As Bitcoin (BTC) navigates an unusually calm ‘Uptober,’ a buying and selling professional believes a evaluate of technical indicators and the asset’s previous efficiency suggests a brand new document may be within the offing.

This projection comes because the maiden cryptocurrency reclaimed the $62,000 mark, with bulls anticipating a possible push towards the $65,000 resistance.

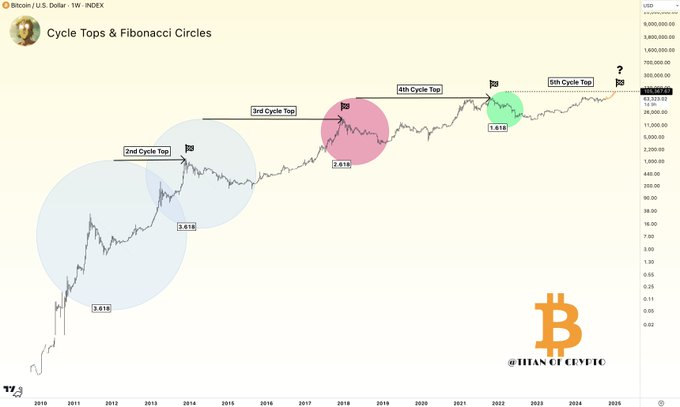

On this regard, Bitcoin might be on observe to achieve $105,000 in its present cycle, pushed by Fibonacci circle evaluation that highlights historic cycle tops, as crypto analyst Titan of Crypto noticed in an X publish on October 13.

The evaluation is predicated on 5 distinct market cycles, every reaching a peak that aligns with key Fibonacci ranges.

Bitcoin technical indicators

In 2013, Bitcoin reached its second main cycle prime across the 3.618 Fibonacci stage, setting a benchmark for future actions. By 2017, Bitcoin’s third cycle prime aligned with the two.618 Fibonacci stage, indicating vital positive factors however at a decrease magnitude relative to Fibonacci ratios. In 2021, the fourth cycle peak reached roughly the 1.618 stage, additional solidifying the pattern of tapering returns with every cycle.

The evaluation forecasts a prime of round $105,000 for the present cycle, as soon as once more concentrating on the 1.618 Fibonacci stage. In accordance with the professional, this projection is a conservative but optimistic outlook, however there’s room for Bitcoin to exceed this goal.

One other analyst, Cryptocon, additionally mentioned Bitcoin cycles and famous that in the long run, the asset appears bullish based mostly on the Consecutive Candles 9 (CC9) indicator. This technical indicator means that Bitcoin may commerce at a excessive of $240,000.

Bitcoin’s bearish outlook

The projection comes as Bitcoin recovers from the October 10 dip under the $60,000 mark in response to the CPI information. Following the restoration, analyst RLinda famous in a TradingView publish on October 12 that Bitcoin’s current value motion has solidified a bearish market construction characterised by sharp fluctuations and a failure to maintain greater value ranges.

She noticed that after retesting the $59,000 mark, Bitcoin rallied by 7%, displaying excessive volatility with none clear technical or basic foundation. Within the final two weeks, the cryptocurrency has skilled speedy actions—dropping by $6,000, then rallying $4,000, solely to fall one other $5,000 and rise once more by $4,000. Regardless of these fluctuations, Bitcoin stays confined inside a sideways buying and selling vary of $65,000 to $52,000.

RLinda said that Bitcoin is at present testing a key resistance zone as a part of its current rally. Nevertheless, the worth will possible face resistance with out sturdy accumulation or technical alerts to interrupt previous this stage.

In the meantime, Ali Martinez’s evaluation advised that the present fluctuation in Bitcoin costs may be wholesome. The volatility, which has seen the asset work together with the $60,000 mark, may present room for a rally towards $78,000.

Bitcoin value evaluation

Bitcoin was buying and selling at $62,770 at press time, having dropped lower than 1% within the final 24 hours. On the weekly chart, BTC is up 1%.

In conclusion, as Bitcoin weathers a interval of volatility and consolidation inside a sideways buying and selling vary, there’s a want for a cautiously optimistic outlook. Bitcoin should overcome key resistance ranges at $65,000 to maintain any upward momentum.

As such, whereas short-term fluctuations might proceed, the outlook for a brand new all-time excessive stays inside attain if market circumstances align.