Over the previous few days, Ethereum (ETH) whales have been relentlessly promoting their cash, dampening the market’s momentum. Whale influx into cryptocurrency exchanges has surged, indicating a powerful want for revenue because the coin’s value has skyrocketed by double digits over the previous seven days.

The spike in promoting strain will possible restrict Ethereum’s near-term upside potential. Right here is how.

Ethereum Whales Take Benefit of Worth Hike

Ethereum’s value has climbed by 14 % over the previous week to commerce at $2,644 at press time. Nevertheless, this rally might face resistance as a consequence of current sell-offs by some giant holders, or “whales.”

On Monday, an early Ethereum Preliminary Coin Providing (ICO) participant, who obtained 150,000 ETH on the Genesis block — now valued at over $389 million — deposited 3,510 ETH ($9.12 million) into Kraken after greater than two years of inactivity.

Over the weekend, one other vital whale, identified for holding giant quantities of ETH, additionally offered off cash. On-chain analyst Spotonchain revealed in a submit on X that the whale deposited 15,000 ETH ($38.4 million) into exchanges. This whale has a historical past of promoting ETH simply earlier than market drops. In July, it offered 10,000 ETH ($34.2 million) forward of a 7.6% value decline, and in August, it unloaded 15,000 ETH ($39.7 million) shortly earlier than a 2.5% dip.

Learn extra: Find out how to Spend money on Ethereum ETFs?

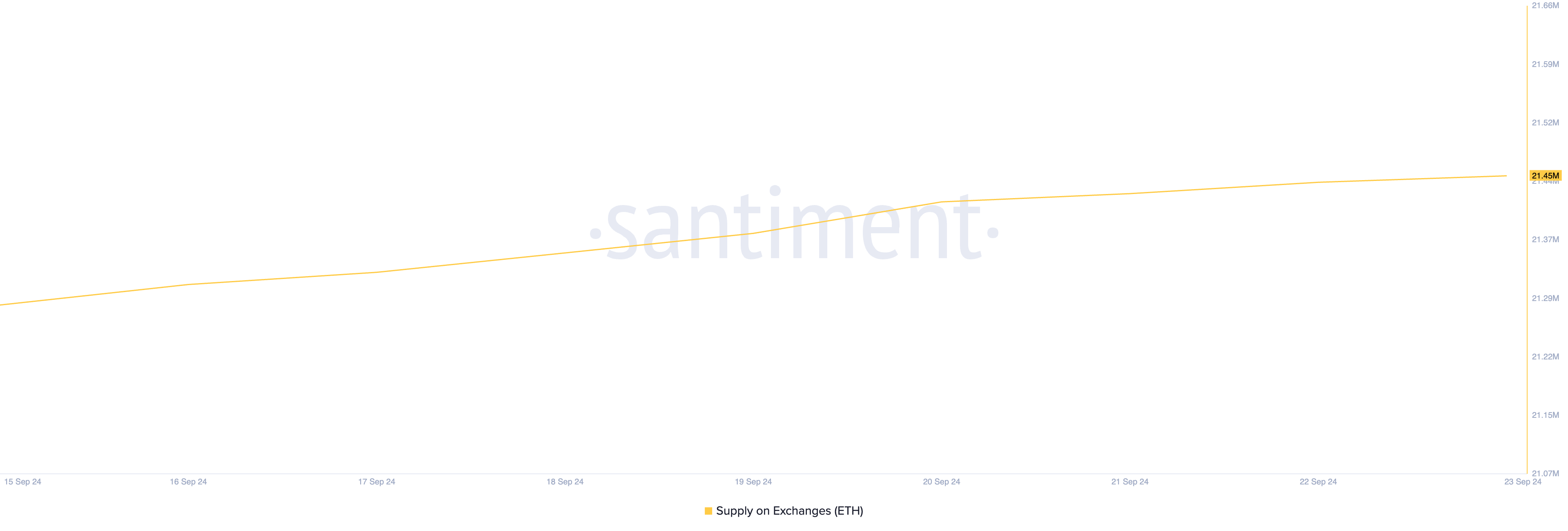

Ethereum Provide on Exchanges. Supply: Santiment

As a result of actions of those whales, the provision of ETH on crypto exchanges has risen. At present, 21.45 million ETH, value above $56 billion, are held throughout crypto exchanges. Since September 20, a cumulative of 30,000 ETH, valued at $79.20 million at present market costs, has been despatched to exchanges.

When an asset’s provide on exchanges climbs, particularly with vital deposits from the whales, it signifies profit-taking exercise. This may occasionally put downward strain on the asset’s value, as extra sellers available in the market can result in oversupply, particularly if new demand doesn’t enter the market.

ETH Worth Prediction: Worth Might Rise To $2,868 Or Fall To $2,111

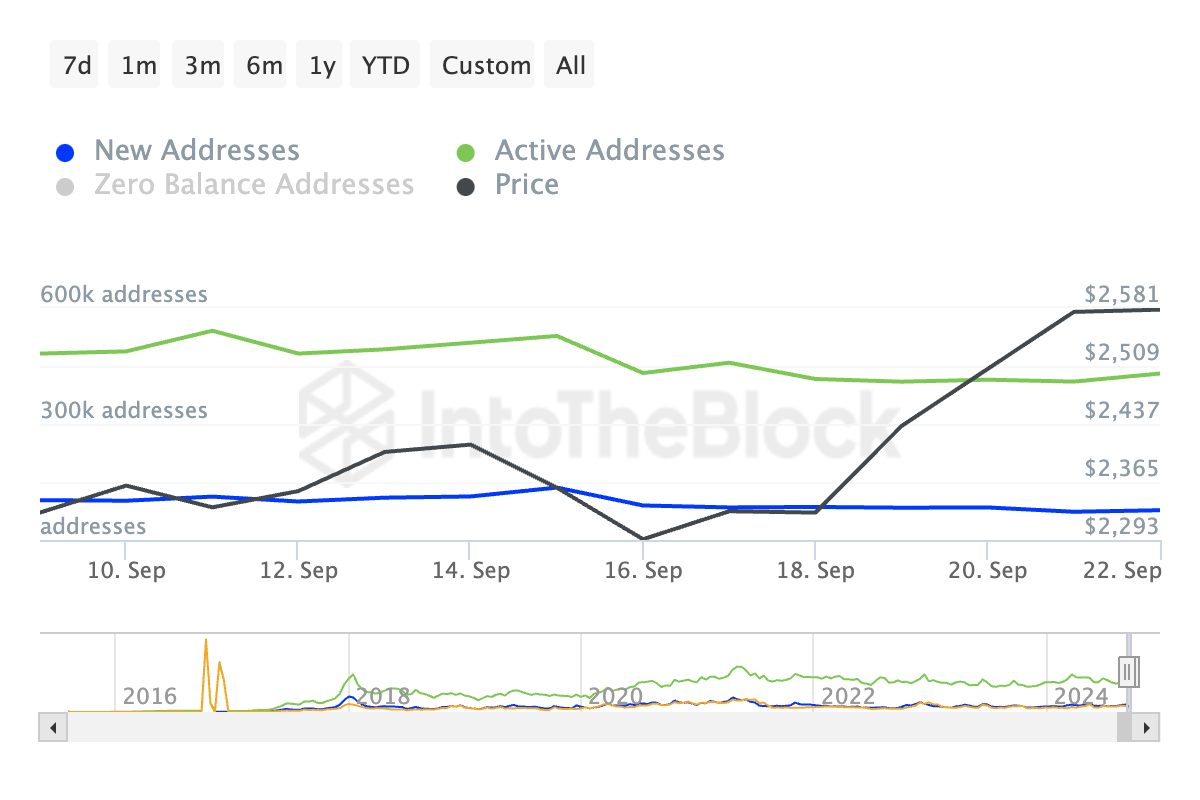

The decline within the variety of new addresses created to commerce ETH over the previous week helps this outlook. IntoTheBlock’s information has revealed a 43% decline in new addresses which have traded the altcoin over the previous seven days. Throughout the identical interval, the lively tackle depend on the community has additionally plummeted by 18%.

Ethereum Every day Lively Addresses. Supply: IntoTheBlock

When an asset’s lively tackle depend drops, it might put downward strain on its value. Diminished community exercise can result in much less demand for the asset and elevated promoting from holders seeking to exit their positions in concern of losses.

Ethereum’s current 14% surge pushed its value above the $2,579 resistance degree. Nevertheless, continued profit-taking by ETH whales may make it tough for the coin to reclaim the $2,868 mark.

If the broader market additionally begins offloading cash, Ethereum’s value might retest the $2,579 degree. Ought to this help fail, the worth may drop by 18%, probably hitting the August 5 low of $2,111.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Ethereum Worth Evaluation. Supply: TradingView

Conversely, if whales cease promoting and new demand enters the market, Ethereum may rise by one other 8%, with a powerful probability of breaking previous the important thing $2,868 resistance.