Bitcoin (BTC) has continued its downward trajectory, buying and selling near the $90,000 key help amid a persistent market selloff. Its value has declined by over 8% prior to now week, elevating issues about additional potential declines.

With declining shopping for strain and a drop in institutional participation, Bitcoin dangers slipping beneath $90,000 within the close to time period. Right here’s why.

Bitcoin Struggles as Institutional Confidence Wanes

On the BTC/USD one-day chart, BTC trades beneath the purple line of its Tremendous Development indicator. This indicator tracks the route and energy of an asset’s value pattern. It’s displayed as a line on the worth chart, altering shade to suggest the pattern: inexperienced for an uptrend and purple for a downtrend.

When an asset’s value falls beneath its Tremendous Development indicator, it indicators bearish momentum and a lower in shopping for strain. Merchants sometimes view this as a promote sign or a cautionary warning.

Bitcoin Tremendous Development Indicator. Supply: TradingView

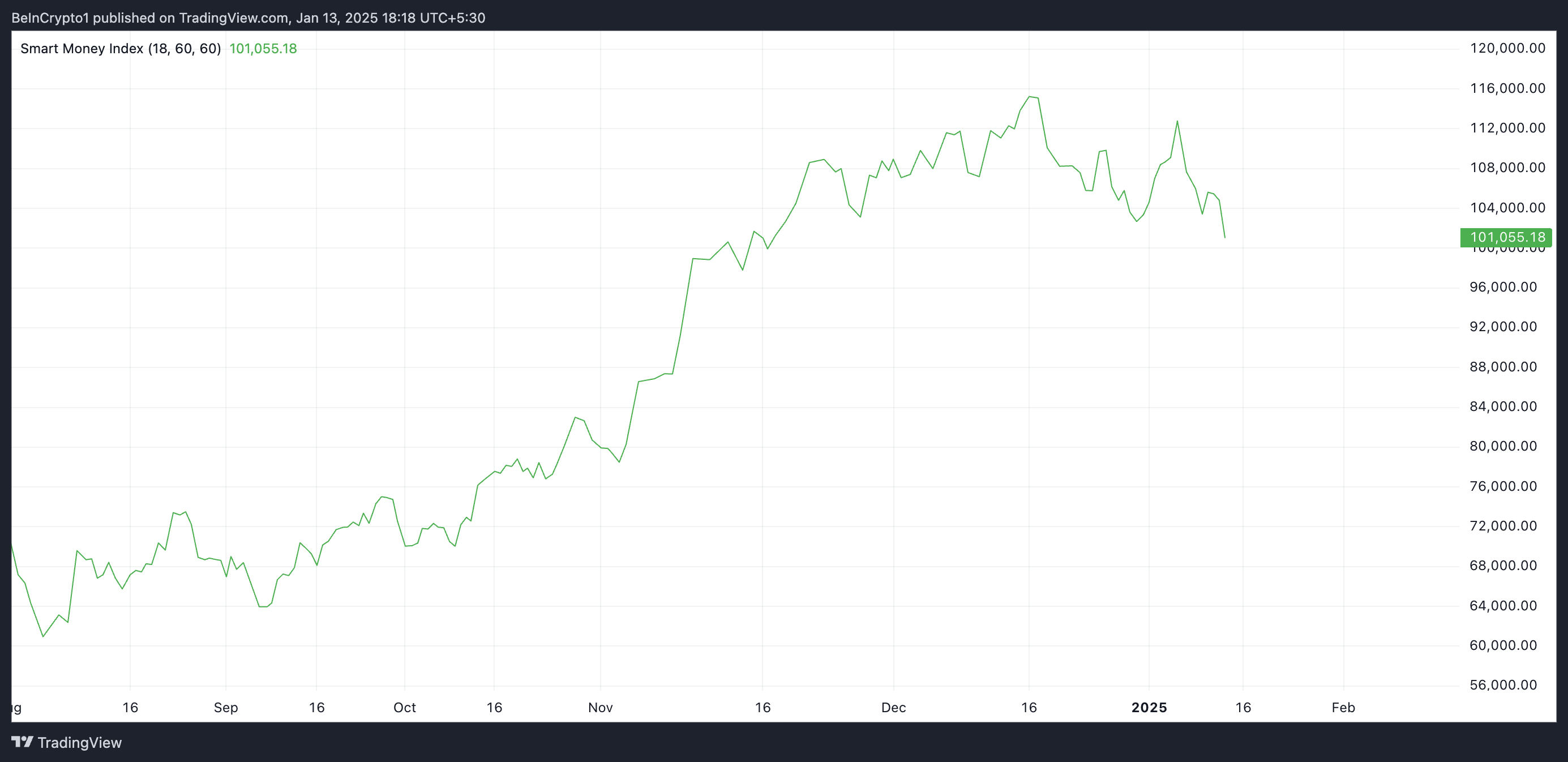

As well as, BTC’s Sensible Cash Index (SMI) has persistently declined since January 6. As of this writing, the indicator is at 101,055, dipping 10% since then.

An asset’s SMI tracks the exercise of skilled or institutional buyers by analyzing market conduct throughout the first and final hours of buying and selling. When the indicator rises, it suggests elevated shopping for exercise by these buyers, signaling rising confidence within the asset.

Then again, a decline in SMI suggests excessive promoting exercise and diminished confidence from these buyers. This hints at a possible decline in BTC’s value within the close to time period.

Bitcoin Sensible Cash Index. Supply: TradingView

In a latest submit on X, veteran crypto dealer Peter Brandt confirms this bearish outlook. Based on him, an evaluation of BTC’s value efficiency on a one-day chart has revealed the potential formation of a head and shoulders (H&S) prime sample.

A H&S sample consists of three peaks: the central peak (the “head”) is the very best, flanked by two smaller peaks (the “shoulders”). The road connecting the bottom factors of those peaks known as the “neckline.”

Bitcoin H&S sample. Supply: X

As recognized by Brandt, in BTC’s case, considered one of three issues might occur: the H&S sample might full and pattern towards its goal, fail and create a bear entice, or morph into a bigger, extra complicated sample.

BTC Value Prediction: Bearish Sample Emerges

BTC’s declining demand suggests the potential affirmation of the pattern and an additional decline in its value. On this situation, the coin might fall beneath $90,000, buying and selling at round $85,224.

Bitcoin Value Evaluation. Supply: TradingView

Then again, a shift in market traits might propel BTC’s value to $102,538.