Ethereum is presently at a crucial juncture, with its value testing the $2.6K-$2.7K resistance zone. A breakout above this vary may sign a mid-term bullish pattern, doubtlessly driving the value towards $2.8K and past.

Nevertheless, if the resistance holds, Ethereum might enter one other bearish consolidation.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum has lately skilled a surge in value, primarily pushed by heightened shopping for exercise across the $2.3K assist degree. This bullish momentum has allowed the cryptocurrency to interrupt above the descending channel’s center trendline, signaling a probably bullish shift.

Nevertheless, the asset is now encountering a considerable resistance area, consisting of the Head and Shoulders (H&S) neckline and the 100-day shifting common (MA) at $2.6K.

If Ethereum can breach this key resistance zone, it might affirm the completion of the H&S sample, which is a bullish reversal sign. This is able to point out a shift towards a mid-term uptrend, doubtlessly pushing the value towards the $2.8K threshold, one other crucial resistance degree. Moreover, a break above the 100-day MA would spotlight patrons’ dominance out there.

Nevertheless, this resistance space may additionally set off a rejection, because it’s thought of a zone with important provide. If sellers regain management, it might result in a bearish consolidation section, stalling additional upward value motion.

The 4-Hour Chart

On the 4-hour chart, Ethereum acquired sturdy assist at $2.3K, forming a double-bottom sample, a bullish reversal indicator. This sample fueled a pointy value improve, pushing ETH to the resistance zone between the 0.5 ($2.6K) and 0.618 ($2.7K) Fibonacci retracement ranges.

This resistance area has confirmed troublesome to interrupt, as Ethereum has confronted a number of rejections from this space in current months. The upcoming value motion can be pivotal for figuring out Ethereum’s subsequent route. If this resistance rejects the value, it might set off a downward motion towards $2.3K. Nevertheless, a breakout above $2.7K would open the door for additional positive aspects and a possible rally.

Onchain Evaluation

By Shayan

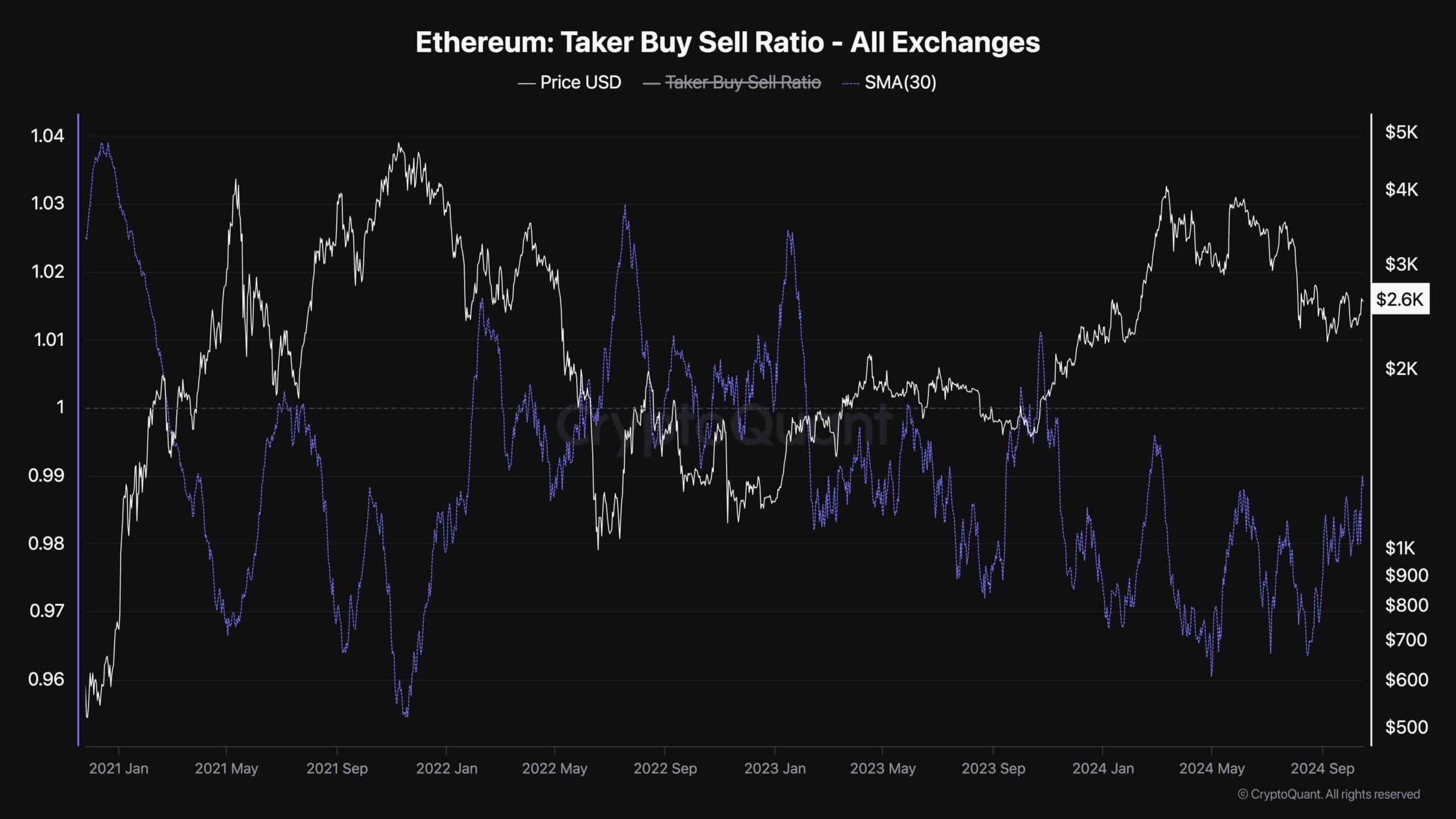

The Taker Purchase-Promote Ratio is a key futures market metric that measures whether or not patrons or sellers are extra aggressive in executing their orders. This ratio offers invaluable perception into futures merchants’ sentiment and may be a necessary complement to conventional value evaluation.

As proven within the chart, after Ethereum’s bullish rebound close to the $2.3K degree, there was a major surge within the execution of market purchase orders within the futures market. This has pushed the Taker Purchase-Promote Ratio to its highest in weeks, suggesting that future members are optimistic about ETH’s short-term value trajectory.

This metric signifies a shift in market sentiment, as aggressive shopping for indicators that merchants anticipate the value to proceed rising. If the Taker Purchase-Promote Ratio surpasses 1, it displays that patrons are overwhelmingly dominant, which regularly aligns with the beginning of a bullish pattern.