Bitcoin (BTC), the primary macro asset in 150 years, is experiencing stagnation after it breached the psychological $100,000 value.

As reported by U.In the present day, regardless of over seven days of buying and selling above this degree, the asset has not been in a position to retest its all-time excessive (ATH).

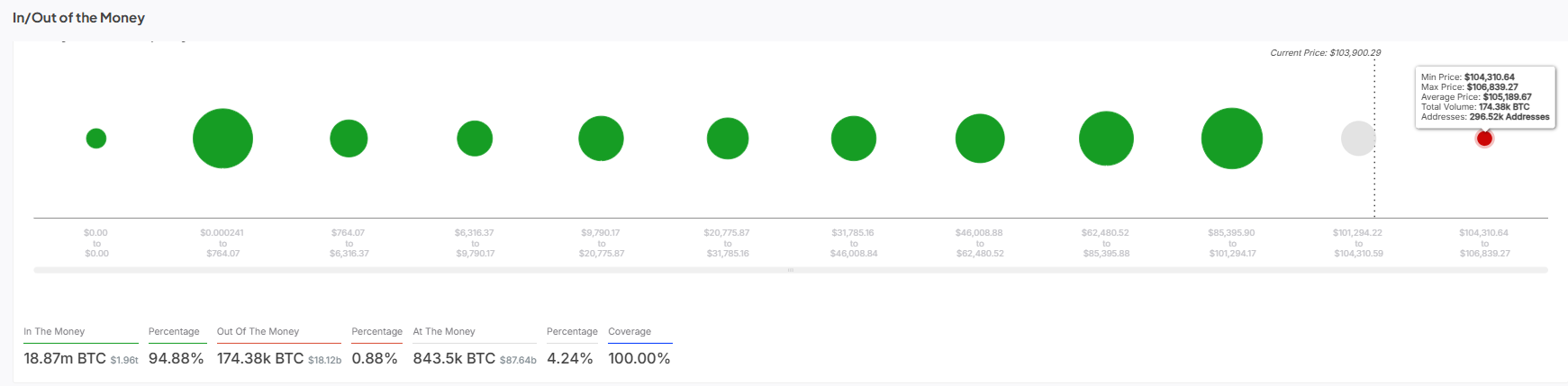

Bitcoin resistance wall

IntoTheBlock knowledge has shared insights on the barrier probably stopping Bitcoin from posting a brand new ATH.

Notably, 174,380 BTC price $18.34 billion have created a promote wall for Bitcoin, as these cash are at present “Out Of The Cash.”

This quantity of Bitcoin comes from 296,520 addresses that purchased Bitcoin when the worth was between $104,310 and $106,839. This locations the common buy value for these traders at $105,169.

Therefore, these out-of-the-money merchants are anticipating a breakout in Bitcoin’s value to the extent at which they purchased it to allow them to promote.

These traders additionally hope to make a revenue, like others who purchased the asset at a a lot lower cost.

The event has prevented Bitcoin from attaining new heights as merchants unload as soon as the worth rises.

Market sentiment dampened by profit-taking

The present scenario might discourage potential patrons as they contemplate the promote wall an enormous resistance degree for Bitcoin to surmount.

As of press time, buying and selling quantity is up by 13.37% to $49.87 billion within the final 24 hours. This means that traders should not dashing to build up the coin as a result of prevailing promote wall.

In the meantime, Bitcoin is altering fingers at $103,689.18, a 1.62% enhance inside the similar timeframe.

In accordance with the IntoTheBlock chart, about 94.88% of traders are “In The Cash.” These merchants account for 18.87 million BTC, valued at $1.96 trillion. This means that they’re profit-taking in the intervening time.

Solely 4.24% of traders holding 843,500 BTC valued at $87.4 billion are “At The Cash,” as they’re neither making a revenue nor a loss.