The Ripple SEC plan has taken middle stage proper now as Chinese language firm Webus Worldwide Restricted filed a $300 million digital asset administration settlement with regulators. This transfer comes alongside knowledgeable XRP worth prediction suggesting potential for large positive factors, whereas XRP information continues highlighting regulatory progress and in addition market volatility throughout the cryptocurrency sector on the time of writing.

Navigating XRP Information, Cryptocurrency Regulation, and Market Volatility Amid $300M SEC Submitting

Webus Worldwide’s Strategic Ripple SEC Plan Submitting

Webus Worldwide Restricted, the Hangzhou-based AI-driven mobility options firm, filed Type 6-Ok with the SEC to ascertain an XRP treasury value as much as $300 million. The Ripple SEC plan represents a major institutional dedication proper now, with the corporate signing an settlement with US-based funding advisor Samara Alpha Administration to create the framework for future crypto operations.

The initiative will assist on the spot worldwide funds for chauffeur providers and in addition reserving packages, integrating XRP straight into the corporate’s enterprise mannequin. This Ripple SEC plan demonstrates how cryptocurrency regulation is enabling firms to formalize their digital asset methods via correct regulatory channels on the time of writing.

Skilled $250 XRP Worth Prediction Sparks Rally Hypothesis

Recreation designer and XRP supporter Chad Steingraber maintains his XRP worth prediction of $250 proper now, suggesting the proposed GENIUS Stablecoin Act may unlock this valuation via mainstream adoption. This XRP information has created vital market consideration, with Steingraber constantly advocating for the $250 goal since early 2024 and in addition all through varied market cycles.

Steingraber said:

“The regulatory framework outlined within the invoice might unlock a path towards mainstream adoption and institutional confidence, elements important for such a dramatic worth enhance.”

The GENIUS Act proposes federal regulatory construction for stablecoins, mandating full backing by bodily money or short-term U.S. Treasuries. This cryptocurrency regulation may catalyze wider XRP adoption via Ripple’s stablecoin RLUSD, which might function on the XRP Ledger and in addition profit from the brand new framework.

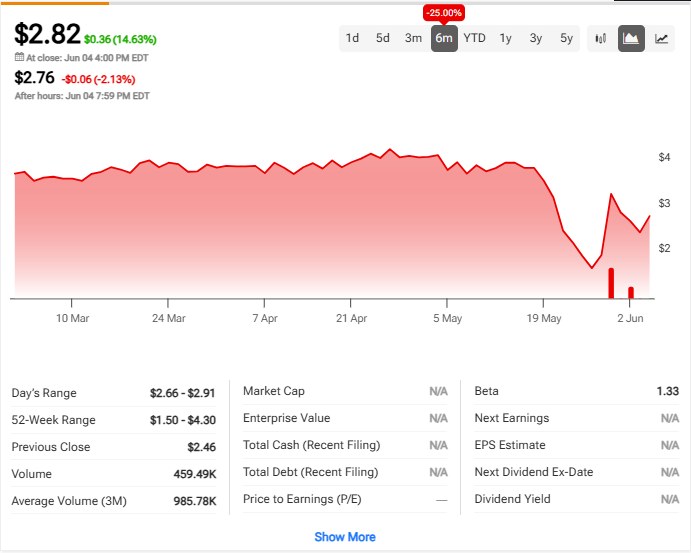

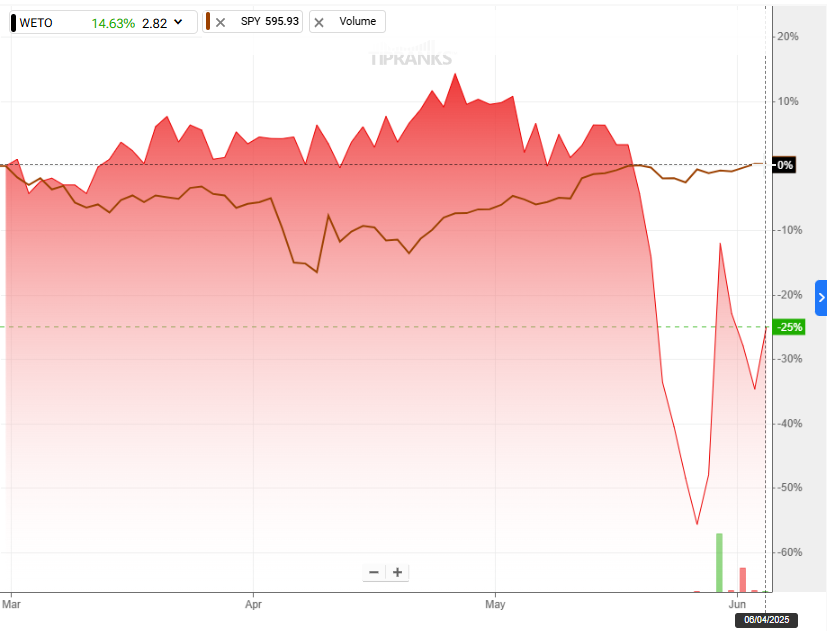

Market Volatility and Institutional Adoption Drive XRP Information

Market volatility continues affecting crypto markets proper now, however the Webus Worldwide Ripple SEC plan alerts rising institutional confidence. The corporate went public on Nasdaq in February, elevating $8 million throughout its IPO, similar to the Circle IPO, and now represents one other publicly traded agency constructing strategic crypto reserves past Bitcoin and in addition Ethereum.

Crypto analyst SMQKE famous:

“Institutional curiosity in RLUSD may enhance if the Act offers higher authorized certainty with formal reserve, audit, and compliance necessities in place.”

This XRP worth prediction aligns with broader market tendencies the place cryptocurrency regulation readability drives institutional adoption. The market volatility that beforehand deterred company funding is being offset by regulatory frameworks just like the Ripple SEC plan construction on the time of writing.

Regulatory Framework Shapes Future XRP Worth Prediction

The mix of the Webus Worldwide Ripple SEC plan and in addition potential GENIUS Act passage creates distinctive situations for XRP development proper now. As RLUSD transactions require XRP for settlement charges, that are then burned, the circulating provide decreases over time via this deflationary mechanism.

Versan Aljarrah from Black Swan Capitalist hyperlinks the GENIUS Act to XRP’s adoption potential, suggesting tokenized U.S. debt may open liquidity pipelines past conventional Federal Reserve channels. This cryptocurrency regulation development addresses earlier market volatility considerations whereas establishing compliant operational frameworks.

The present XRP information cycle additionally displays how regulatory readability transforms speculative belongings into institutional-grade investments, with the Chinese language firm’s Ripple SEC plan serving as a helpful template for some future company adoption methods on the time of writing.