A market veteran warns merchants and traders in opposition to using leverage for Bitcoin trades regardless of admitting Bitcoin’s attraction.

Whereas Bitcoin‘s current rally to new highs has sparked a flurry of ‘up solely’ calls, current market volatility has provided a reminder concerning the want for warning within the nascent market.

Say No to Leverage?

Seasoned finance knowledgeable Fred Krueger has warned Bitcoin traders in opposition to leverage. In an X submit on Thursday, December 19, the angel investor described the main digital asset as seemingly the one greatest commerce ever however warned that many risked blowing it with leverage.

Equally, pro-crypto lawyer and former U.S. Senate candidate John Deaton contended that leverage buying and selling made no sense with Bitcoin and crypto. That is seemingly because of the better volatility concerned. He as an alternative advocated for traders to easily maintain the asset, which he described as “the perfect performing asset of all time.”

I’ll admit, at instances, prior to now, I’ve used margin to purchase shares. I’ve been burnt and accomplished effectively. However I’ll by no means perceive utilizing leverage with bitcoin or crypto. Simply make use of the KISS technique: Preserve it easy silly. Bitcoin’s the perfect performing asset of all time. Simply personal it. https://t.co/uGC0FegTVW

— John E Deaton (@JohnEDeaton1) December 19, 2024

Leverage permits merchants and traders to regulate a bigger quantity of capital than they’ve by borrowing from their dealer within the hopes of multiplying returns. Nonetheless, with the upper revenue potential additionally comes better dangers.

These dangers embody amplified losses, margin calls, which require merchants to place up extra capital when their account stability falls beneath a set threshold, and liquidations, the place merchants’ belongings are forcibly bought to cowl losses.

The warnings from Krueger and Deaton come as a number of Bitcoin merchants have felt the brunt of those dangers over the previous 24 hours.

Bitcoin Merchants Lose Over $140M

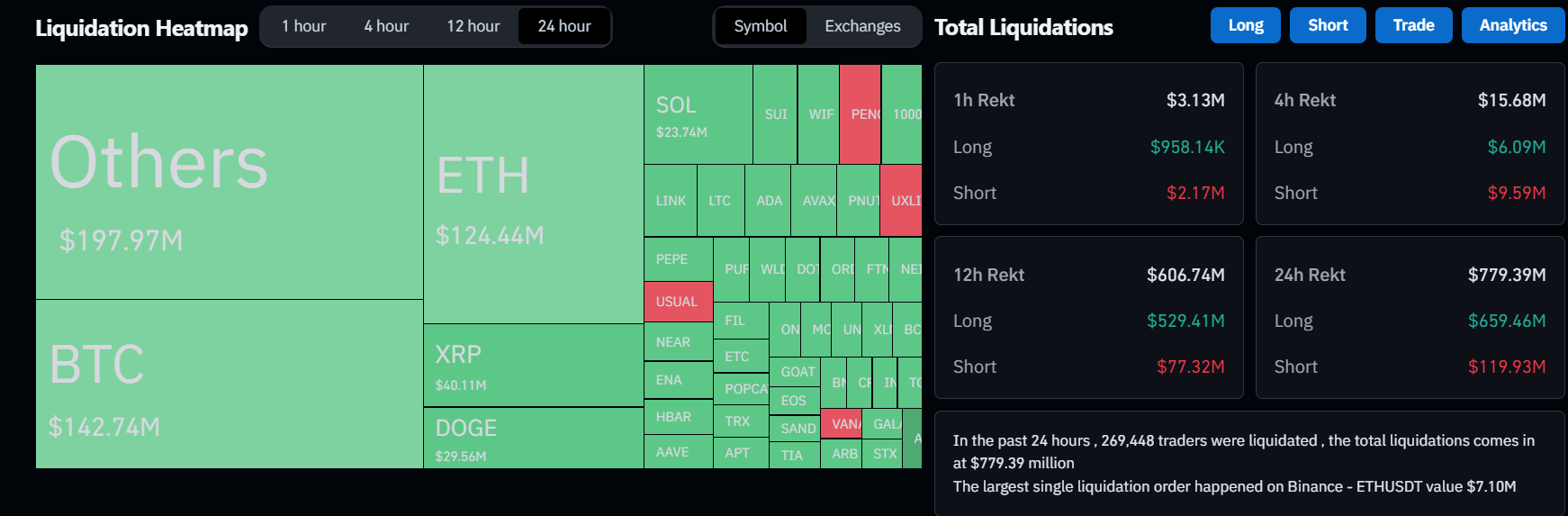

Leveraged Bitcoin merchants have misplaced over $140 million prior to now 24 hours, in line with CoinGlass information on the time of writing.

Crypto liquidation heatmap Supply CoinGlass

The losses come because the asset took many unexpectedly with a pointy decline from highs of over $106,500 on Wednesday, December 18, to lows of $98,800 amid hawkish feedback from Fed Chair Jerome Powell.

In a press convention following the December 2024 Federal Open Market Committee (FOMC) assembly, Powell harassed that the central financial institution’s battle with inflation was not over and that rates of interest have been prone to stay greater for longer. The Fed now tasks solely two quarter-point fee cuts in 2025, versus the preliminary projection of 4.