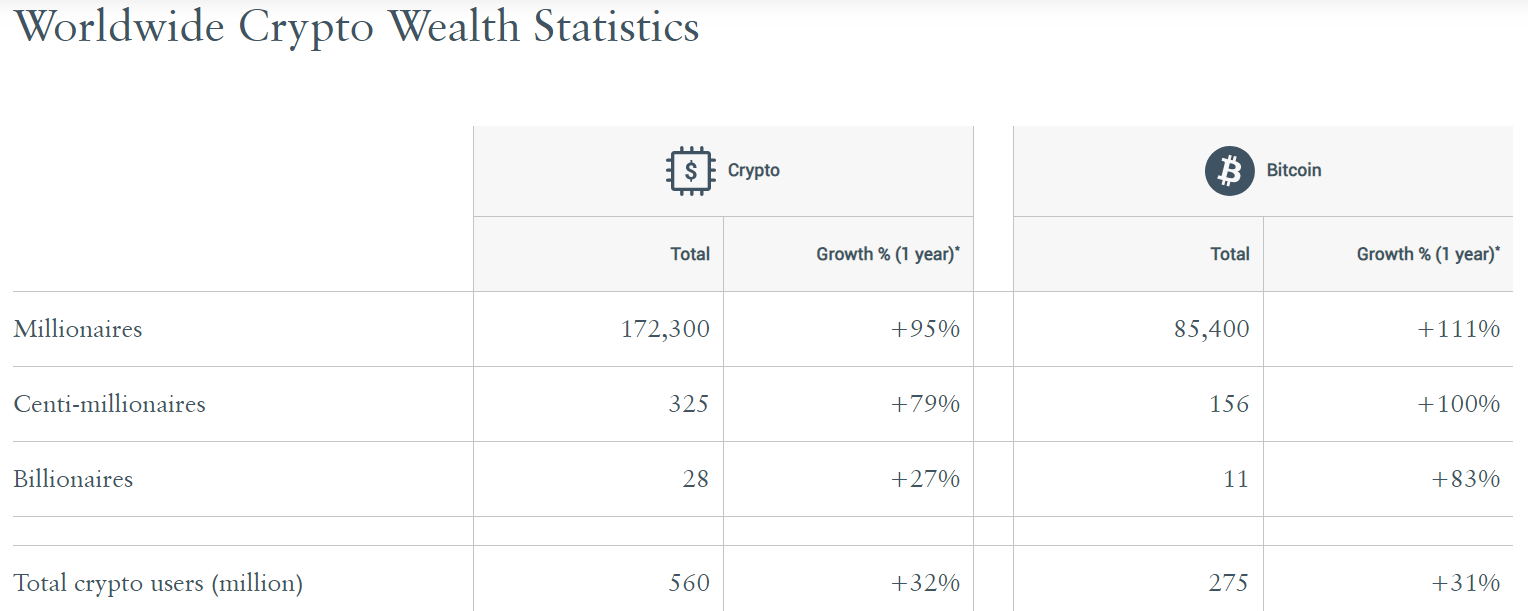

In keeping with Henley & Companions Crypto Wealth Report, Bitcoin millionaires have elevated by over 111% from 2023 to 85400, accounting for 49.6% of crypto millionaires in 2024. By way of crypto billionaires, 5 out of the six new entrants this yr additionally owe their fortunes to Bitcoin.

Crypto millionaires have elevated by 95% from final yr’s figures

Presently, 172300 individuals maintain 1 million crypto belongings and counting, an enormous 95% spike from 2023. BTC holders have notably contributed to the surge in crypto millionaires, with the asset-related millionaires rising by over 111% in the identical interval to 85400. Bitcoin millionaires now make up almost half of worldwide crypto millionaires.

Supply: Henley & Companions

Furthermore, there are actually 28 crypto billionaires, with six new entrants this yr. 5 of the six new billionaires in 2024 have most of their belongings in Bitcoin. By way of customers, Bitcoin holders stand at 275 million, representing 49% of the overall 560 million+ crypto customers.

ETFs and pleasant rules drive the rise in Bitcoin millionaires

Within the US, the approval of the 11 spot Bitcoin ETFs has helped drive Bitcoin adoption and, by extension, the variety of millionaires, as some traders want the funds over buying and selling on centralized exchanges. Thus far, near $20 million has been poured into these ETFs, pointing to the rising curiosity of their spot services and products.

Nations like Singapore and UAE are encouraging crypto adoption with their progressive rules. The UAE, for starters, launched zero capital good points taxes and allowed Dubai’s residents to commerce cryptocurrencies straight with their financial institution accounts.

In April 2024, Singapore additionally supplied detailed tips on digital asset custody and launched cryptocurrency-related amendments to the Fee Companies Act, specializing in digital cost token (DPT) service suppliers and person safety requirements.

Switzerland additionally stands out with its famend “Crypto Valley” in Zug, which helps a vibrant blockchain ecosystem and presents beneficial circumstances for digital belongings. Moreover, Caribbean nations, resembling Antigua, Barbuda, St. Kitts, and Nevis, have additionally applied forward-thinking laws to draw digital asset entrepreneurs.