Bitcoin’s worth has been shifting steadily upward in latest weeks, displaying indicators of renewed investor confidence and potential for additional positive factors. Nonetheless, a number of important ranges on the day by day chart point out that the present rally faces important hurdles. Let’s dive into the technical evaluation and discover the chances for Bitcoin’s worth trajectory within the coming days.

What Does the Present Bitcoin Worth Motion Inform Us?

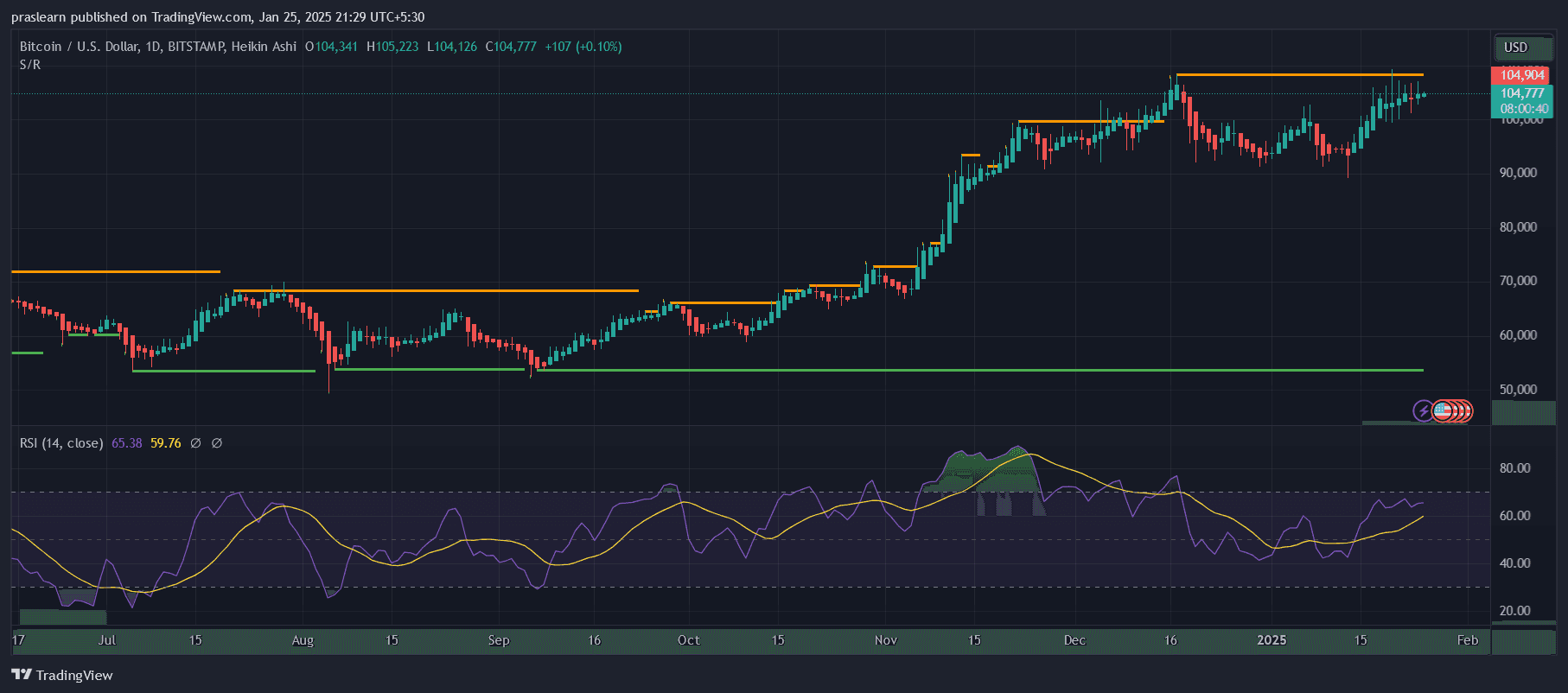

BTC/USD Every day Chart- TradingView

The day by day chart reveals Bitcoin buying and selling slightly below a key resistance stage round $105,000, which aligns with earlier highs marked by horizontal orange traces. These ranges have acted as formidable limitations prior to now, with a number of rejections seen over the previous couple of months. Every time Bitcoin has approached this stage, it has both consolidated or corrected decrease. The present try seems stronger, given the sequence of upper lows that signify rising bullish momentum.

The candlestick patterns, particularly the Heikin Ashi bars, point out a gradual uptrend with minimal draw back wicks, displaying lowered promoting strain. The value has additionally remained constantly above assist ranges close to $95,000, as proven by the horizontal inexperienced line. This means that consumers are stepping in to defend the pattern, giving Bitcoin a sturdy basis for potential upward strikes.

Is the RSI Signaling Overbought Circumstances?

The Relative Power Index (RSI) presently hovers round 65, which is beneath the overbought threshold of 70. This means that whereas Bitcoin is approaching overbought circumstances, there’s nonetheless room for the rally to proceed with out triggering important profit-taking. Nonetheless, it’s important to notice the divergence between the RSI and worth motion throughout earlier rallies. On some events, the RSI failed to succeed in larger peaks, resulting in short-term corrections.

Moreover, the RSI trendline has been rising steadily, displaying no instant indicators of reversal. So long as Bitcoin maintains RSI ranges beneath 70 with out sharp declines, the bullish momentum might stay intact. If the RSI breaks above 70 in tandem with a worth breakout, it might affirm the power of the following leg upward.

Bitcoin Worth Evaluation: Are We on the Verge of a Breakout or Reversal?

The present consolidation beneath resistance raises the query of whether or not Bitcoin will escape or reverse. For a breakout to happen, Bitcoin wants to shut decisively above $105,000 on sturdy quantity. Such a transfer might pave the way in which for a speedy rise towards $115,000, the following important psychological and technical stage.

Nonetheless, if Bitcoin fails to breach this resistance and begins to kind decrease highs, it might sign a reversal. In that situation, the worth might retest the $95,000 assist stage. A breakdown beneath this assist might expose Bitcoin to additional draw back, doubtlessly concentrating on $85,000, a stage of historic significance.

What Are the Broader Implications for Bitcoin Worth?

Bitcoin’s latest power might be attributed to macroeconomic elements, together with an bettering risk-on sentiment within the monetary markets and renewed institutional curiosity. Moreover, upcoming Bitcoin halving occasions and reducing mining provide are boosting long-term investor optimism.

Whereas these fundamentals assist a bullish outlook, merchants ought to stay cautious of potential market volatility. The present resistance stage has been examined a number of instances, and a false breakout might result in heightened promoting strain. Monitoring quantity, RSI conduct, and candlestick patterns might be essential in figuring out the following important transfer.

Will Bitcoin Worth Soar or Stumble?

Bitcoin’s worth motion means that the cryptocurrency is at a important juncture. The battle between bulls and bears close to the $105,000 resistance stage will probably outline the pattern for the weeks forward. If Bitcoin can escape decisively, it might set the stage for a rally towards $115,000 or larger. Nonetheless, a rejection at this stage might result in a retest of assist, with the danger of additional draw back if the $95,000 stage fails to carry.

Buyers and merchants ought to look ahead to affirmation indicators earlier than committing to their positions. The market’s path will rely upon a fragile stability between technical momentum and broader market sentiment. For now, Bitcoin’s trajectory stays promising, however warning is suggested because it approaches a important inflection level.