Central, Northern, and Western Europe made up 22% of worldwide crypto quantity between July 2023 and June this 12 months, in keeping with Chainalysis.

Central, Northern, and Western Europe has emerged because the second-largest crypto economic system globally, receiving $987.25 billion in on-chain worth between July 2023 and June, blockchain forensic agency Chainalysis famous in a current analysis report.

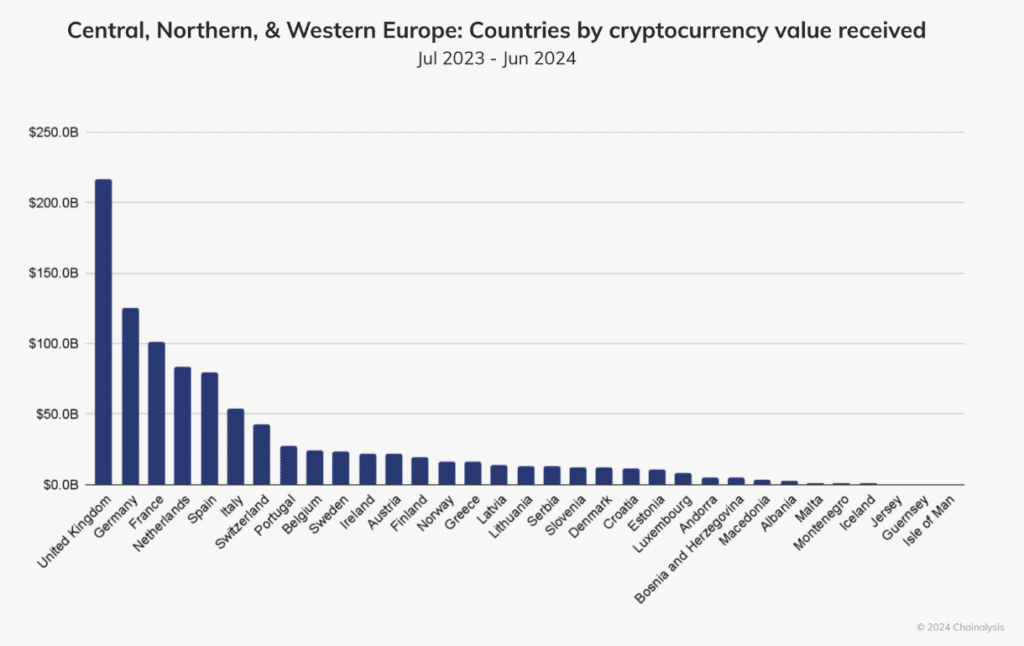

International locations in CNWE by crypto worth obtained | Supply: Chainalysis

This determine accounts for greater than 21.5% of the whole international transaction quantity, with most CNWE nations witnessing a year-over-year development fee of 44%. The analysts say the UK stays on the forefront of this pattern, contributing $217 billion to the area’s complete and rating twelfth within the international crypto adoption index.

Of the sum, Bitcoin (BTC) recorded almost 75% development for transactions under $1 million, marking it because the highest-performing asset kind within the area.

“Throughout all transaction sizes, BTC accounted for $212.3 billion — roughly one-fifth — of CNWE’s complete worth obtained on-chain.”

Chainalysis

You may additionally like: Crypto ETP large 21Shares urges European regulator to deliver regulatory readability

Bitcoin a lot much less common than stablecoins for small transactions

Nonetheless, Bitcoin’s efficiency in smaller transactions lagged behind that of North America, with stablecoins making up almost half of CNWE’s complete inflows at $422.3 billion. Stablecoin purchases utilizing fiat forex within the area considerably outpaced Bitcoin, with the euro accounting for twenty-four% of stablecoin purchases in comparison with simply 6% for BTC.

Within the U.Ok., which recorded a development fee of 58.4%, stablecoins dominate the service provider companies market, persistently holding a 60-80% market share. The demand for stablecoins continues to rise, significantly as companies in inflation-affected economies like Argentina search monetary stability via crypto amid challenges posed by conventional currencies, the report famous.

Learn extra: Worldcoin shifts focus from Europe to Asia amid GDPR challenges