Ethereum has seen a major uptick in shopping for strain close to the $2.4K help degree, driving an impulsive worth surge and reclaiming a number of key resistance areas. This motion is signaling a possible shift in the direction of a bullish market sentiment, with larger worth ranges anticipated within the mid-term.

By Shayan

The Every day Chart

The each day chart reveals that intensified shopping for close to the channel’s center boundary of $2.4K has sparked a considerable upward transfer, permitting Ethereum to interrupt by a number of important resistance factors:

- The 100-day shifting common at $2.5K

- The descending channel’s higher boundary is round $2.8K

- The 200-day shifting common at $3K

This sturdy efficiency suggests a bullish shift, with Ethereum reclaiming these resistance ranges. Moreover, crossing the psychological $3K threshold reinforces a optimistic market sentiment, elevating the opportunity of reaching a brand new all-time excessive by year-end. Nevertheless, a short consolidation corrections part may be essential to maintain this pattern healthily, permitting for potential profit-taking and market stabilization.

The 4-Hour Chart

The 4-hour chart reveals an preliminary surge from $2.4K, the decrease boundary of the descending flag sample, the place shopping for strain has been sturdy. Ethereum has now surpassed the $2.8K resistance, which had acted as a major barrier in current months.

This break highlights patrons’ intent to extend the worth, with eyes probably set on a brand new ATH.

At the moment, Ethereum is approaching $3.1K, the flag’s higher boundary, the place notable promoting strain could emerge. Given the impulsive nature of the current improve, a short-term rejection adopted by a short lived corrective retracement appears potential. On this case, a short correction towards the help vary of $2.7K —$2.6K (bounded by the 0.5 and 0.618 Fibonacci retracement ranges) can be useful, setting the stage for a more healthy uptrend.

By Shayan

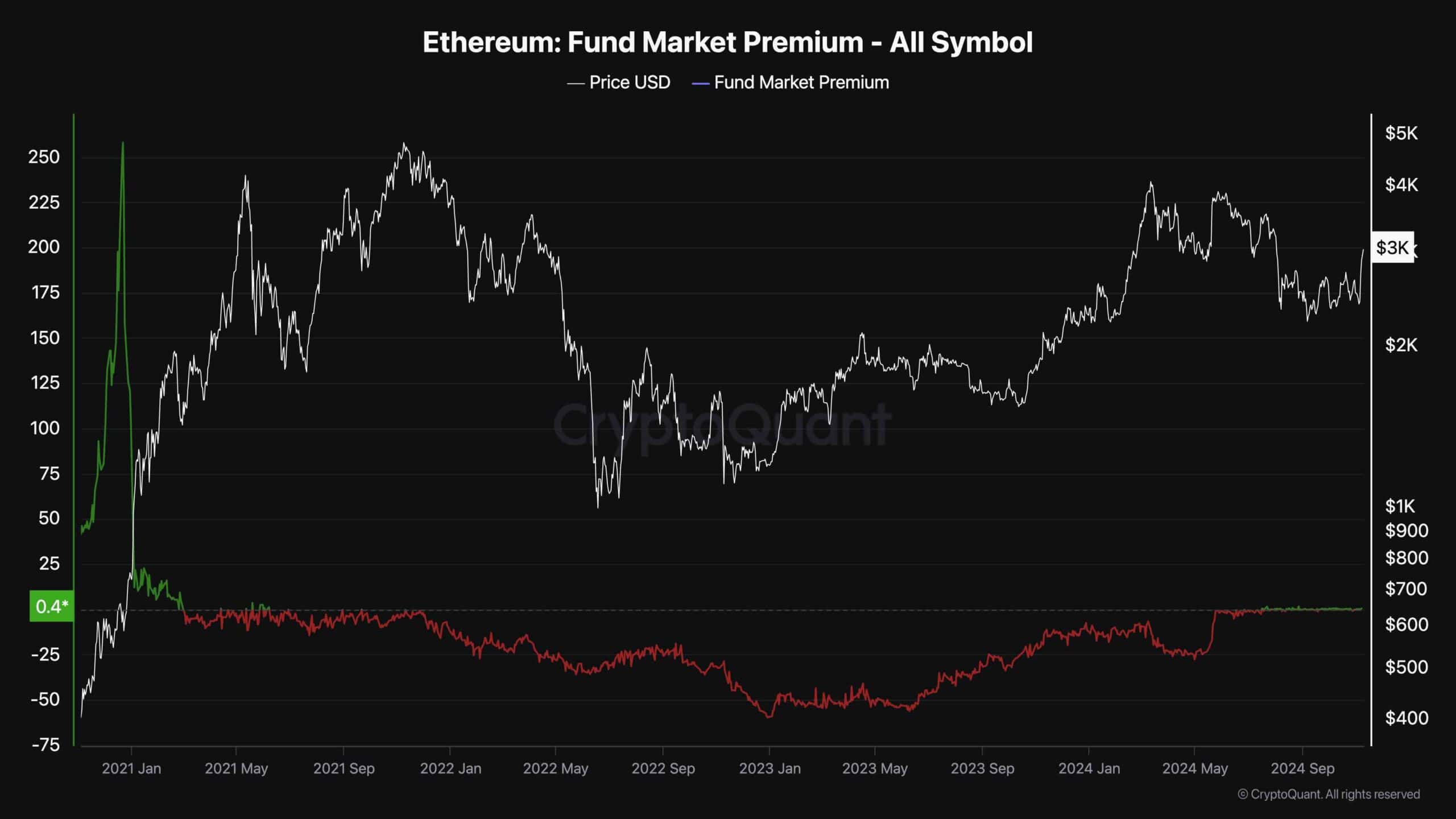

The fund market premium metric is a vital indicator, because it displays the distinction between a fund’s market worth and its Internet Asset Worth (NAV). When the premium is elevated, it suggests sturdy shopping for strain inside a particular area, indicating that buyers are paying the next worth for fund shares relative to the underlying belongings.

This premium metric considerably declined from mid-November 2021, when Ethereum reached its all-time excessive. This decline aligned with waning curiosity in Ethereum funds, a typical response as buyers grew to become cautious through the subsequent bear market.

Nevertheless, a pivotal shift occurred as Ethereum reached its bear market low. The premium metric began to rise modestly, marking a return on investor curiosity. Since January 2023, this premium has steadily elevated, signaling a resurgence in confidence for Ethereum-backed belongings. Just lately, the premium moved above zero, revealing optimistic market sentiment and suggesting strong demand for Ethereum funds.

In abstract, the optimistic shift within the premium metric is a promising signal of renewed market optimism. If this pattern persists, it may reinforce Ethereum’s broader worth momentum, probably contributing to its future worth development trajectory.