The Bitcoin market is rising at an unbelievable fee. Open curiosity for Bitcoin futures contracts on the CME not too long ago reached a document of greater than 51,000 contracts. This improve clearly exhibits rising institutional involvement as extra capital pours into Bitcoin-related funding merchandise.

The rise, in accordance with the Kobeissi Letter, is noteworthy, nevertheless it additionally displays a broader sample of rising confidence in Bitcoin’s long-term financial price.

Institutional Impact Driving The Explosion

A lot of the credit score for the meteoric rise in open curiosity goes to the big monetary establishments. Certainly, open curiosity elevated fivefold in simply the primary three months of 2024, suggesting that main gamers are investing extra money into Bitcoin futures.

#Bitcoin buying and selling exercise has by no means been better:

Open curiosity in Bitcoin futures contracts on CME is now at a document 51,000.

The variety of energetic positions held by market contributors has risen 5 TIMES because the starting of 2024.

This coincided with the launch of spot… pic.twitter.com/6z1sdTqoqU

— The Kobeissi Letter (@KobeissiLetter) January 8, 2025

This institutional curiosity is unmistakable proof that Bitcoin is creating past speculative retail funding to attract strategic curiosity from extra highly effective corporations. Institutional demand might be going to rise as corporations like Grayscale and Bitwise maintain introducing Bitcoin-related merchandise.

Bitcoin Spot ETFs

The opposite motive for this surge in Bitcoin futures open curiosity is the introduction of Bitcoin spot exchange-traded funds (ETFs) in 2024. These merchandise have attracted an enormous quantity of capital, with practically $44 billion to this point. In reality, the emergence of Bitcoin ETFs facilitates simple accessibility to Bitcoin for the investor with out direct possession of the forex itself.

As of immediately, the market cap of cryptocurrencies stood at $3.21 trillion. Chart: TradingView

Which means wider accessibility past standard retail funding is now attainable. Because the funds develop additional, they stimulate the curiosity in Bitcoin futures additional, the place extra merchants wish to capitalize on the value actions linked to Bitcoin’s spot value.

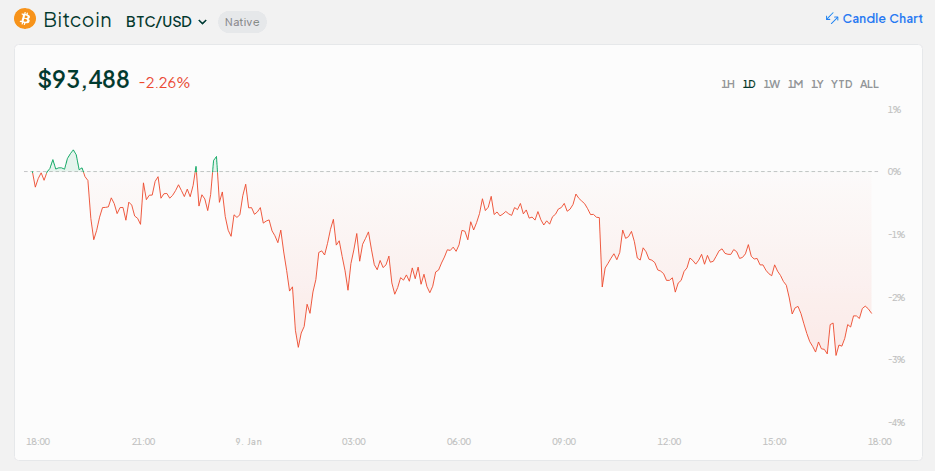

BTC value decrease immediately at $93488. Supply: Bitstamp

Bitcoin Futures: A Extra Mature Market

This additionally exhibits, in addition to present tendencies within the open curiosity, growing institution of Bitcoin among the many international monetary markets, sparking extra institutional involvement within the area,

Bitcoin is gaining recognition as a authentic asset, paving the way in which for its futures to be extra extensively built-in into monetary merchandise. The rising use of Bitcoin futures exhibits elevated confidence in its stability, regardless of the everyday volatility related to cryptocurrencies.

Picture: Geoffroy Van Der Hasselt/AFP by way of Getty Pictures

What’s Forward For Bitcoin Futures?

Going ahead, extra individuals are prone to be inquisitive about Bitcoin futures. Since massive consumers have gotten extra inquisitive about Bitcoin ETFs, the futures market is prone to see much more exercise within the subsequent few months.

However Bitcoin continues to be a dangerous funding, and consumers want to concentrate on the value adjustments that include it. In any case, Bitcoin futures have a vibrant future because the market grows up and massive gamers take the lead.

Featured picture from Fortune, chart from TradingView