Chainlink (LINK) is revisiting worth ranges not seen since 2021 because the token inches nearer to the $30 mark. Current on-chain evaluation reveals growing whale exercise with massive wallets getting in at this worth degree.

Chainlink (LINK) has grow to be enticing to whale patrons as seen on current on-chain knowledge. In a single transaction, a large-scale purchaser acquired $4.94M of LINK tokens, at a mean worth of $28.18. The funds went by an middleman pockets earlier than touchdown in a high-balance holder’s pockets that has been energetic since November.

LINK is now returning to ranges not seen since 2021. The token has a novel trajectory, peaking in late 2020 at above $49. Since then, LINK has served as a utility token and has typically gone counter to the market.

In late 2024, LINK rallied together with different “dinosaur cash” after the launch of a short altcoin season. LINK has all the time had a neighborhood of long-term holders, which has arrange expectations for brand spanking new all-time highs.

LINK is likely one of the few tokens with each a powerful enchantment as a neighborhood and utility by its oracle providers. The corporate continues to develop its portfolio of initiatives, organising knowledge for crypto insiders and a number of TradFi purchasers. Chainlink secures knowledge for 407 crypto entities, securing $38.33B in worth.

LINK is carefully watched for its potential to chart at new highs towards the tip of 2024 because it inches nearer to new all-time highs.

As of December 12, open curiosity for LINK grew to an all-time excessive above $656M, with fixed progress previously few days. LINK retains 70% of lengthy positions in opposition to a mean of 30% for shorts on most main crypto exchanges.

The current rise of LINK can be linked to Bybit’s current breakout. Most LINK volumes have now moved to the rising alternate, with $341.7M in open curiosity on that market. LINK can be using extra hype because it already climbed into the highest 15 of cash and tokens by market capitalization.

Chainlink positive factors from oracle service partnerships

The current rally can be in response to information that Donald Trump’s DeFi enterprise, World Liberty Monetary, is buying LINK tokens for its portfolio. World Liberty additionally acquired ETH and AAVE as a part of its makes an attempt to construct a DeFi vault. World Liberty holds $1.15M value of LINK or 41.33K tokens on a broadly recognized public pockets.

World Liberty buys LINK as a part of its partnership in utilizing oracle providers, going past short-term hypothesis.

Chainlink has totally different enchantment factors in its relationshipe with its neighborhood and real-world monetary entities. Not too long ago, Chainlink turned part of the Digital Asset Board with Emirates NBD. Chainlink will add its experience to already established board members PwC, Fireblocks, R3 and Chainalysis.

The corporate with $260B in property beneath administration will discover Chainlink’s providers for elevated effectivity. Chainlink continues to check its digital knowledge providers and oracle connections to make conventional enterprise processes extra environment friendly.

Chainlink will get enhance from cross-chain transfers

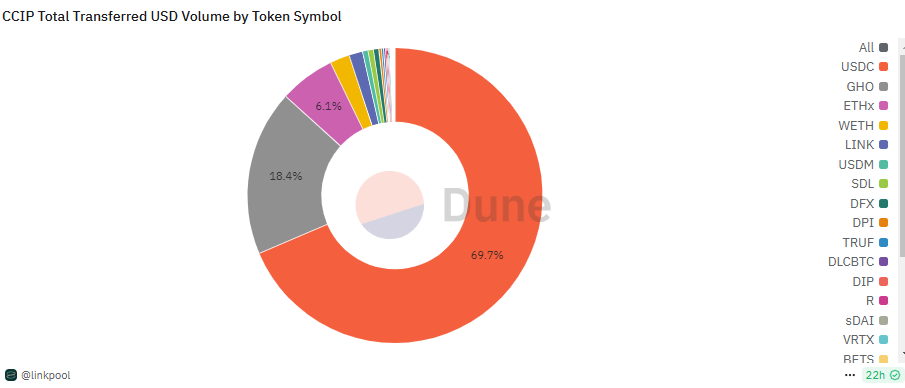

Chainlink’s essential product along with its oracle providers is the Cross-Chain Interoperability Protocol (CCIP). The protocol’s key asset is Circle’s USDC, thought of a completely regulated and clear asset.

Chainlink’s CCIP carries principally USDC and GHO as a part of the Aave and different DeFi ecosystems. | Supply: Dune Analytics

Greater than 90% of the CCIP volumes are for stablecoins, one of many key progress areas of crypto utilization. The 2 most typical multi-chain transfers are for USDC and Aave’s GHO stablecoin. Chainlink is likely one of the essential facilitators of the Aave lending vault ecosystem on a number of chains.

CCIP additionally unfold to the Ronin Community, one of many rising platforms for Web3 and gaming. Ronin’s neighborhood voted emigrate its cross-chain exercise to CCIP and substitute its present bridges. The Ronin Community was extraordinarily profitable however suffered a setback after one in all its essential bridges was hacked for upward of $600M.

From Zero to Web3 Professional: Your 90-Day Profession Launch Plan