Seven in ten publicly traded bitcoin (BTC) mining firms are having fun with a powerful begin to 2025, with Riot Platforms main the pack when it comes to proportion positive factors among the many prime ten companies by market cap.

Riot Platforms Rallies As 7 out of the High 10 Bitcoin Miners by Market Cap Begin 2025 within the Inexperienced

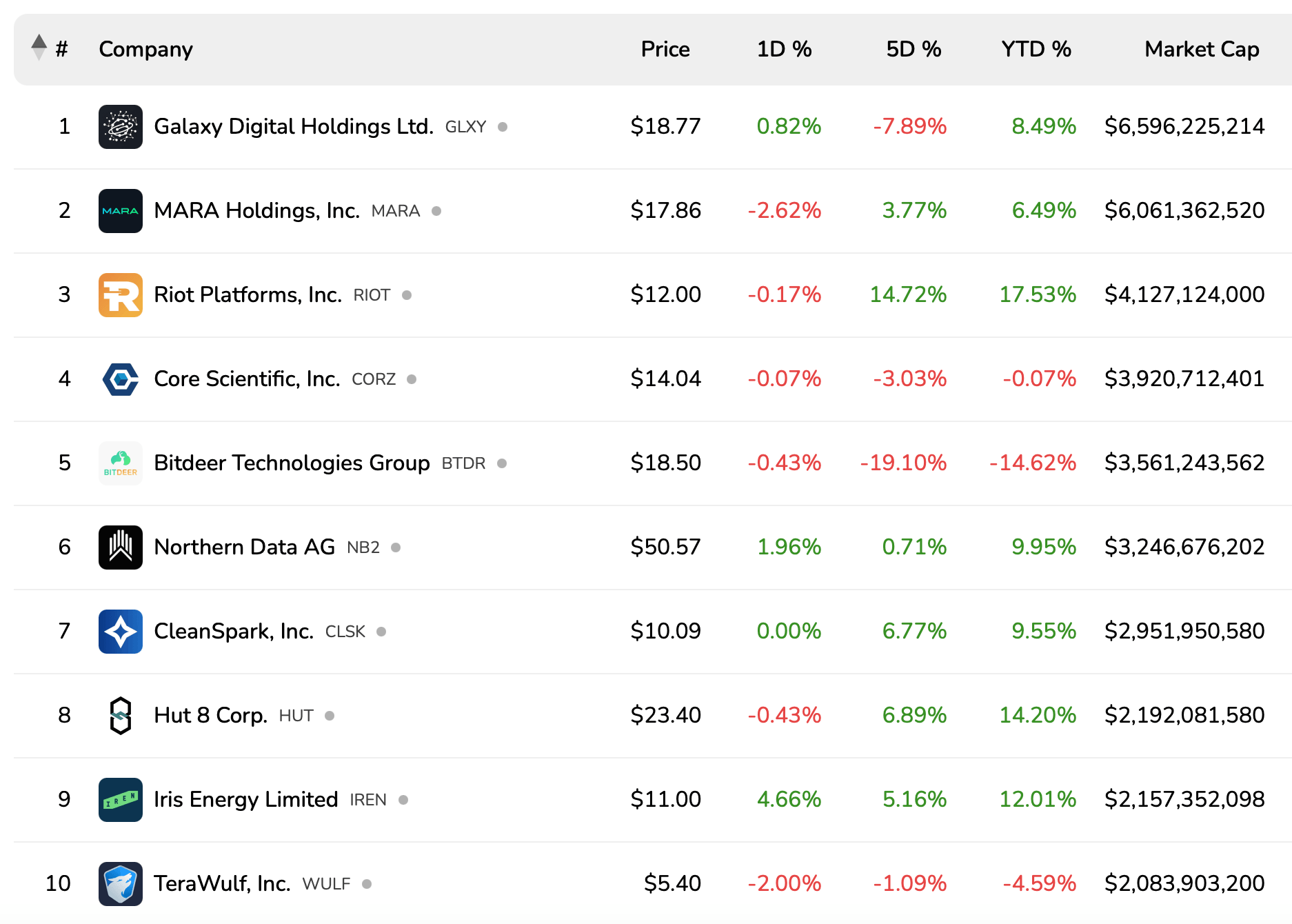

Though miners proceed to grapple with income constraints tied to bitcoin’s value holding beneath the $100,000 threshold, shares of those publicly listed BTC mining firms are trending upward, hinting at a positive begin to the yr. As of Saturday afternoon, knowledge from bitcoinminingstock.io reveals the mixed market capitalization of 31 publicly traded bitcoin (BTC) mining companies stands at $44.09 billion. Amongst these, 26 firms have witnessed their inventory values rise towards the U.S. greenback.

Supply: bitcoinminingstock.io

Main the cost is Cathedra Bitcoin, Inc. (TSXV: CBIT), which has soared 25% year-to-date, marking essentially the most important acquire. Throughout the prime ten companies by market capitalization, Riot Platforms, Inc. (Nasdaq: RIOT) claimed the highest spot with a 17.53% improve in 2025. Following carefully is Hut 8 (Nasdaq: HUT), which has climbed 14.2%. In the meantime, firms like Galaxy, MARA, Northern Information, Cleanspark, and Iris Power skilled positive factors starting from MARA’s 6.49% to Iris Power’s 12.01%.

On the draw back, three companies have recorded declines this yr, with losses starting from a marginal 0.07% to a sharper 14.62%. Core Scientific (Nasdaq: CORZ), the fourth-largest agency by market capitalization, dipped by a mere 0.07%. Terawulf (Nasdaq: WULF) has fallen 4.59%, whereas Bitdeer (Nasdaq: BTDR) has seen a extra important drop of 14.62%. Aside from Bit Origin Restricted (Nasdaq: BTOG), which is down 10.32% year-to-date, BTDR emerges because the steepest decliner among the many group.

Amid these shifts, a number of firms are diversifying their focus, exploring high-performance computing (HPC) and synthetic intelligence (AI) internet hosting alongside their BTC strategic reserves. Notably, Blocksbridge Consulting’s theminermag.com stories that publicly listed miners collectively maintain document reserves of over 92,000 BTC as of Dec. 2024.