September has traditionally been the weakest month for Ethereum, with median returns displaying losses of greater than 12%. This 12 months’s September began no in a different way. ETF outflows and broader market hesitation saved the Ethereum value below strain within the opening week.

Nevertheless, September 2025 won’t comply with historical past so neatly. Three bullish indicators have emerged that might flip the script and push the Ethereum value towards new highs, in its traditionally weakest month. Nicely, that might be such an anti-climax.

Whales Purchase Massive as Weak Arms Exit

At press time, Ethereum trades close to $4,406. Simply this week, ETH touched lows of $4,261 however shortly regained floor.

Over the previous 24 hours, the ETH value has remained largely flat, displaying no indicators of a potential breakout on paper. But, whales have aggressively accrued. The provision held by whale wallets outdoors exchanges elevated from 95.72 million ETH to 99.41 million ETH in below a day. That represents a web pickup of three.69 million ETH, valued at over $16 billion at present costs.

Ethereum Whales Add Hundreds of thousands In ETH: Santiment

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Such giant inflows from whales recommend confidence. Whereas retail merchants could hesitate, whales seem like positioning for a rally.

However whale buys can meet resistance if retail, particularly the short-term holders, promote. Nicely, that appears to have been taken care of, too. Their shopping for coincides with weak palms exiting.

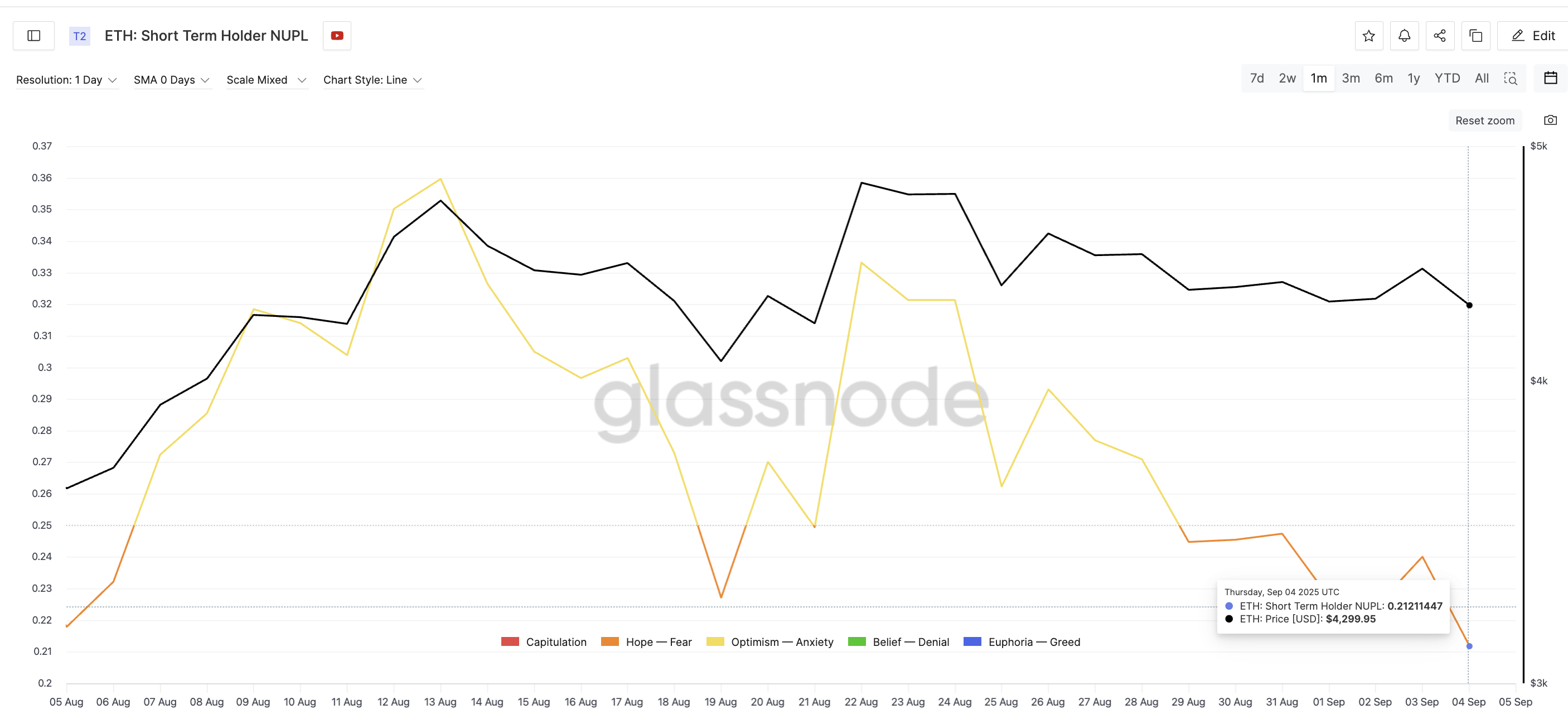

Weak Arms Exit As NUPL Takes A Hit: Glassnode

The short-term holder Internet Unrealized Revenue/Loss (NUPL) metric — which signifies the revenue or lack of short-term holders — has decreased to 0.21, the second-lowest degree in a month. Traditionally, native lows on this metric usually sign rebound factors as hints at weak palms exiting and others sitting on smaller income.

For instance, on August 19, when NUPL was close to 0.22, the Ethereum value was $4,077. Within the following classes, ETH rallied practically 20% to $4,829.

This mixture of whales shopping for and weaker holders promoting paints a bullish image. Even a ten% transfer (not 20%) from present ranges may carry ETH near testing new highs.

Ethereum Value Ranges and RSI Divergence Validate Bullishness

The third cause for the all-time high-inclined bullishness comes from the charts themselves. Ethereum’s each day value chart exhibits a hidden bullish divergence. Whereas ETH made the next low, the Relative Power Index (RSI) — which measures shopping for and promoting momentum — made a decrease low.

Ethereum Value Evaluation: TradingView

This divergence is necessary as a result of it normally indicators pattern continuation. It exhibits that sellers are operating out of steam even because the Ethereum value holds agency. RSI divergences, when mixed with whale accumulation, strengthen the upside case additional.

For the Ethereum value, the important thing resistance to look at is $4,672 as soon as it breaks $4,496. A clear break above this degree opens the trail to $4,958, and doubtlessly greater into value discovery.

On the draw back, invalidation comes if ETH breaks under $4,210, which might weaken the bullish case.

The submit 3 Causes Why Ethereum Value Might Peak in Its Weakest Month appeared first on BeInCrypto.