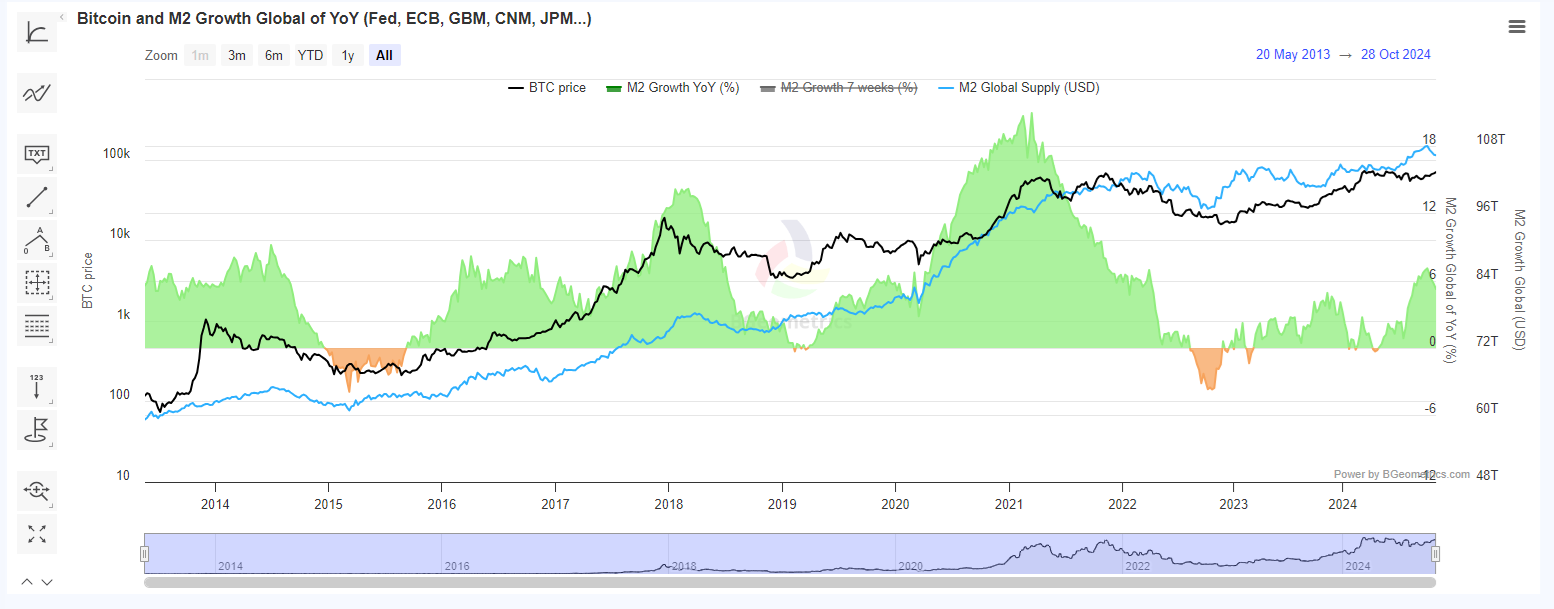

Bitcoin solidified its progress development in October, climbing above $73,500 for a short interval. The most recent rally coincides with a brand new interval of M2 cash provide progress, one of many key components behind the rise of BTC markets.

BTC remains to be inside a small distance of its all-time excessive. The current rally nonetheless adheres to the development of rising M2 cash provide.

The BTC market value is a lagging indicator of quantitative easing. Within the quick time period, BTC has rallied even throughout liquidity crunches, however its total arc coincides with M2 cash provide shifts. The M2 indicator took months to recuperate since a small April crunch, coinciding with Bitcoin’s sluggish achieve to over $70K.

Bitcoin grows in periods of M2 inflows and continues to rally even after the liquidity peak. | Supply: BGeometrics

The worldwide M2 provide peaked round September 20 and slid barely within the final month or so. The value of BTC carried out in its often lagging format, after transferring inside a comparatively small vary. Now, the hopes of an even bigger BTC rally or a 2025 bull market hinge on selections concerning the M2 cash provide.

The previous decade has seen nearly fixed M2 enlargement for the main central banks, although with occasional backtracks and minor provide crunches. Probably the most influential metric takes under consideration the world’s largest central banks – The US Fed, the ECB, the Financial institution of Japan, and the Folks’s Financial institution of China.

Will M2 proceed to develop?

The M2 panorama could fluctuate regionally, shifting demand for investments. In 2025, the US cash provide is anticipated to develop extra conservatively, with some backtracking anticipated throughout the yr. The Euro Space expects cautious progress, with the exclusion of the German financial system.

The M2 cash provide predictions are primarily based on a whole lot of financial indicators, reflecting the state of regional improvement. With financial headwinds and uncertainty, M2 progress could stay uneven, making a disparity in demand for crypto belongings.

Whereas crypto goals to go in opposition to banking, the M2 provide issued by central banks can also be a proxy metric for total sentiment and prosperity, creating demand for dangerous investments like BTC. The current BTC inflows and value motion observe comparable demand for spot gold and gold ETF.

Regardless of the inclusion of stablecoins, BTC enlargement coincides with intervals of financial restoration and progress, whereas additionally serving as a hedge in opposition to uncertainty. BTC demand can also be used as a device to offset inflation, given the expectation of appreciating to a better value vary.

In consequence, BTC rallies typically observe cycles of M2 progress with as much as six months’ lag. The largest rallies observe peaks in M2 provide and proceed throughout the liquidity crunch section.

The current M2 progress development could also be one of many highly effective underlying drivers, as BTC expects a renewed bull market in 2025.

BTC faces predictions of TradFi supercycle

The current BTC rally follows a yr of fixed inflows into ETFs. For now, mainstream adoption of BTC is seen extra as a novelty and a complement to the portfolios of the brand new technology of buyers.

BTC remains to be working at a a lot smaller scale, and has not lined as much as the dimensions of conventional markets. For now, BTC remains to be allotted to portfolios on a comparatively small scale. At present valuations, BTC has a market cap of round 1.4T, whereas asset courses like shares and bonds are valued at $46 trillion every.

BTC makes up almost 60% of the crypto market, and there are expectations for extra inflows from TradFi. The inflows can come by means of ETFs in addition to by means of MicroStrategy (MSTR) inventory. One of many extra excessive predictions is for a $2M per BTC valuation, at a market capitalization of $40T.

Value predictions for BTC vary between a supercycle primarily based on macro components like M2 and short-term corrections because of liquidations. The most recent value strikes additionally trigger disparate predictions, between a 30% drawdown and a continuous rally to six-digit costs.

BTC accumulation has already occurred over the previous yr, with each massive ETFs and whale holders growing their wallets. At this stage, the retail provide crunch may trigger one other FOMO market.

BTC can also be seen as having meme potential, inflicting renewed irrational inflows. The FOMO situation breaks away from the opposite potential value path, buying and selling in a variety as previously few years.