Predominant Takeaways

-

BFUSD affords a excessive APY (not too long ago within the 30%-47% vary) by means of returns from funding charges and staking, however such returns are dynamic and rely upon market situations.

-

A strong Reserve Fund shields customers from adverse funding charges, making certain stability even throughout bearish market situations.

-

Backtesting exhibits that BFUSD’s Reserve Fund can face up to excessive market situations, offering a dependable buffer that may possible develop over time.

It is a common announcement. Services and products referred to right here is probably not accessible in your area.

The introduction of BFUSD, our unique reward-bearing margin asset launched in November 2024, has sparked enthusiasm and curiosity, notably concerning its Annual Share Yield (APY), which has not too long ago ranged from 30% to 47%. Many customers marvel: How is that this excessive APY potential? Is it sustainable? What are the dangers?

On this weblog, we’ll break down how BFUSD generates its returns, clarify the position of funding charges and staking, and supply insights into the mechanisms that guarantee its stability, together with the Reserve Fund. By the top, you must have a a lot clearer view of how BFUSD works and why it’s a beneficial addition to your buying and selling technique.

How Does BFUSD Generate Excessive APY?

The reply lies in BFUSD’s construction. Its day by day APY is derived from an combination return generated from staking charges and funding charges from the day gone by. It’s essential to notice that APY will not be mounted, and previous outcomes don’t assure future efficiency.

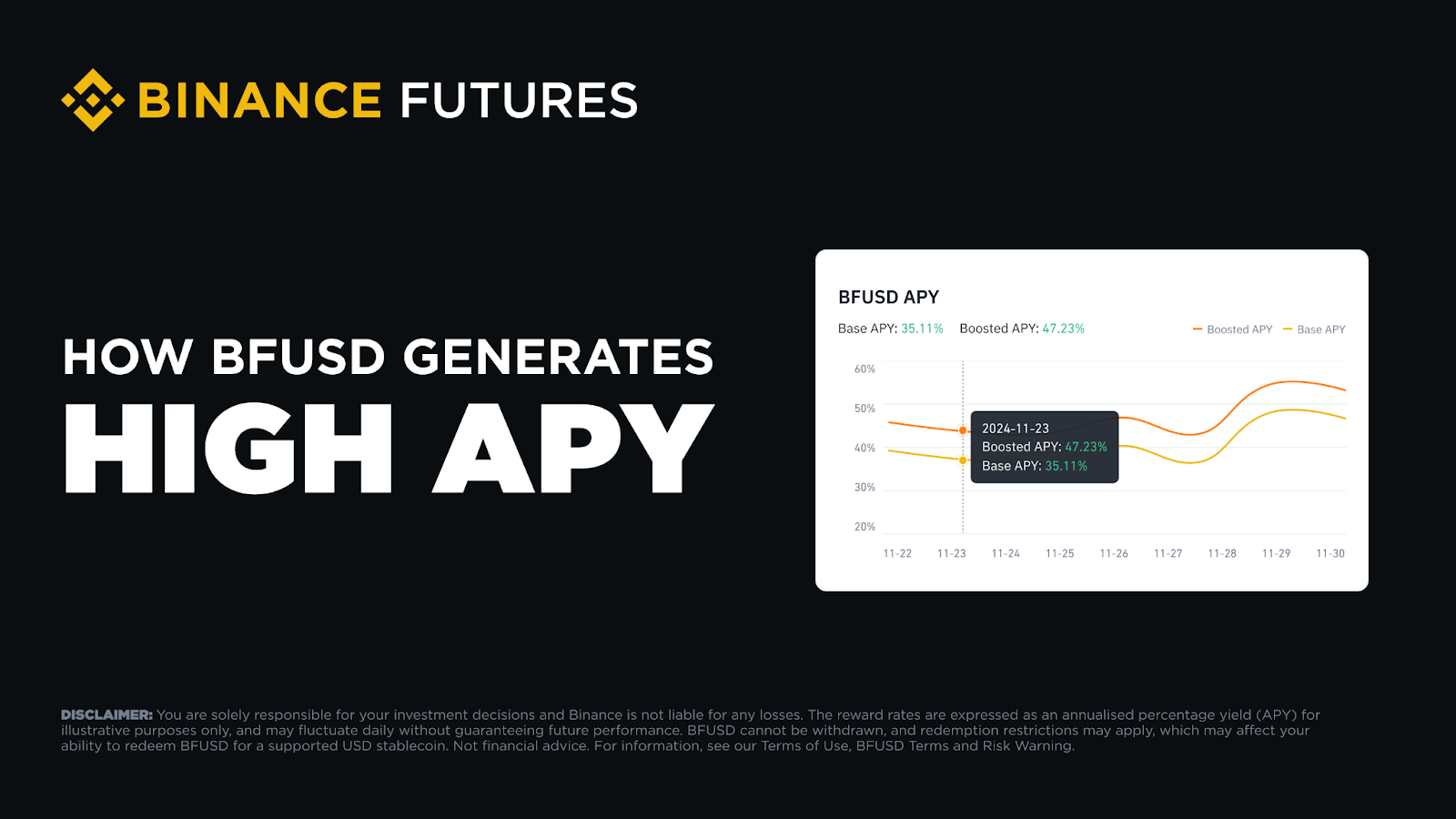

For instance, on November 23, 2024, BFUSD provided a Boosted APY of 47.23%, whereas the Base Charge stood at 35.11%. This elevated APY was pushed by favorable market situations, together with notably excessive ETHUSDT funding charges throughout this era, as mirrored in Binance’s publicly accessible funding charge knowledge.

Funding charges, that are influenced by market demand and volatility, performed a key position in reaching this excessive yield. By design, BFUSD shares the worth generated from these mechanisms as rewards with Binance’s group and merchants.

Can BFUSD’s Funding Payment Be Damaging?

The reply is sure. There will likely be instances when the APY for BFUSD is adverse — particularly throughout bearish market situations when funding charge revenue turns adverse.

To mitigate this, BFUSD is designed with a built-in Reserve Fund. Throughout favorable market situations, a portion of the full APY generated is allotted to this Fund. This buffer ensures customers are shielded from adverse funding charges when the market shifts.

For instance — as beforehand talked about — on November 23, 2024, BFUSD provided a Base Charge of 35.11% and a Boosted Charge of 47.23% for these actively buying and selling. These charges have been supported by favorable market situations, together with notably excessive ETHUSDT funding charges on that day. Alongside distributing aggressive APYs to customers, BFUSD strategically allotted a portion of the returns throughout this era to the Reserve Fund.

This allocation reinforces the Reserve Fund’s capability to supply a security web in periods of adverse funding charges, making certain long-term stability for BFUSD holders even in much less favorable market situations. Nevertheless, it’s important to know that BFUSD’s APY will not be assured, and will even be zero at instances. As a dynamic product, its efficiency is dependent upon market situations. Previous APY outcomes don’t assure future outcomes.

For extra particulars on dangers and situations, please confer with our FAQ and Phrases.

Can BFUSD Persistently Generate a Excessive APY Regardless of Damaging Funding Charges?

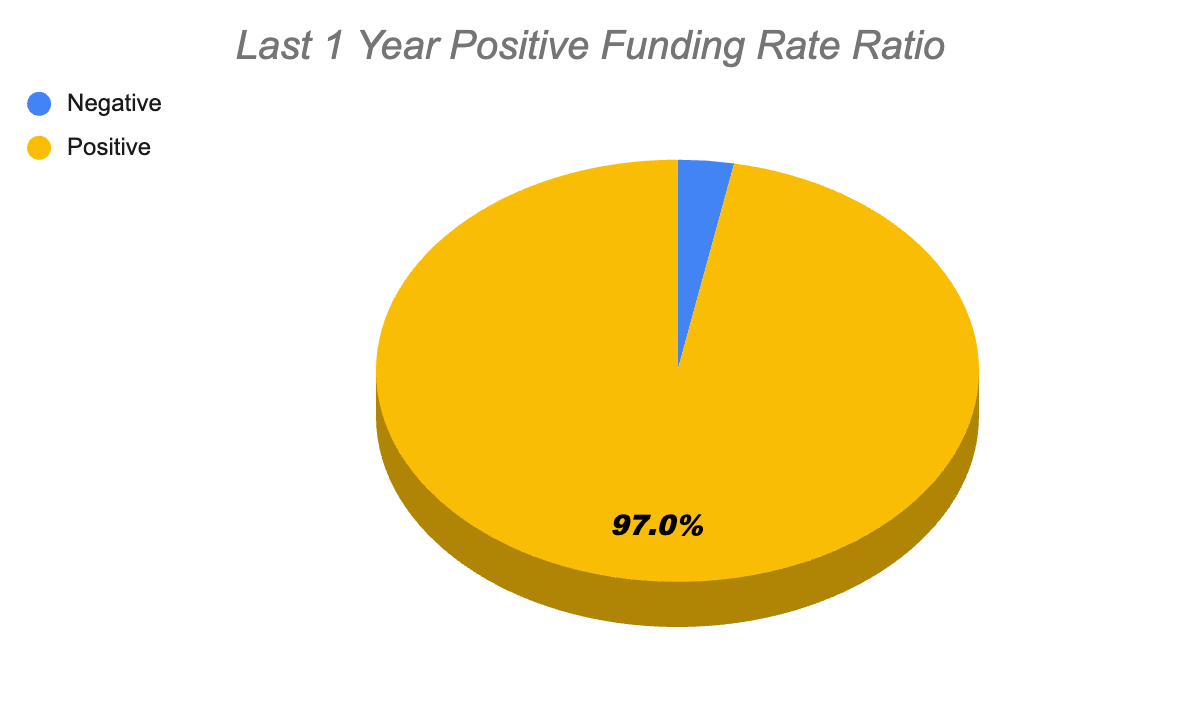

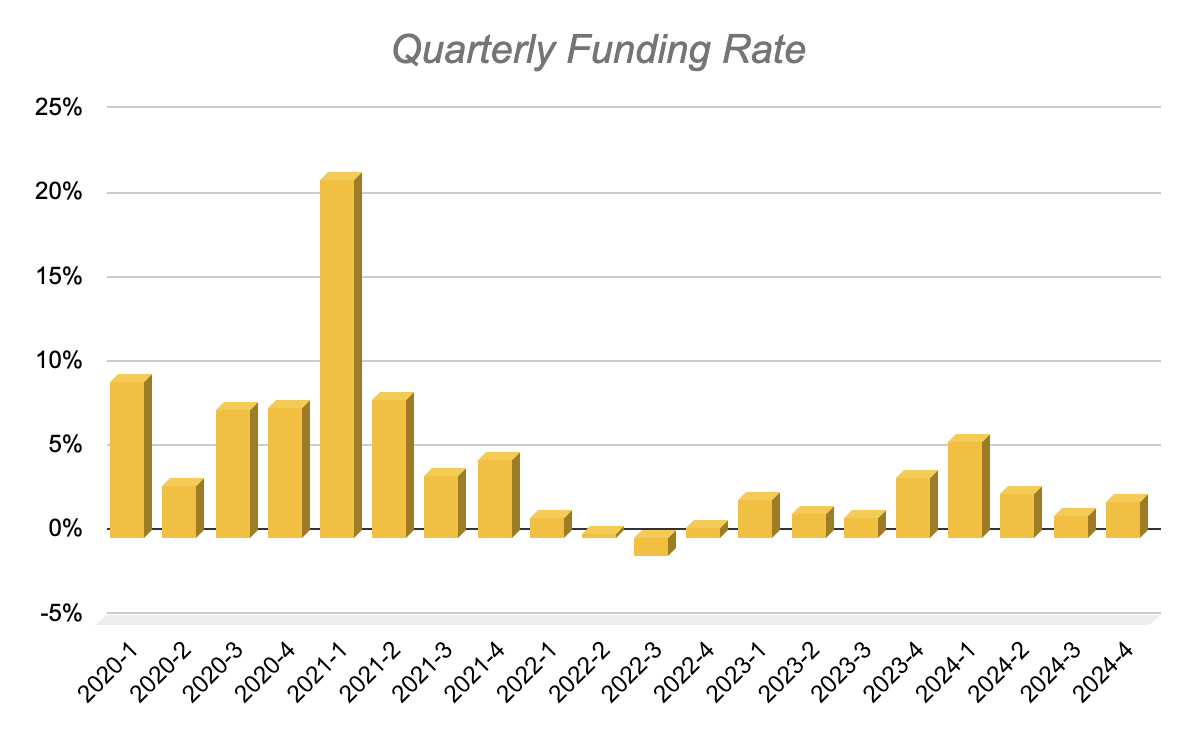

Whereas it’s true that derivatives funding charges can flip adverse, they’re predominantly constructive — a pattern supported by the bullish market sentiment and the non-inflationary nature of crypto belongings. Take the ETHUSDT buying and selling pair for instance.

Over the previous 12 months, its funding price has been constructive for 354 out of one year. historic developments, funding charges have been largely constructive on a quarterly foundation because the launch of Binance Futures in late 2019. This sturdy observe file underpins BFUSD’s potential to constantly generate APY from funding charges, even in a unstable market.

Above: Binance’s ETHUSDT Constructive Funding Days over the previous 12 months

Above: an summary of Binance’s Common Quarterly Perpetual Funding Charges

Can the Reserve Fund Absolutely Defend Customers from Damaging Funding Charges?

As defined above, we’ve carried out a strong Reserve Fund to safeguard BFUSD customers from the impression of adverse funding charges. At launch, the Fund was seeded with 1 million USDT, and its resilience has been rigorously examined in opposition to excessive situations.

Backtesting the Reserve Fund

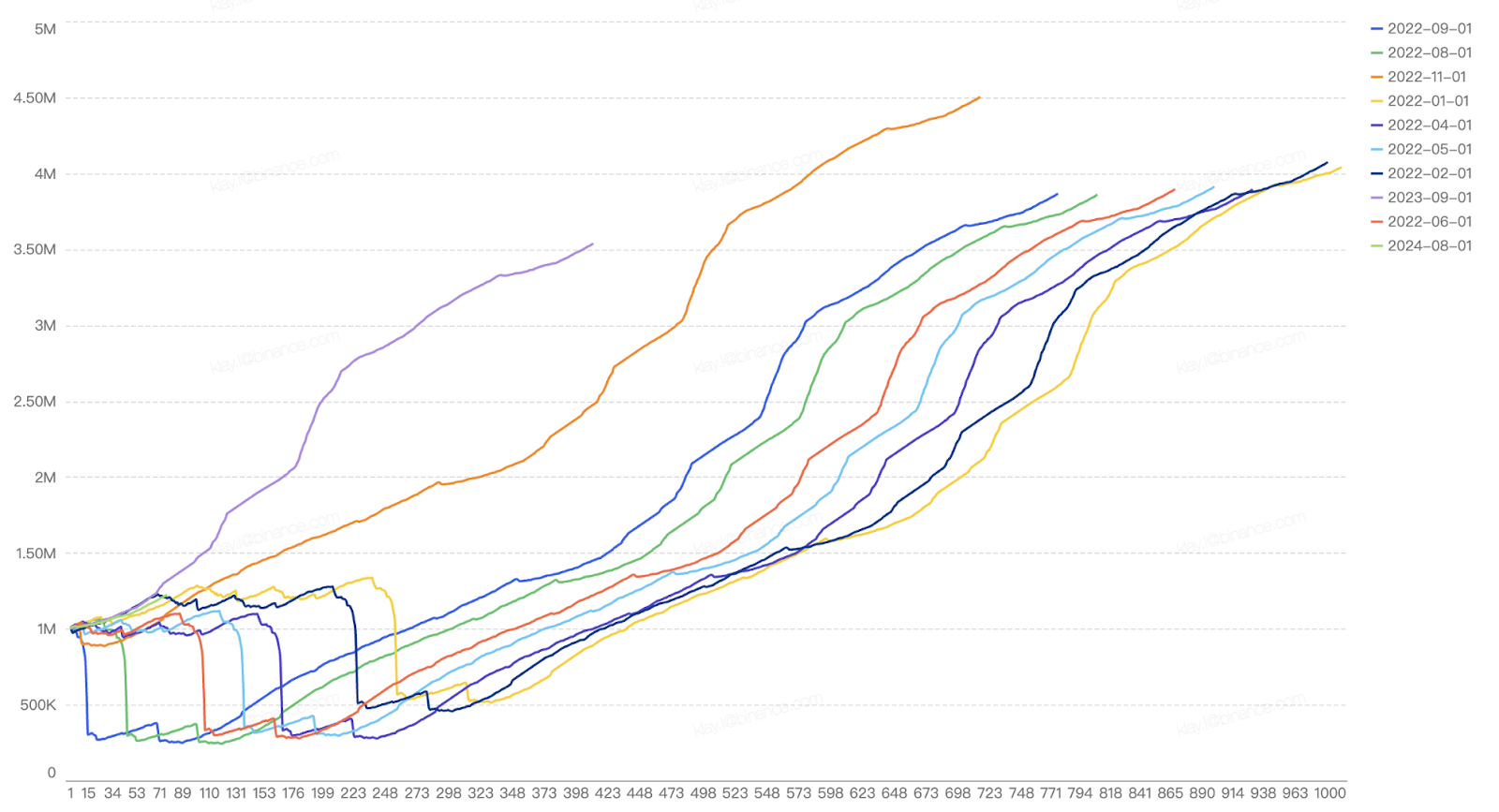

We carried out a backtest utilizing the next assumptions (for illustrative functions solely):

-

Subscription Dimension: $50 million flat preliminary subscription.

-

Preliminary Reserve Fund: $1 million.

-

ETH Staking APY: 3%.

-

Reserve Fund Allocation: 30%.

-

No Place Discount: Positions stay unchanged throughout adverse funding situations, with the Reserve Fund masking adverse funding charges.

The backtest simulated efficiency in the course of the 10 worst funding months in Binance Futures historical past, ranked by probably the most adverse funding charges. The chart beneath illustrates the Reserve Fund’s dimension over a 1,000-day interval following every backtested launch:

Key Insights

Even beneath probably the most difficult backtested situations, the Reserve Fund demonstrated its potential to guard customers. Based mostly on our calculations, the 1M USDT Reserve Fund wouldn’t solely face up to the stress of the worst historic funding intervals, but additionally possible develop over time.

Ongoing Monitoring

Whereas the backtest confirms the Reserve Fund’s resilience, Binance is dedicated to constantly monitoring and managing the Fund to make sure its adequacy. Common changes will likely be made as wanted to take care of a dependable buffer.

Ultimate Ideas

BFUSD was designed with the group in thoughts, aiming to ship higher worth to Binance customers by combining versatile margin with day by day rewards.

All through this weblog, we’ve explored how BFUSD generates its excessive APY by means of funding charges and staking revenue, the mechanisms in place to defend customers throughout difficult market situations, and the position of the Reserve Fund in making certain stability.

The keenness from our group has been inspiring, and we’re dedicated to refining and bettering the product to higher serve your wants. As we proceed to innovate, your suggestions will stay on the coronary heart of BFUSD’s evolution. Thanks on your assist — collectively, we’re shaping a extra rewarding futures buying and selling expertise.

Additional Studying

-

What Is BFUSD and Easy methods to Use It as Margin in Futures Buying and selling

-

Easy methods to Purchase BFUSD and Redeem for USD Stablecoin

-

How are the Reward Charges for BFUSD Holders decided?

-

BFUSD Phrases

Disclaimer: You might be solely liable for your funding choices and Binance will not be chargeable for any losses you could incur. The reward charges (together with the Base Charge and the Boosted Charge) are calculated day by day, and are expressed as an annualised proportion yield (APY) for illustrative functions solely. Every reward price will not be consultant of the efficiency of BFUSD for any interval apart from the actual date specified and isn’t indicative of future outcomes. The reward charges are more likely to fluctuate day-to-day. Previous efficiency will not be a dependable predictor of future efficiency. It’s best to solely put money into merchandise you’re accustomed to and the place you perceive the dangers. It’s best to rigorously think about your funding expertise, monetary state of affairs, funding aims and threat tolerance and seek the advice of an unbiased monetary adviser prior to creating any funding. BFUSD can’t be withdrawn or used for any function apart from as margin in a Binance Futures Account. Redemption restrictions might apply, which can have an effect on your potential to redeem BFUSD for a supported USD stablecoin.

This content material is introduced to you on an “as is” foundation for common info and academic functions solely, with out illustration or guarantee of any variety. It shouldn’t be construed as monetary recommendation, neither is it meant to advocate the acquisition of any particular services or products. Digital asset costs will be unstable. The worth of your funding might go down or up and you could not get again the quantity invested. You might be solely liable for your funding choices and Binance will not be chargeable for any losses you could incur.

The services and products referred to herein could also be restricted in sure jurisdictions or areas or to sure customers, in accordance with relevant authorized and regulatory necessities. These supplies are meant just for these customers who’re permitted to entry and obtain the services and products referred to and are usually not meant for customers to whom restrictions apply. You might be liable for informing your self about and observing any restrictions and/or necessities imposed with respect to the entry to and use of any services and products provided by or accessible by means of Binance in every nation or area from which they’re accessed by you or in your behalf. Binance reserves the correct to alter, modify or impose further restrictions with respect to the entry to and use of any merchandise and/or companies provided sometimes in its sole discretion at any time with out notification.

This materials shouldn’t be construed as monetary recommendation. For extra info, see our Phrases of Use, the BFUSD Phrases and our Danger Warning. To study extra about how one can shield your self, go to our Accountable Buying and selling web page.