Asset supervisor 21Shares is searching for to launch an exchange-traded fund (ETF) monitoring the token behind the perpetual futures protocol and blockchain, Hyperliquid, amid rising Wall Road curiosity in various cryptocurrencies.

The corporate filed for the 21Shares Hyperliquid ETF with the Securities and Trade Fee on Wednesday, which didn’t disclose a ticker image or payment. Coinbase Custody and BitGo Belief have been named as custodians.

It follows the same submitting for a Hyperliquid (HYPE) ETF from Bitwise final month. The token offers reductions on the Hyperliquid decentralized trade and is used to pay charges on its blockchain. It has elevated in worth over the previous yr, in keeping with the service’s rising recognition.

US buyers have demonstrated their urge for food for ETFs monitoring extra risky altcoins, a few of which embrace novel devices corresponding to staking. Bitwise’s new Solana (SOL) ETF recorded vital buying and selling quantity on its second day available on the market.

Bitwise Solana staking ETF quantity sees “big quantity”

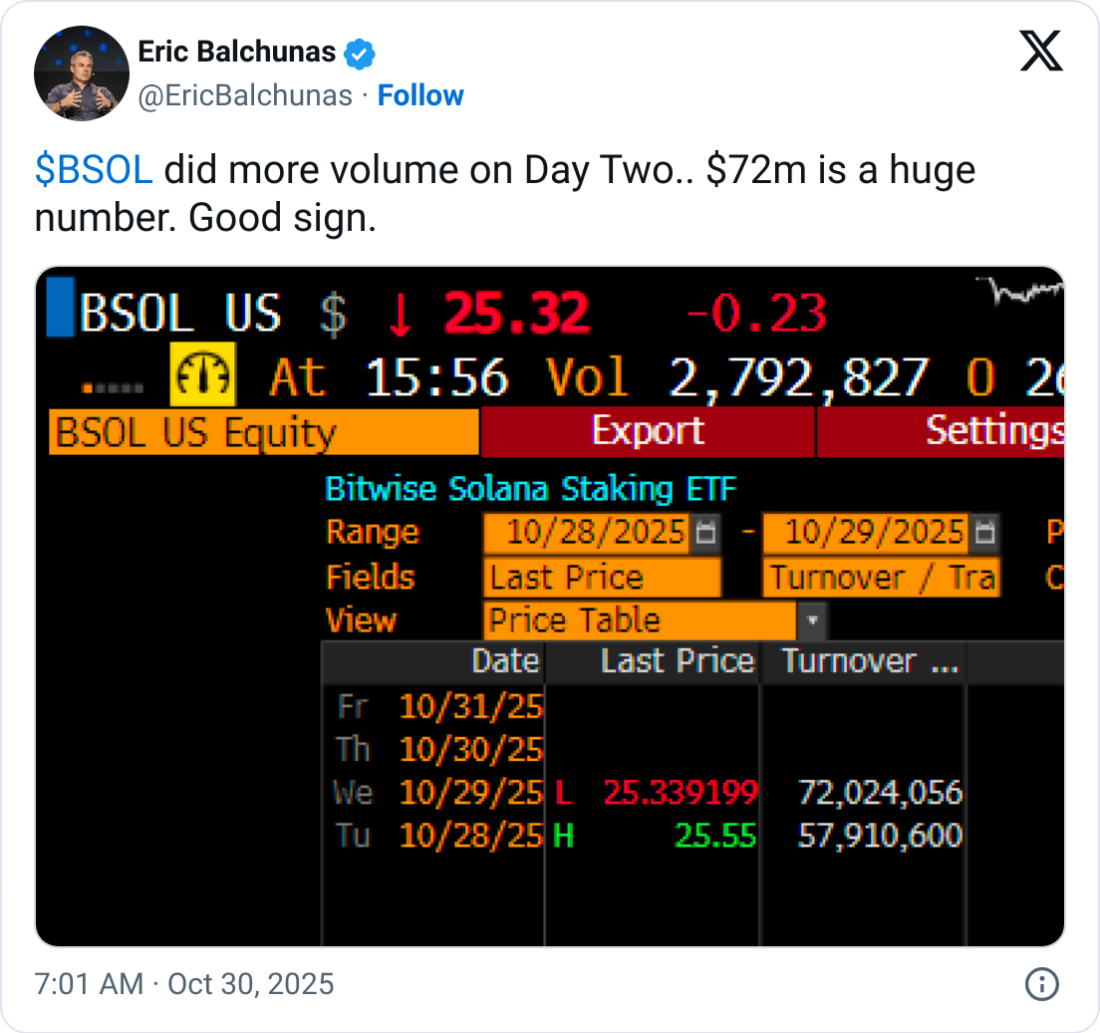

In the meantime, the Bitwise Solana Staking ETF (BSOL) ended its second day of buying and selling on Wednesday with over $72 million in buying and selling quantity.

Bloomberg ETF analyst Eric Balchunas mentioned the determine “is a big quantity” and a “good signal” because the buying and selling quantity on most ETFs drops “after [the] day one hype is over.”

Supply: Eric Balchunas

BSOL debuted for buying and selling on Tuesday alongside Canary Capital’s Litecoin (LTC) and Hedera (HBAR) ETFs. Bitwise’s ETF pulled in $55.4 million in buying and selling quantity in what Balchunas mentioned was the most important of all crypto ETFs launched in 2025.

Associated: Solana staking ETFs are ‘lacking a part of puzzle’: Bitwise CIO

Grayscale Investments additionally debuted its staking-enabled Grayscale Solana Belief ETF (GSOL) on Wednesday to rival Bitwise’s related ETF.

Nevertheless, Balchunas mentioned GSOL’s notched $4 million in buying and selling quantity on debut, which he referred to as “wholesome however [obviously] wanting BSOL.”

“Being simply at some point behind is definitely actually big,” he added. “Makes it a lot more durable.”

Journal: Sharplink exec shocked by stage of BTC and ETH ETF hodling — Joseph Chalom