Koji Higashi, a distinguished entrepreneur within the Japanese BTC crypto enviornment, has mentioned that whereas many individuals in Japan imagine Bitcoin just isn’t backed by something of worth, the Japanese yen (JPY) is backed by residents held hostage to the financial system. Higashi’s sentiment strikes the basis of an even bigger, extra controversial situation for Bitcoin followers: the political co-opt of cryptocurrencies.

Japanese crypto entrepreneur and CEO of the Diamond Arms Lightning Community (LN) resolution supplier, Koji Higashi, has just lately mentioned that the Japanese individuals are being held as “hostages” to a faltering JPY.

Higashi has a wealthy file of crypto initiatives and involvement in Bitcoin in Japan reaching again to 2014.

‘The Japanese yen is backed by hostages’

In a current submit on X, Higashi proclaimed (translated from Japanese): “The argument that Bitcoin just isn’t backed up is one thing most people agrees with … however what in regards to the backing of the Japanese yen?”

The crypto developer went on to say that the presently embattled JPY is “backed by hostages – Japanese individuals who, even when their lives are struggling, work diligently, pay taxes, and get monetary savings in yen and not using a phrase.”

Certainly, the plight Higashi references eroding the Japanese high quality of life up to now decade has grow to be noticeable for a lot of.

Retirees who can’t reside on their pensions, underpaid employees attempting to maintain up with a weak yen and inflation, and victims of the large tax racket in Japan’s ever-expanding paperwork are all beginning to communicate out. This, coupled with an incentivized inflow of USD- and euro-toting vacationers is all taking an impact.

“That’s all it’s worthwhile to say,” the Diamond Arms co-founder and CEO ends his submit.

However Higashi’s remark about people demanded (below risk of police violence) to pay up taxes, and endure in silence with a sub-par yen, opens one other can of worms that’s been a scorching matter these days: the concept that there could also be a state and company co-opt of in style cryptos.

Blackrock Bitcoin and the Saylor Moon: The ‘fiat-ization’ of crypto

In a current submit on crypto pioneer Roger Ver, Cryptopolitan notes that the early Bitcoin evangelist maintains in his new guide that the unique Bitcoin — BTC — has been co-opted by highly effective and vested pursuits.

He’s not alone. Some imagine the current orange coin worth highs are pumps from market hype and the identical fiat system (however this time in USD) that Higashi calls out in his submit.

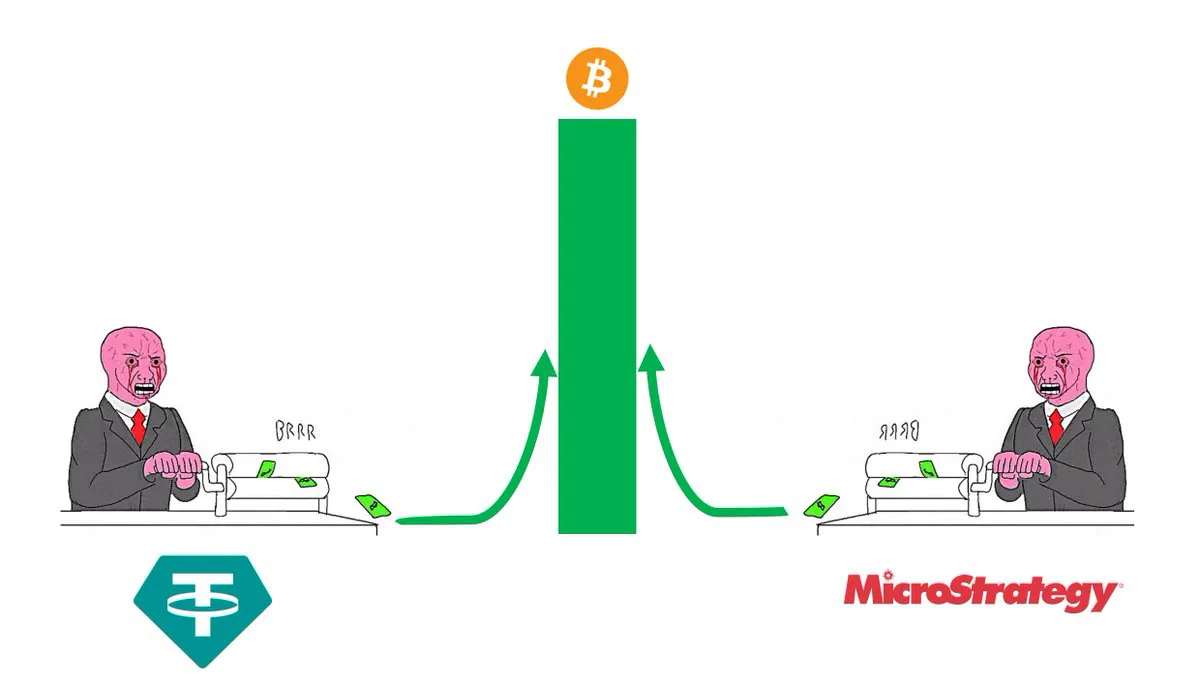

“I imply Tethers are unredeemable and MicroStrategy can all the time borrow extra for extra leverage, so this celebration can simply proceed perpetually, proper?” software program engineer and self-described “Bitcoin Evangelist” David Shattuck quipped on Nov. twenty first through social media.

In response to retorts that the vastly in style USD stablecoin is certainly redeemable, one other person of X famous: “If something undermines the market’s belief in it, it loses its peg and the entire thing falls aside.”

No matter one’s view, certainly, USDT’s reserves are overwhelmingly denominated in U.S. Treasury payments. With American president-elect Trump who says “You by no means need to default since you print the cash,” one might marvel if a state and mega-corporate buy-up of Bitcoin is an efficient factor.

However in keeping with MicroStrategy CEO, Michael Saylor, these issues of vested, centralized seize by Blackrock and different state-embedded actors are simply the delusions of “paranoid crypto-anarchists.”

Higashi, for his half, is a fan of hotly contested Layer 2, custodial entities just like the Liquid and Lightning Networks, however has additionally mentioned “It isn’t that tough to foretell the event by which MicroStrategy and Saylor will grow to be ‘enemies of Bitcoin’ in October.