Crypto US shares are exhibiting blended efficiency at this time, with Core Scientific (CORZ), MicroStrategy (MSTR), and Coinbase (COIN) in focus.

CORZ is down -0.84% within the pre-market and stays one of many worst performers within the sector this 12 months. In the meantime, MSTR is gaining momentum after a recent $285 million Bitcoin buy, pushing its 5-day positive factors to 16%. COIN is up +0.88% pre-market because it heads into its Q1 2025 earnings report on Might 8, attempting to get better from a steep YTD decline.

Core Scientific (CORZ)

Core Scientific (CORZ) is down -0.84% in pre-market buying and selling, persevering with its latest underperformance. Regardless of broader energy throughout crypto-related equities, the inventory has struggled to draw consumers.

The corporate operates one of many largest Bitcoin mining companies in North America. It offers infrastructure, internet hosting, and self-mining companies by way of its community of knowledge facilities.

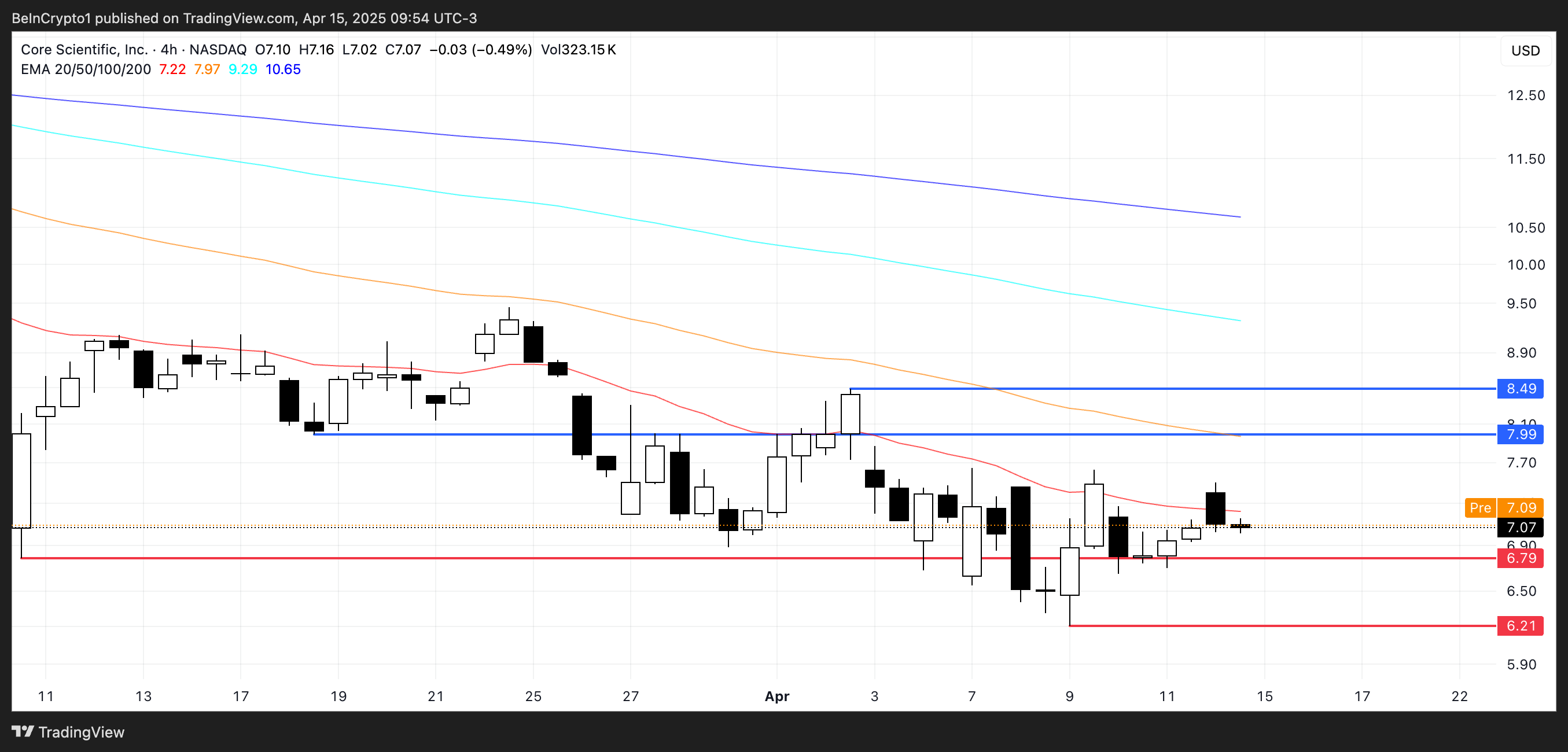

CORZ Value Evaluation. Supply: TradingView.

CORZ is down practically 50% year-to-date, making it one of many worst performers amongst crypto shares. In distinction, friends like Marathon Digital (MARA) and Coinbase (COIN) have held up a lot better.

Whereas others profit from diversification or stronger narratives, Core Scientific stays tied to mining economics—an space hit by rising prices and thinning margins, however that it might have a rebound as BTC rebuilds momentum.

Technique (MSTR)

MicroStrategy (MSTR) closed yesterday up 3.82%, pushing its year-to-date return to 7.54%. The inventory has proven sturdy momentum alongside Bitcoin’s latest worth restoration, with MSTR worth up 16% within the final 5 days.

The corporate, led by Michael Saylor, is finest recognized for its aggressive Bitcoin accumulation technique. Whereas it initially centered on enterprise software program, it has since develop into closely tied to BTC’s efficiency.

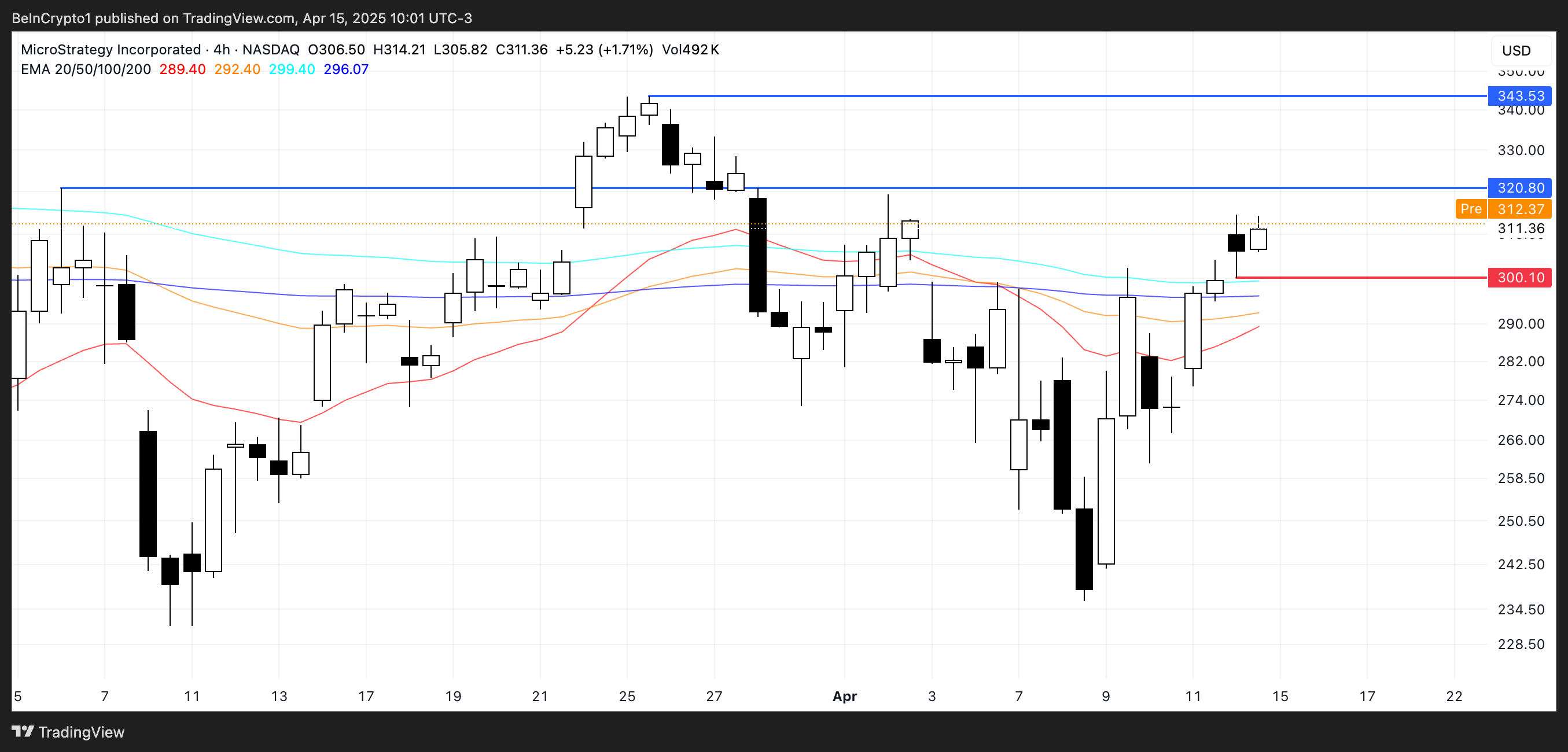

MSTR Value Evaluation. Supply: TradingView.

Technique just lately bought a further $285 million price of Bitcoin, including 3,459 BTC to its steadiness sheet. This brings its whole holdings to 531,644 BTC.

The transfer reinforces the agency’s place as the biggest company holder of Bitcoin, successfully turning it right into a leveraged BTC play for traders.

Coinbase (COIN)

Coinbase (COIN) is buying and selling up +0.88% within the pre-market, exhibiting indicators of continued short-term energy. The transfer comes forward of a key earnings replace.

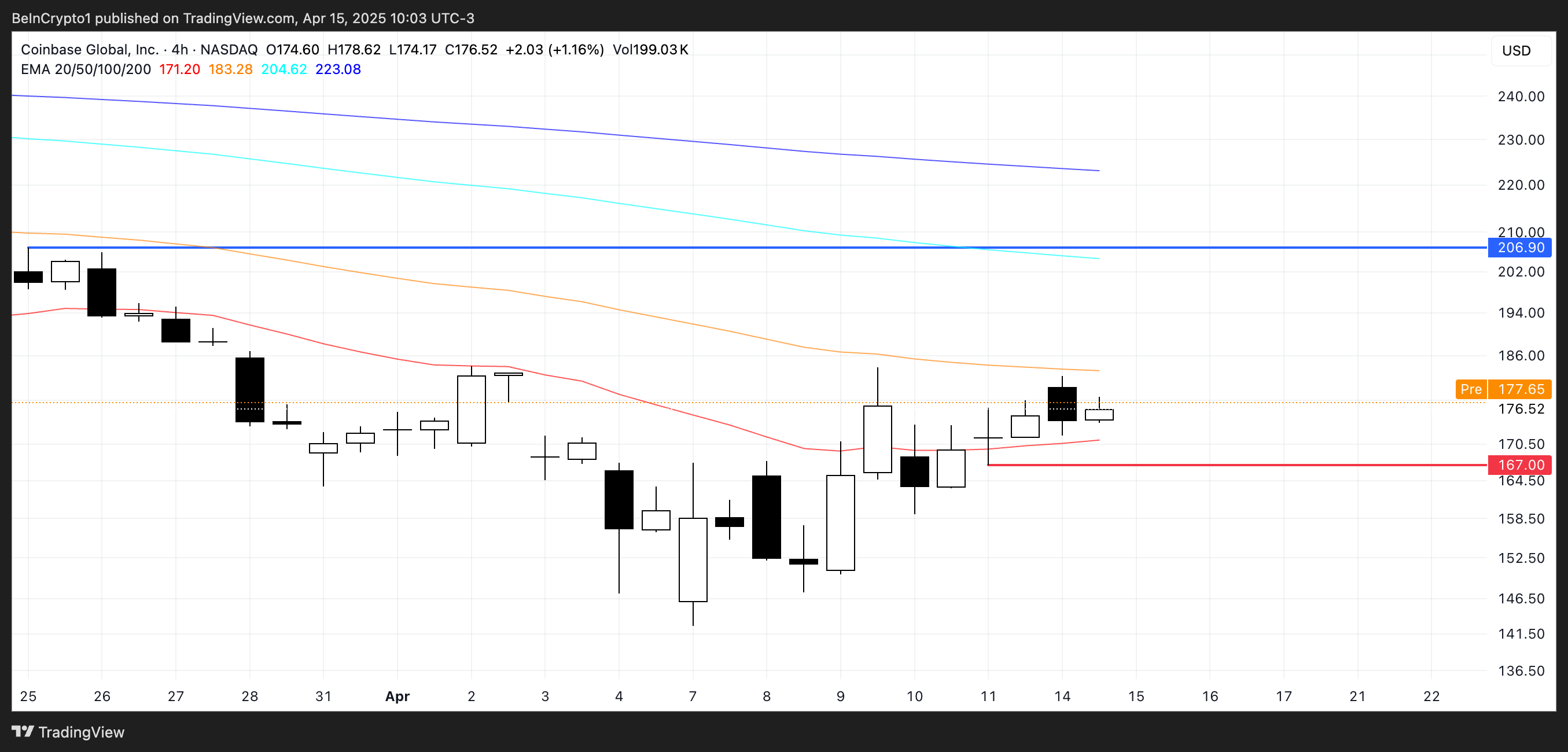

COIN Value Evaluation. Supply: TradingView.

The corporate operates one of many largest cryptocurrency exchanges within the US, providing buying and selling, custody, and staking companies. Coinbase is about to report its Q1 2025 earnings on Might 8, which may very well be a serious catalyst for the inventory.

COIN is up 12% during the last 5 days, trying to rebound after falling practically 29% year-to-date.