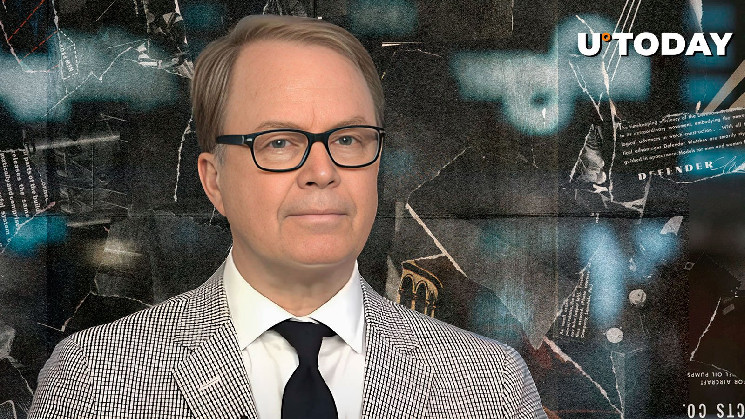

Jurrien Timmer, director of world macro at Boston-based mutual fund behemoth Constancy, believes that Bitcoin exchange-traded funds (ETFs) seem like one of many predominant catalysts behind the current rally that almost introduced the biggest cryptocurrency to the much-coveted $100,000 value mark.

The Constancy government has additionally taken notice of levered speculators pushing Bitcoin’s open curiosity (OI) increased. “But it surely’s not simply money leaping on the development. The open curiosity within the futures market is hovering as nicely, pushed by hedge funds and levered speculators,” he mentioned.

As reported by U.At present, Galaxy Digital CEO Mike Novogratz lately predicted that Bitcoin would inevitably surge increased. Nonetheless, he additionally warned in opposition to extreme leverage. The Bitcoin bull appropriately predicted that there could be a big correction.

Earlier this week, Bitcoin dipped to as little as $90,742 on the Bitstamp alternate earlier than paring most of its losses.

Bitcoin stays in its worth vary

Timmer has additionally opined that the main cryptocurrency by market cap “sits squarely” in its truthful worth vary.

“If the ability regulation of Bitcoin’s increasing community (amplified by actual charges and the cash provide) is one of the simplest ways to worth this most intriguing asset, then Bitcoin sits squarely in its truthful worth vary,” he mentioned in a current social media put up.

The Bitcoin valuation mannequin cited by Timmer relies on such elements because the cryptocurrency’s hypothetical adoption curve, actual charges, and cash provide.

The main cryptocurrency is at the moment altering palms at $96,386 after including 4.7% over the previous 24 hours.

Bitcoin is now solely 3.4% away from reclaiming its file excessive of $99,645 which was achieved 5 days in the past.