Bitcoin (BTC) is rallying forward of President-elect Donald Trump’s inauguration, with renewed U.S. investor curiosity driving momentum. On the time of writing, the main crypto is buying and selling at $102,471k, having elevated by greater than 2% within the final 24 hours.

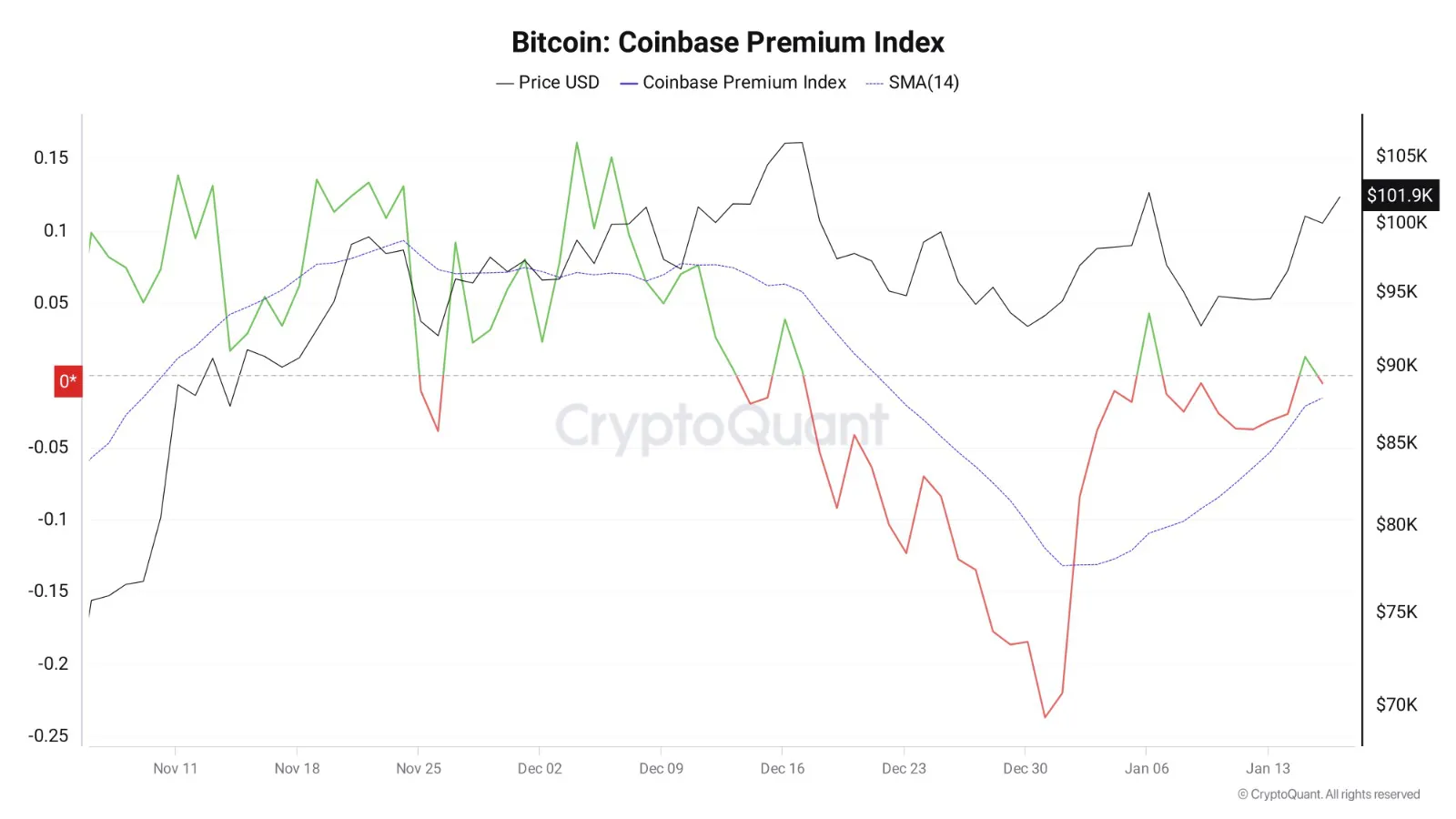

The latest knowledge on the on-chain analytics platform CryptoQuant exhibits restoration in the important thing Coinbase premium metric. This metric tracks the value distinction between Coinbase’s BTC/USD pair and Binance’s BTC/USDT equal, reflecting U.S. sentiment.

U.S. traders drive market momentum as Coinbase Premium turns constructive

CryptoQuant contributor Burak Kesmeci wrote in considered one of its Quicktake weblog posts that U.S. traders are displaying renewed shopping for curiosity as BTC continues to surge.

The Coinbase Premium Index (CPI) turned constructive for the primary time since Jan. 6, suggesting a rising willingness amongst U.S. traders to extend BTC publicity. Traditionally, a constructive CPI has indicated a market dominated by consumers, whereas a unfavourable studying suggests promoting stress.

Bitcoin Coinbase Premium Index (CPI). Supply: CryptoQuant

Rumors of pro-crypto insurance policies beneath the incoming Trump administration are fueling optimism. Day-one bulletins may set the tone for a brand new bull market section for Bitcoin and altcoins.

Kesmeci famous:

With just a few days left till Trump’s inauguration, U.S. traders are clearly taking a bullish stance. CPI knowledge confirms that, on each each day and hourly timeframes, U.S. traders are reclaiming dominance out there.

– Burak Kesmici

Bitcoin worth surpasses $102,000 key stage

Forward of the Jan. 17 Wall Road session—the final earlier than the inauguration—BTC/USD climbed 2%, reaching $102,471, its highest stage in 10 days.

Monitoring platform CoinGlass reported $60 million in BTC quick liquidations over 24 hours, as bearish merchants confronted losses amid Bitcoin’s resurgence.

Daan Crypto Trades cited CoinGlass knowledge displaying quarterly BTC/USD efficiency through the years. He famous that Q1 has been good total for BTC, particularly within the post-halving years (2013, 2017, and 2021), and this pattern is anticipated to proceed.

BTC’s constructive efficiency comes amid hypothesis {that a} strategic Bitcoin reserve could possibly be introduced as early as subsequent Monday.

Nonetheless, opposite to some group expectations, Polymarket sees solely a 37% likelihood of such a reserve being fashioned in early 2025.

A number of weeks in the past, Jeff Park, head of alpha methods at Bitwise Make investments, lately stated that there was solely a ten% likelihood of the strategic Bitcoin reserve being fashioned in 2025. Nevertheless, he famous that the Bitcoin worth would possibly surge to $1 million if it occurs.

As U.S. traders ramp up their exercise, questions stay about how the incoming administration’s insurance policies will affect Bitcoin’s trajectory. The market’s constructive momentum and renewed investor curiosity may sign the start of one other important rally beneath Trump’s presidency.

A Step-By-Step System To Launching Your Web3 Profession and Touchdown Excessive-Paying Crypto Jobs in 90 Days.