The Bitcoin market is buzzing, and for those who’re feeling the remorse of lacking out on early beneficial properties, you’re not alone. Bitcoin not too long ago surged previous $76,000, marking a vital level in its 4-year cycle and setting the stage for doubtlessly reaching new all-time highs. The value habits has adopted acquainted patterns, and we could also be coming into the later section of the bull market.

To maximise beneficial properties we have to analyze the latest surge, clarify the importance of Bitcoin’s 4-year cycles, and description methods for coming into the market well to capitalize on the continuing bull run.

Understanding Bitcoin’s 4-Yr Cycle

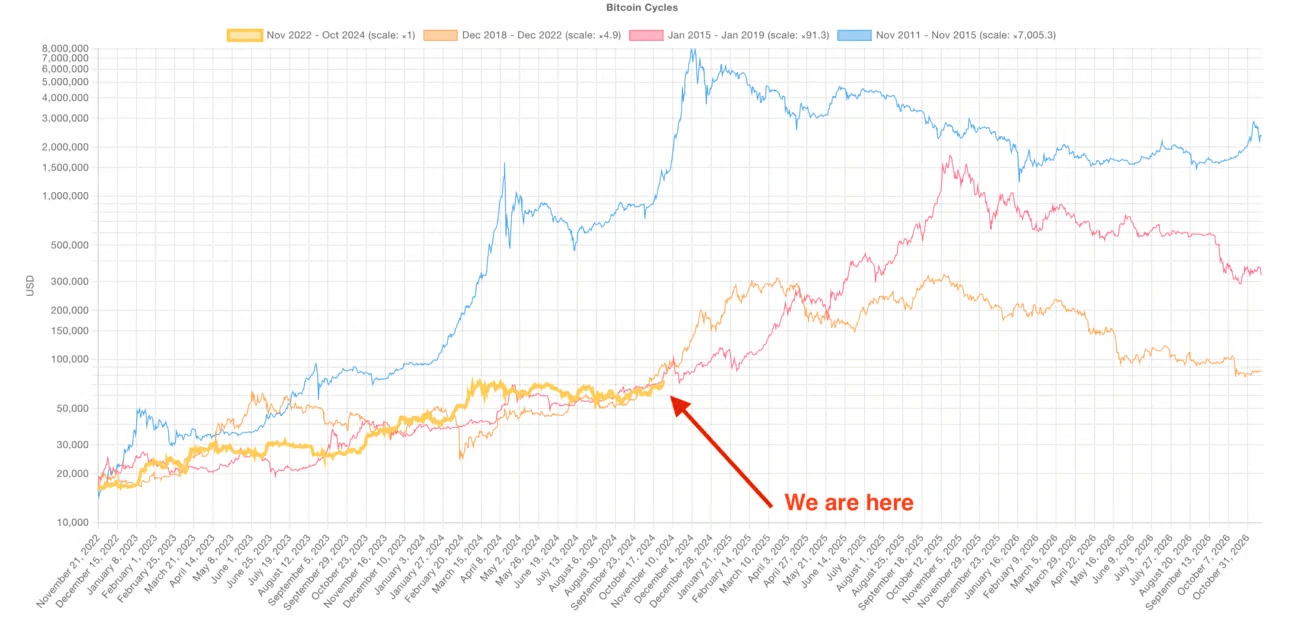

Traditionally, Bitcoin has proven cyclical value habits each 4 years, sometimes aligning with halving occasions, decreasing Bitcoin’s provide and infrequently triggering value appreciation. As proven within the picture above, we’re within the late levels of the present cycle, much like earlier cycles when Bitcoin skilled huge value spikes earlier than reaching its peak. This timing suggests {that a} additional rally could also be on the horizon, although it’s essential to be cautious as we close to potential all-time highs.

Methods to Revenue from Bitcoin’s Bull Run

Now that we perceive the elements behind Bitcoin’s progress, listed here are actionable methods that can assist you profit from the present market momentum.

1. Brief- to Mid-Time period Buying and selling Methods

For these seeking to make shorter-term income, concentrate on these methods:

- Partial Revenue-Taking at Key Ranges: As Bitcoin nears main psychological resistance factors (e.g., $80,000 or $100,000), take into account taking partial income. This strategy lets you safe beneficial properties whereas nonetheless holding a portion of your funding to learn from additional value will increase.

- Look ahead to Resistance Ranges: Key resistance factors are sometimes adopted by pullbacks. Regulate these ranges to keep away from overcommitting at market peaks.

2. Lengthy-Time period Holding (HODLing) for Main Positive aspects

When you’re extra centered on long-term progress, take into account adopting a HODL technique:

- Trip Out Volatility: Bitcoin’s cycle has proven that those that maintain by way of the ups and downs are sometimes rewarded with important returns over time. Holding throughout the bull run may help you capitalize on the potential for brand new highs.

- Put together for Corrections: Whereas the market is climbing, it’s sensible to be mentally and financially ready for inevitable corrections. Bitcoin typically sees sharp pullbacks even in bull markets, so staying calm and holding by way of dips can repay.

3. Greenback-Value Averaging (DCA) for New Entrants

For individuals who are new to Bitcoin and wish to keep away from coming into abruptly throughout a peak, dollar-cost averaging (DCA) is an efficient strategy:

- Mitigate Worth Volatility: By investing a hard and fast quantity frequently, you possibly can common your buy value over time, which helps cut back the influence of sudden value swings.

- Rebalance Throughout Peaks: As Bitcoin reaches potential peaks, take into account rebalancing by progressively shifting a portion of beneficial properties to extra steady belongings. This technique permits flexibility for re-entry if the market corrects.

Whereas some might really feel they missed the boat on Bitcoin’s latest surge, there are nonetheless alternatives to take part within the bull run and doubtlessly revenue from this cycle. Whether or not by way of short-term buying and selling, long-term holding, or dollar-cost averaging, you possibly can enter the market strategically and cut back the chance of leaping in throughout a peak. By following the historic patterns outlined within the Bitcoin cycle picture and adopting disciplined funding methods, you possibly can place your self to learn from Bitcoin’s ongoing rally and future progress.