Ethereum worth has spent most of October struggling to construct power above $4,000. Regardless of holding its broader uptrend, ETH trades round $3,935 at press time, down 6.6% this week, displaying hesitation as Bitcoin recovers.

The indicators on-chain and on the chart inform a transparent story: Ethereum’s rally remains to be ready for affirmation. Listed here are three explanation why ETH hasn’t damaged $4,000 within the close to time period with conviction — and why the true take a look at lies barely increased.

Whales Are Promoting, And Accumulation Has Slowed Down

The primary signal of stress comes from Ethereum’s largest holders. Since October 20, whale addresses have diminished their mixed holdings from 100.60 million ETH to 100.46 million ETH — a drop of about 140,000 ETH, or roughly $550 million at present costs. This regular promoting provides quiet resistance to any short-term rally try and retains the market cautious.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Ethereum Whales In Motion: Santiment

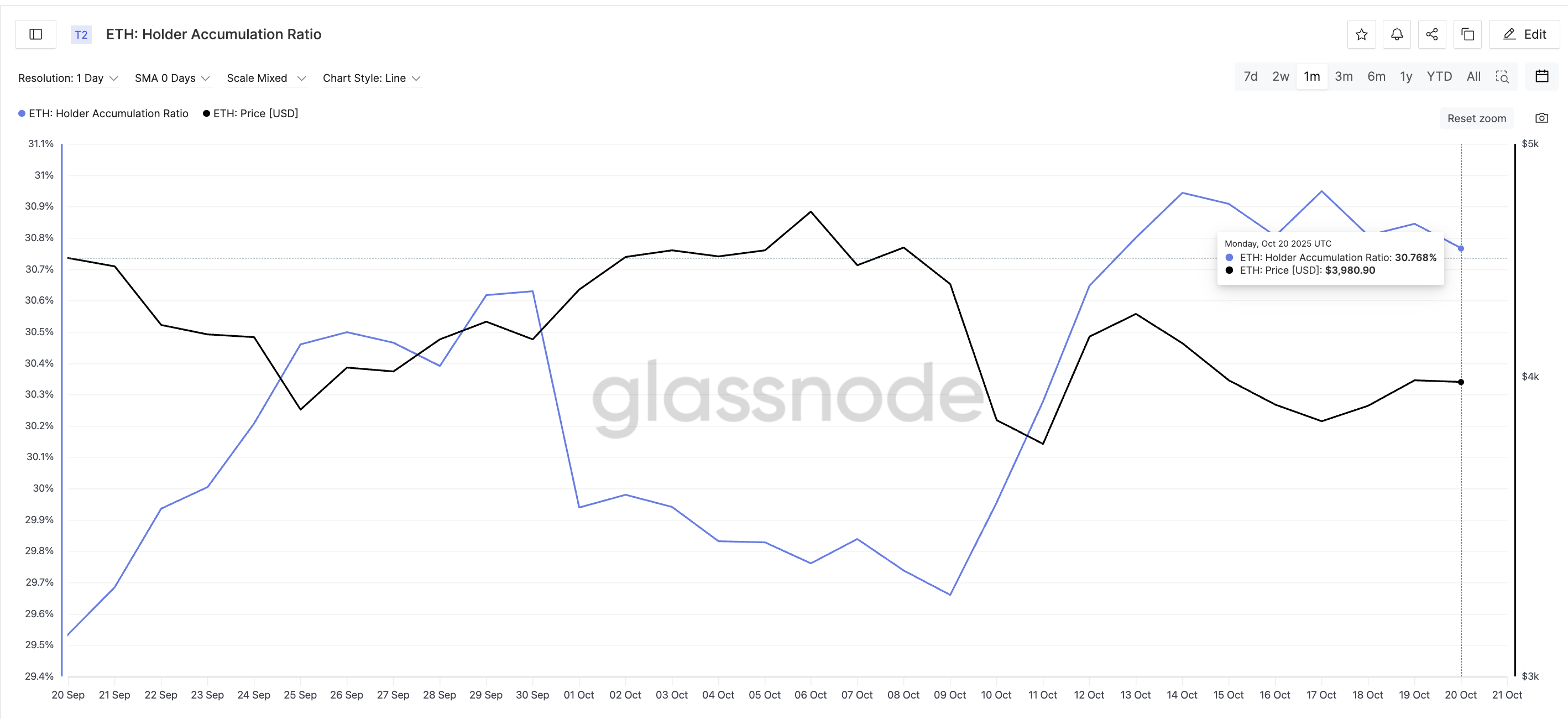

On the identical time, Ethereum’s Holder Accumulation Ratio (HAR) — which tracks the share of lively holders including to their positions versus trimming them — has stalled close to 30.77%. It had been rising earlier in October however has flattened since mid-month, displaying that new accumulation is slowing. In easy phrases, current holders should not shopping for aggressively, and contemporary cash isn’t stepping in but.

Ethereum Accumulation Ratio Stagnates: Glassnode

When the HAR traits sideways after a gradual climb, it typically indicators that merchants are ready for a transparent breakout earlier than committing once more. This cautious stance from each whales and lively holders explains Ethereum’s latest hesitation close to $4,000.

Heavy Resistance Band Above $3,955 Retains Value In Examine

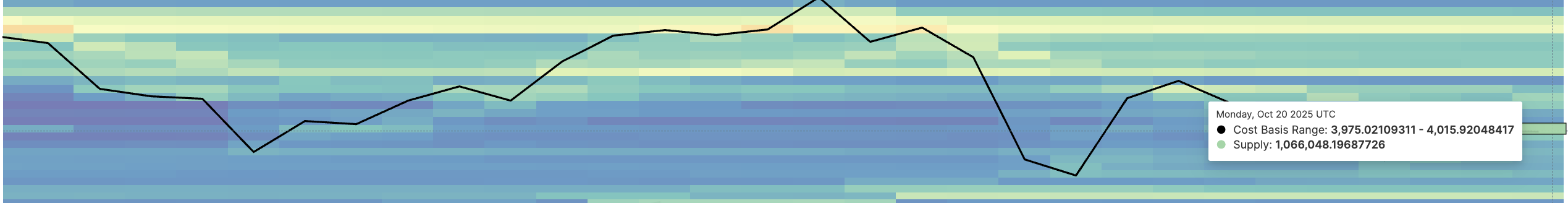

The second cause lies in Ethereum’s Value Foundation Distribution (CBD) map — a instrument that reveals the place most ETH provide final modified fingers. This helps establish “provide partitions,” or worth zones the place many holders would possibly promote to get better earlier losses.

Proper now, a dense resistance band exists between $3,955 and $4,015, with about 1.06 million ETH bought on this vary. This makes the realm simply above the present ETH worth troublesome to interrupt, as each transfer towards $4,000 brings extra promoting stress.

Key ETH Provide Zone: Glassnode

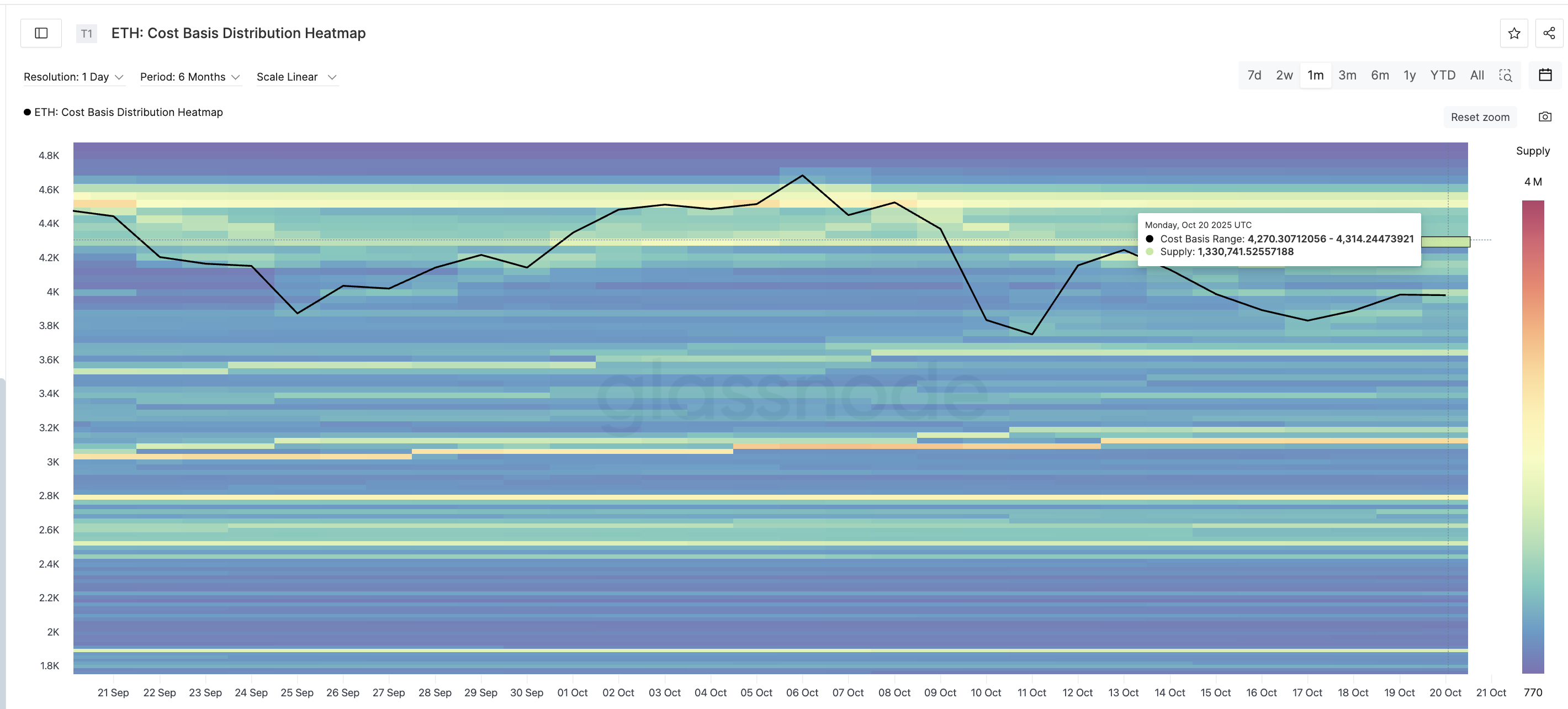

However this isn’t the one problem. One other massive cluster sits between $4,270 and $4,314, the place practically 1.33 million ETH had been purchased. This second zone aligns carefully with the technical resistance at $4,340 (which we are going to talk about later), that means Ethereum might face its true breakout take a look at there.

Ethereum Value Partitions: Glassnode

Till ETH clears these layers, merchants are prone to maintain taking earnings close to $4,000, stopping any sustained transfer increased.

Ethereum Value Setup Is Nonetheless Bullish, However Wants A Shut Above $4,340

Regardless of these hurdles, Ethereum’s construction stays constructive. The value continues to respect an ascending trendline that has held since early August, holding the broader uptrend intact.

The each day chart reveals ETH reacting to Fibonacci retracement ranges drawn from its earlier rally. The 0.618 Fibonacci degree sits round $4,200, whereas the 0.786 degree is close to $4,340 — each overlapping with the important thing resistance zones seen on-chain (per the CBD heatmap). A each day candle shut above $4,340 would affirm a breakout and will open the trail to $4,520 and even $4,960, retesting the all-time excessive vary.

Nonetheless, the primary hurdle to cross is $4,000, aligning with the 0.382 Fib degree. It is usually the zone ETH worth has been making an attempt to cross convincingly since October 16.

Momentum indicators additionally assist this view. The Relative Energy Index (RSI) — which measures the stability between shopping for and promoting stress — reveals a hidden bullish divergence. Meaning whereas worth has made increased lows since August 2, RSI has made decrease lows, typically signaling an ongoing uptrend beneath short-term weak point.

Ethereum Value Evaluation: TradingView

The final time this divergence appeared, between August 2 and September 25, Ethereum rallied practically 24%, shifting near $4,880. An identical transfer from present ranges might ship ETH towards the $4,960 zone. However that might solely occur after a confirmed breakout above $4,340.

If ETH fails to carry $3,880, nevertheless, short-term sentiment might flip detrimental. That will expose assist at $3,680 — the bottom of its long-term trendline.

The submit 3 Causes Ethereum Value Stalls Beneath $4,000 — And Why The Actual Take a look at Lies Increased appeared first on BeInCrypto.