- Key catalysts embody over $1.17B in June spot ETF inflows, $888M stablecoin development on Ethereum in per week, and shrinking alternate reserves.

- Giant holders accrued ETH on the quickest tempo since 2017, even throughout worth dips.

Ethereum (ETH) worth is as soon as once more displaying energy, gaining 6% within the final 24 hours, shifting to $2,600. Extra importantly, as we speak’s ETH rally is accompanied by a 79% improve in day by day buying and selling volumes to $27.58 billion. Moreover, knowledge from Coinglass exhibits that ETH futures open curiosity is up 7.56% to $34.4 billion, highlighting a robust bullish sentiment amongst merchants.

After a significant 45% crash in Q1, ETH worth has recovered sharply through the second quarter with 36.5 % features. As Q3 begins, Ethereum is constructing contemporary momentum. With a 5% acquire in simply the previous week, bullish sentiment seems to be returning, with a robust breakout above $2,544, as talked about in our earlier story.

Crypto market analyst Eric Connor said that a number of bullish elements are aligning, which may drive ETH even greater. Let’s check out 4 elements that might drive the ETH rally additional.

1. Stablecoin Progress Can Present Required Liquidity Enhance For Ethereum Rally

Ethereum stays the inspiration of the stablecoin ecosystem. Whereas stablecoin market cap on the community peaked at $251 billion, it nonetheless holds a stable $126.31 billion as we speak, up $888.92 million prior to now week alone, as reported by Crypto Information Flash.

Tether leads with $64.12B, adopted by USDC at $38.10B and Ethena’s USDe at $5.09B. The regular demand displays sturdy on-chain exercise and continued belief in Ethereum’s infrastructure.

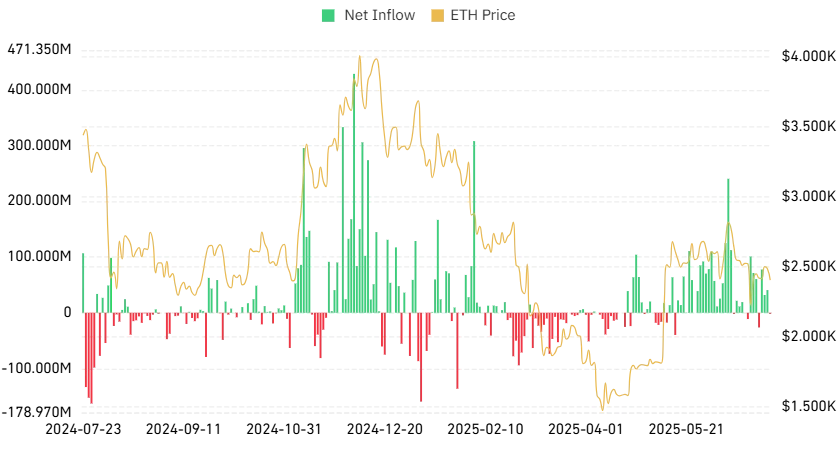

2. Rising Ethereum ETF Inflows Present Institutional Curiosity Stays Sturdy

Inflows into spot Ethereum ETF have surged considerably over the previous month. In the course of the month of June, this ETH funding product noticed over $1.17 billion in internet inflows recorded in June alone.

The optimistic pattern continues into July, with $54.8 million in inflows on July 1 for BlackRock’s ETHA, and a further $10 million for Grayscale’s ETHE. This regular demand from conventional finance alerts rising institutional confidence in Ethereum’s long-term potential.

Supply: Coinglass

As reported by CNF, BlackRock’s iShares Ethereum Belief (ETHA) has emerged because the frontrunner within the U.S. spot Ether ETF market, recording over $5.3 billion in internet inflows to this point.

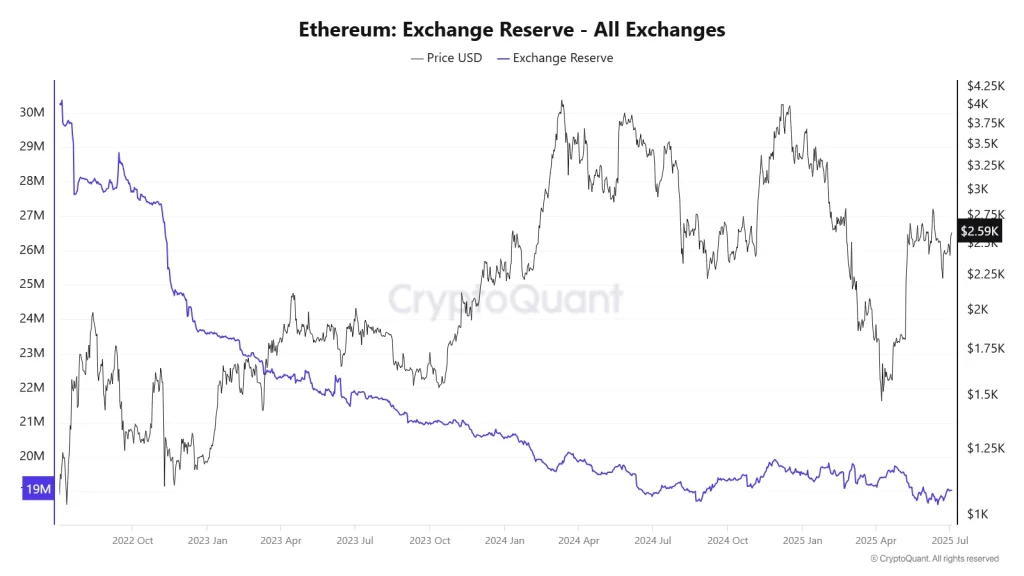

3. Ethereum Trade Reserves Are Dropping

CryptoQuant knowledge exhibits that ETH provide on centralized exchanges has dropped steadily from 19.51 million at the beginning of 2025 to 19.03 million at present. This decline alerts decreased promoting stress, creating circumstances the place renewed demand may gasoline a sooner worth breakout.

Supply: CryptoQuant

4. ETH Whale Exercise on the Rise

Wallets holding between 1,000 and 10,000 ETH accrued greater than 800,000 ETH day by day throughout per week in June, marking probably the most aggressive shopping for since 2017. This sturdy accumulation got here regardless of a 1.62% dip in ETH’s worth, signaling rising conviction amongst massive traders.

With ETF inflows rising, stablecoin exercise climbing, alternate reserves falling, and whales loading up, Ethereum seems poised for a significant breakout. A clear transfer above the $2,600 resistance may set off a pointy upward rally