Crypto enterprise capital funding is projected to achieve roughly $18 billion in 2025, in response to a PitchBook analyst.

It’s because, following Donald Trump’s victory, enterprise capitalists are anticipating a good regulatory atmosphere.

2025 Crypto Investments Set to Soar

In an interview with CNBC, analyst Robert Le predicted $18 billion in crypto investments within the new yr, citing the return of ‘generalist’ traders following Bitcoin’s post-election rally. This represents a 50% bounce from 2024 ranges.

“Our prediction is we’re going to see $18 billion or extra in enterprise capital greenback in 2025,” mentioned Robert Le of PitchBook.

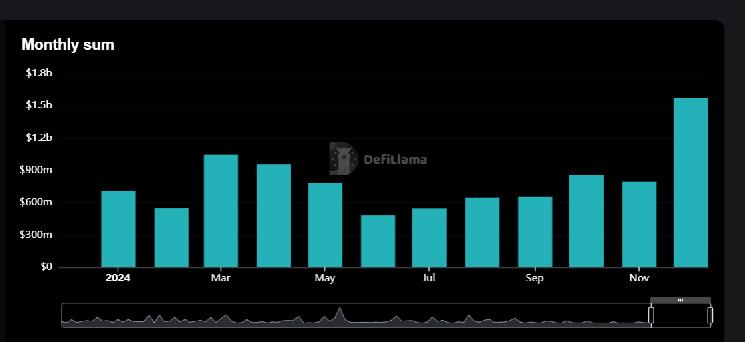

Speaking about funding in 2024, Le mentioned that Q1 noticed quantity of investments after Bitcoin ETFs have been accepted. The constructive sentiment drove enterprise capitalists to the market.

Nonetheless, investments slowed down later as Bitcoin staggered amid a summer season droop.

Robert Le additional observes that a number of favorable situations have been set for the return of traders in 2025.

“The setup appears to be like nice, there may be expectation that regulatory atmosphere goes to be extra favorable, macroeconomic atmosphere appears to be like fairly first rate, and a number of the tokens, Solana, Bitcoin, all of them hit their ATHs or surpassed it. Our prediction is we’re going to see $18 billion or extra in enterprise capital in 2025 which can quantity to 50% improve in comparison with final yr.” Le defined.

Nonetheless, the $18 billion determine is far lower than the $33 billion in investments made in 2021. Based on Galaxy Analysis, enterprise capitalists invested greater than $33 billion into crypto/blockchain startups in 2021, of which $22 billion went to fundraising rounds.

Furthermore, crypto startups obtained virtually 5% of enterprise capital distributed in 2021.

Within the dialog with CNBC, Robert Le additionally talked about how in 2025, extra conventional monetary establishments might be coming into crypto. He mentioned tradfi has a extra ‘trusted’ relationship with regulators. This might assist lend extra credibility to the crypto area.

“We’re chatting with a few of the massive corporations, they usually’re all occupied with crypto once more. So we’re going to anticipate to see them begin investing in crypto subsequent yr as effectively, and that’s going to be an enormous driver. Extra conventional monetary establishments will enter into the area, and that’s going so as to add much more credibility and belief in crypto,” Le added.

One other attention-grabbing level was that the main focus of investments will change in 2025. Le mentioned that within the final two years, a number of investments have been made within the infrastructure facet. So, within the subsequent yr, investments might be made to strengthen the appliance layer to lure in additional customers.

Relating to regulators, Le mentioned that if the SEC writes new crypto guidelines, that may be useful. Nonetheless, Le additional added that, even when they do nothing constructive, that’s nonetheless a lot better than the strict enforcement over the past two years.