.74 billion in ETH have exited exchanges.

2025’s Liquidity Vanishing Act

Withdrawing bitcoin (BTC) and ethereum (ETH) from centralized buying and selling platforms diminishes promoting stress by tightening accessible provide. This shift amplifies self-custody adoption, empowering customers to safe belongings in noncustodial wallets—bolstering possession and shielding towards institutional vulnerabilities like hacks or insolvency.

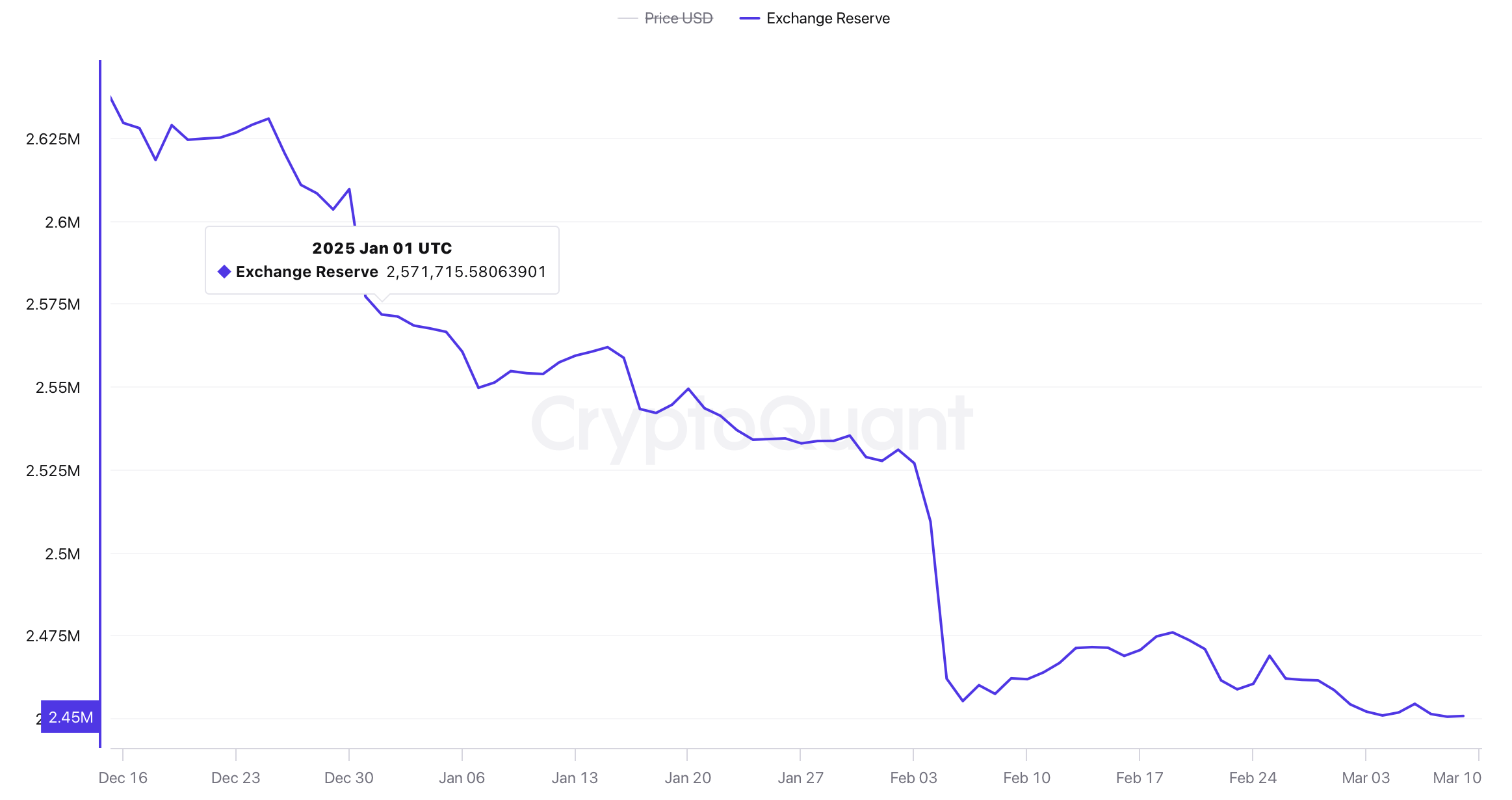

Change bitcoin reserves between Jan. 1, 2025, and March 9, 2025, in accordance with cryptoquant.com information.

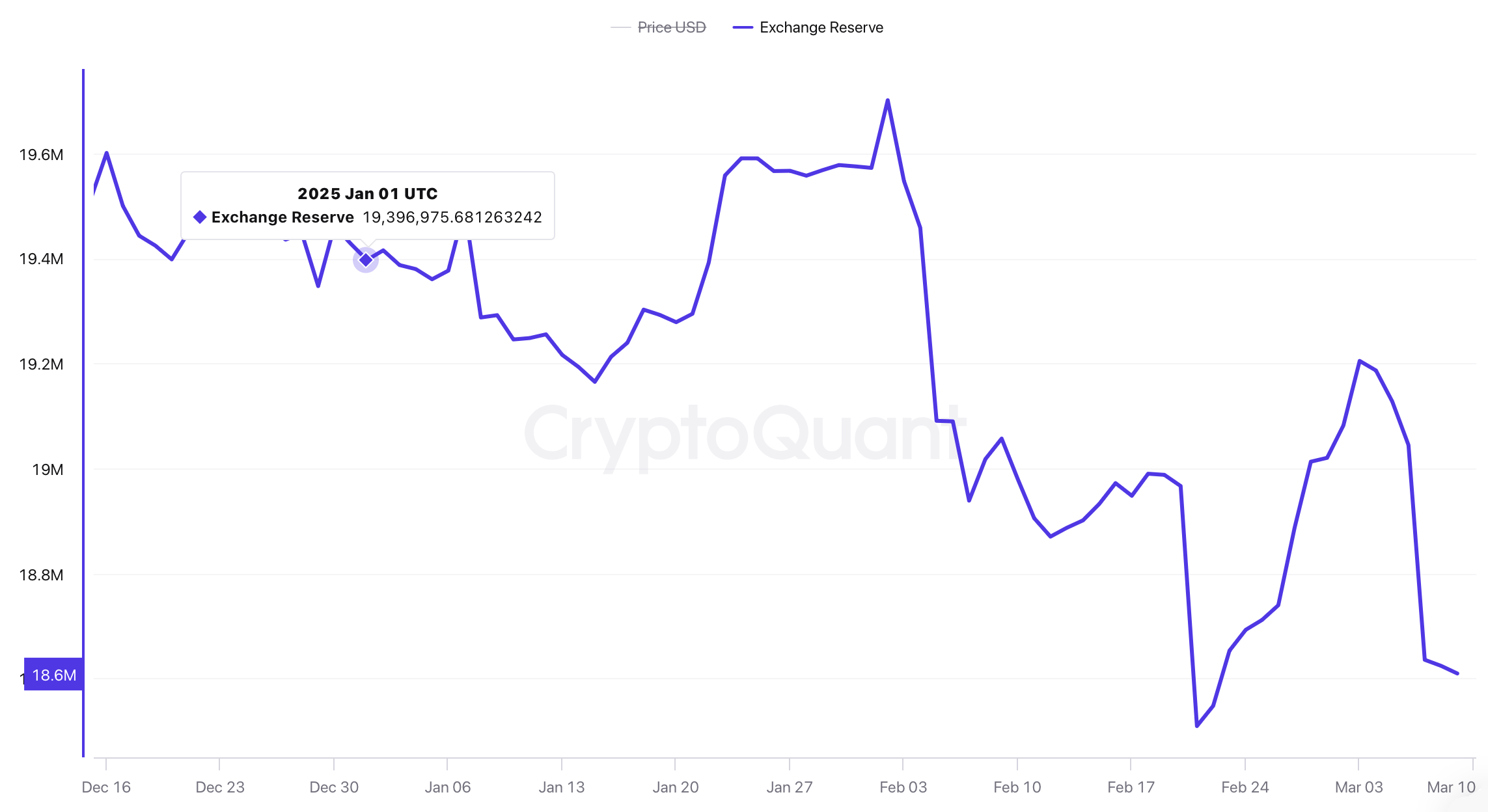

Such practices fortify decentralized beliefs and incentivize strategic, long-term asset retention. Per cryptoquant.com, 121,000 BTC ($10.46B) has departed exchanges since Jan. 1, 2025. Parallel information signifies centralized platforms shed 790,000 ETH this 12 months as properly, culminating in a mixed $12.2 billion exodus.

Change ethereum reserves between Jan. 1, 2025, and March 9, 2025, in accordance with cryptoquant.com information.

Ether reserves on exchanges have plummeted to ranges unseen since summer season 2016, whereas BTC liquidity on these platforms now mirrors July 2018 lows. In the meantime, bitcoin miners have amplified reserves by 1,000 BTC ($86.5M) because the begin of January. Accumulating reserves eases miners’ reliance on liquidating freshly minted cash to fund operations, tempering market volatility and nurturing worth equilibrium.

Over the long term, retaining higher bitcoin stockpiles additionally fortifies miners’ fiscal well being, fostering operational endurance amid erratic market cycles. This additionally aligns with Bitcoin’s decentralized philosophy by prioritizing direct asset custody over third-party publicity.

By constraining readily tradable provides, unusual holders and miners collectively domesticate worth resilience whereas championing safety and self-reliance above centralized vulnerabilities. This concerted shift displays mounting conviction in blockchain’s decentralized promise, harmonizing financial sturdiness with ideological tenets to sustainably redefine crypto’s financial structure.