Cryptocurrencies have reworked the monetary panorama, fascinating tech fans, traders, and regulators worldwide. Nonetheless, as digital property acquire prominence, important questions come up concerning the function of economic literacy and cognitive biases in shaping funding behaviours.

Empirical proof underscores that monetary literacy considerably influences monetary stability by enhancing particular person decision-making. Folks with larger monetary literacy make prudent decisions, similar to budgeting successfully, saving for emergencies, and understanding borrowing prices.

Conversely, low monetary literacy usually results in poor selections, over-indebtedness, and susceptibility to distorted expectations, amplifying systemic dangers.

Why does monetary literacy play a pivotal function within the cryptocurrency ecosystem? The inherent complexity of digital property like cryptocurrencies necessitates correct monetary data to navigate their dangers. Understanding blockchain expertise, digital wallets, and buying and selling platforms—all important elements of cryptocurrency funding—requires a degree of digital and monetary literacy that many traders lack.

Cryptocurrencies themselves are numerous, starting from established names like Bitcoin and Ethereum to speculative altcoins. With out the flexibility to critically assess expertise stacks and market tendencies, traders might fall prey to speculative bubbles or initiatives with little intrinsic worth.

A scarcity of economic literacy exacerbates these challenges, making it troublesome to understand the potential penalties of market fluctuations, thereby rising vulnerability to shocks. The connection between monetary literacy and cryptocurrency possession is especially vital given the complexity of those property in comparison with conventional monetary devices and the dangers they pose to monetary stability.

Research Hyperlinks Overconfidence to Crypto Investments

A current examine, Cryptocurrency Possession and Cognitive Biases in Perceived Monetary Literacy, carried out in Spain by Santiago Carbó, Pedro J. Cuadros, and Francisco Rodríguez and funded by Funcas, sheds gentle on this challenge. The analysis investigates how monetary literacy bias—the hole between perceived and precise monetary data—impacts cryptocurrency possession.

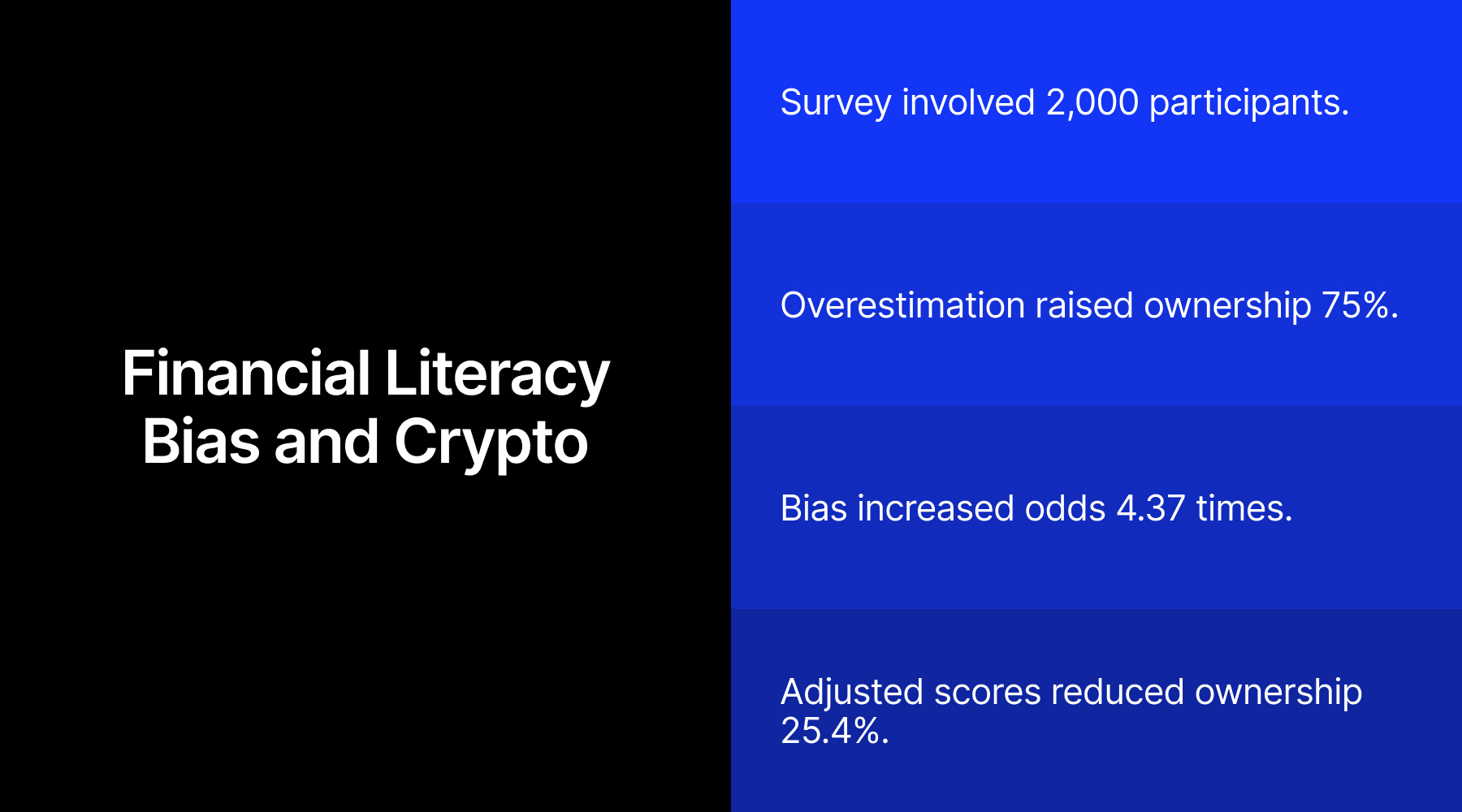

Based mostly on a survey of over 2,000 members, the examine identifies monetary literacy bias as a important determinant of cryptocurrency possession, even after controlling for variables similar to age, revenue, and digital exercise.

Machine Studying Highlights Crypto Possession Elements

Utilizing superior machine studying strategies, the examine reveals that people who overestimate their monetary data are considerably extra more likely to spend money on cryptocurrencies. Particularly, those that overestimated their monetary literacy have been 75% extra more likely to maintain digital property in comparison with these with correct self-assessments. For each unit improve in monetary literacy bias, the chances of proudly owning cryptocurrencies rose by roughly 4.37 instances.

In case you constantly become profitable and lose it again to the market even when you understand you might be clever, then what’s lacking out of your training is monetary literacy.

💥What you do along with your cash when you make it

💥Easy methods to preserve the market /folks from taking the cash from you…— Adaora Favour Nwankwo (@adaora_crypto) January 6, 2025

Why does this occur? People who overestimate their monetary literacy might really feel overly assured in going through the complexities of the cryptocurrency market. Cognitive biases, similar to affirmation bias, can additional reinforce this confidence by main people to give attention to info that validates their funding decisions whereas disregarding proof of potential dangers. Addressing these biases is important for fostering extra rational and knowledgeable funding behaviour.

Cognitive Biases Gasoline Crypto Speculative Bubbles

Curiously, the examine additionally discovered that when monetary literacy scores have been adjusted to account for bias, the probability of cryptocurrency possession decreased by 25.4%. This highlights the significance of correct self-assessment in mitigating dangerous funding behaviours.

Whereas cryptocurrency adoption is just not inherently dangerous, it could pose systemic dangers when pushed by misinformation or cognitive biases. Cryptocurrencies usually entice people in search of fast returns, probably fueling speculative bubbles and rising market volatility. Such circumstances additionally create alternatives for fraud and scams, additional destabilising the monetary ecosystem.

Save for later✅ Comply with for extra ❤️

Since Crypto is a excessive threat asset and might make your funding zero too, so make investments properly and Do your correct analysis earlier than investing and develop your portfolio properly! pic.twitter.com/zU8kyUxkGl

— Mohini Of Investing (@MohiniWealth) January 5, 2025

Selling Monetary Schooling to Mitigate Dangers

For policymakers and regulators, these findings emphasize the urgency of selling monetary training. Initiatives that deal with cognitive biases and improve goal monetary literacy may also help mitigate dangers and encourage accountable funding behaviour. Regulators and business leaders ought to collaborate to make sure that traders have entry to dependable info and safeguards towards deceptive claims.

By fostering a tradition of economic literacy and addressing cognitive biases, we may also help be certain that the cryptocurrency revolution is each inclusive and sustainable. Whether or not as traders, educators, or policymakers, recognizing the interaction between data, notion, and behavior is essential to succeeding on this dynamic monetary panorama.

Francisco Rodríguez additionally contributed to this text.