Not way back, the Bitcoin blockchain launched 94.42% of its whole provide, leaving solely—or 174,583.24 bitcoins—to be mined till 20 million are in circulation. Calculations point out that this milestone will probably be reached earlier than the fifth Bitcoin halving, anticipated to happen in April 2028.

Algorithmic Shortage: Bitcoin Nears 20 Million

The generally cited whole provide of bitcoin (BTC) is 21 million, but the precise quantity destined to exist is barely decrease—roughly 20,999,999.97 BTC. This variation outcomes from rounding errors within the Bitcoin protocol. Even with the differing figures, the genuine whole stays very near the continuously talked about 21 million.

Just lately, 94.42% of the provision has been mined, and as of now, 19,825,416.76 BTC has been issued. As a result of Bitcoin’s issuance price is mathematically predictable and we will approximate dates such because the fifth block subsidy halving occasion, we will additionally decide when the community will mine the remaining 174,583.24 bitcoins to achieve 20 million.

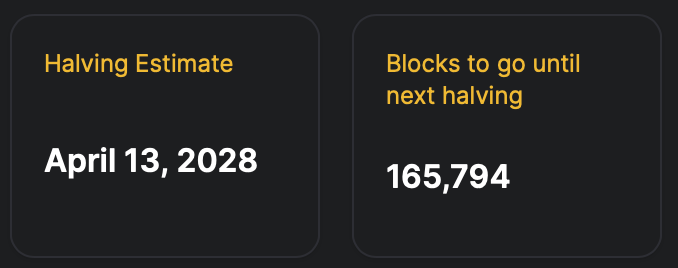

Halving estimate based on hashrateindex.com.

Projections point out that the fifth block halving will happen on or round April 13, 2028, at which level the block subsidy will drop from 3.125 BTC to 1.5625 BTC per block.

This estimation depends on block interval averages that sometimes hover round ten minutes. Making use of the identical block interval calculation and contemplating that the community’s mining problem maintains this regular rhythm, the 20 million BTC milestone is anticipated on or round March 12, 2026, at block peak 940,217.

At that second, with just one million—or roughly 999,999.97 BTC—will stay to be mined. Given these estimates, the milestone needs to be reached roughly midway between the upcoming halving occasions, with the 20 million mark possible occurring two years previous to the following halving.

Satoshi Nakamoto’s genius crystallizes in Bitcoin’s unyielding issuance mechanics—halvings, problem changes, and rhythmic block intervals—orchestrating shortage with algorithmic precision. These self-regulating protocols transmute community volatility into predictable issuance, making certain seamless development towards the provision cap.

By way of a symphony of code, Nakamoto’s design defies chaos, embedding belief in mathematical inevitability. On this world, shortage isn’t mined; it’s engineered, cementing decentralized consensus as humanity’s most audacious ledger.