Crypto mining gear makers created improved machines, giving solo miners an opportunity to unravel blocks or share rewards with bigger mining swimming pools. Technical improvements have turned the tide for Bitcoin mining. Let’s step again and look into the business that spawned the cryptocurrency financial system and its ramifications.

What’s Cryptocurrency Mining?

Cryptocurrency mining is the method of performing so-called proof of labor, utilizing high-level computing energy to offer cryptographic safety and course of transactions. Miners competing with extra computational energy additionally make the community safer since no single miner can management cryptocurrency transactions or alter the state of the community.

Bitcoin mining is a extremely aggressive operation that mixes a number of components to achieve success. Miners face the problem of native rules, in addition to the technicalities of securing the suitable mining {hardware}. Large mining operations normally have the foresight to safe electrical energy contracts at a low worth, in addition to dependable spots for his or her knowledge facilities.

Crypto mining operations have grown over the previous few years, competing with large-scale company gamers. Some mining swimming pools are even prepared to soak up losses whereas nonetheless preventing for block rewards and transaction charges. Miners additionally typically retain their proceeds for an extended timeframe, benefitting from BTC appreciation. Bitcoin mining alternatives and limitations are shifting for all contributors.

Taking over crypto mining privately after over 13 years of Bitcoin historical past is a matter of calculating prices versus advantages. Mining Bitcoin is extraordinarily aggressive and requires funding in specialised {hardware}. Bitcoin miners can nonetheless select to run a solo operation and soak up all computing prices. They typically be a part of one of many main mining swimming pools to earn a proportional share of the block reward.

How Bitcoin Mining Works

The Mining Course of

Bitcoin mining is, at its coronary heart, energy-intensive quantity era, the place every output is examined in opposition to a predetermined worth. It includes producing random numbers after which testing every of these numbers in opposition to the goal worth.

To mine Bitcoin additionally means to find the alpha-numeric string to fulfill that worth is the brand new block header. The header is a quantity that can not be simply faked, and incorporates inside it the hash of the earlier block header. This course of ensures blockchain safety.

Every new block secures the Bitcoin community by making the earlier block immutable. Any adjustments to the contents of the earlier block won’t produce the identical header quantity and can reveal the tampering. Block manufacturing is thus the true proof of the immutable distributed ledger.

Miners produce block headers, which endure further cryptographic operations to provide the following block header. This course of ensures that each one transactions included in a block can’t be modified with out leaving simple digital proof. The Bitcoin mining course of ensures the blockchain is protected in opposition to brute-force assaults and is the central tenet of constructing a safe digital foreign money.

As a reward for the vitality—and computation-intensive job, miners obtain a payout for every block. Rewards fall over time till they attain the focused 21M BTC provide. Bitcoin has already gone by way of 4 halvings, slicing the reward from 50 BTC to three.125 BTC per block.

Every block may comprise charges, that are additionally shared with miners. Charges haven’t any predetermined degree and develop throughout occasions of excessive community overload. Charges have grown as much as 70% of the block reward and, sooner or later, often is the solely payout for miners.

Mining can be a mixture of energy and luck, as some miners could produce the required quantity earlier. Each few months, a solo miner produces a block, taking the entire reward, the place even the largest swimming pools don’t succeed.

Profitability is determined by the mining problem degree

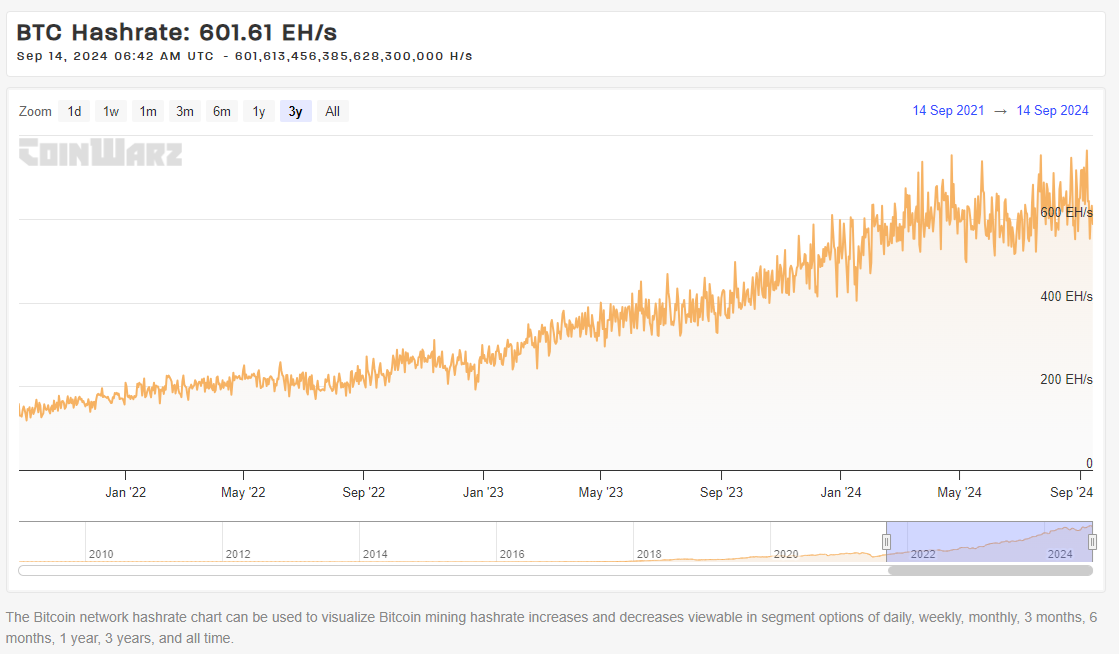

Miners need to compete at a predetermined metric of problem. A better mining problem means the required block header is tougher to find. Issue is the metric that is determined by obtainable hashing energy and adapts to the variety of miners. Over time, Bitcoin miners pushed the hashrate to a document degree.

The Bitcoin hashrate is close to peak ranges at 700 EH/s. | Supply: Bitinfo

The Bitcoin community matches its problem to presently lively miners and their hashrate. Whether or not it’s simply Satoshi Nakamoto on one laptop or thousands and thousands of rigs around the globe, it all the time takes 10 minutes to discover a Bitcoin block header. Thus, if miners level extra machines on the drawback, the Bitcoin algorithm will simply give them a tougher drawback, so it would take the identical 10 minutes to unravel.

Bitcoin mining requires the SHA-256 algorithm, which is likely one of the most generally used encryption instruments. The cryptographic algorithm additionally defines the necessity for highly effective mining rigs to create unbreakable cryptographic safety for every block.

SHA-256 chains can’t be brute-forced. A number of cash use the same mining method, whereas different belongings like Litecoin require Scrypt mining. Every mining algorithm requires specialised mining gear with the suitable firmware to provide blocks in essentially the most power-efficient manner doable.

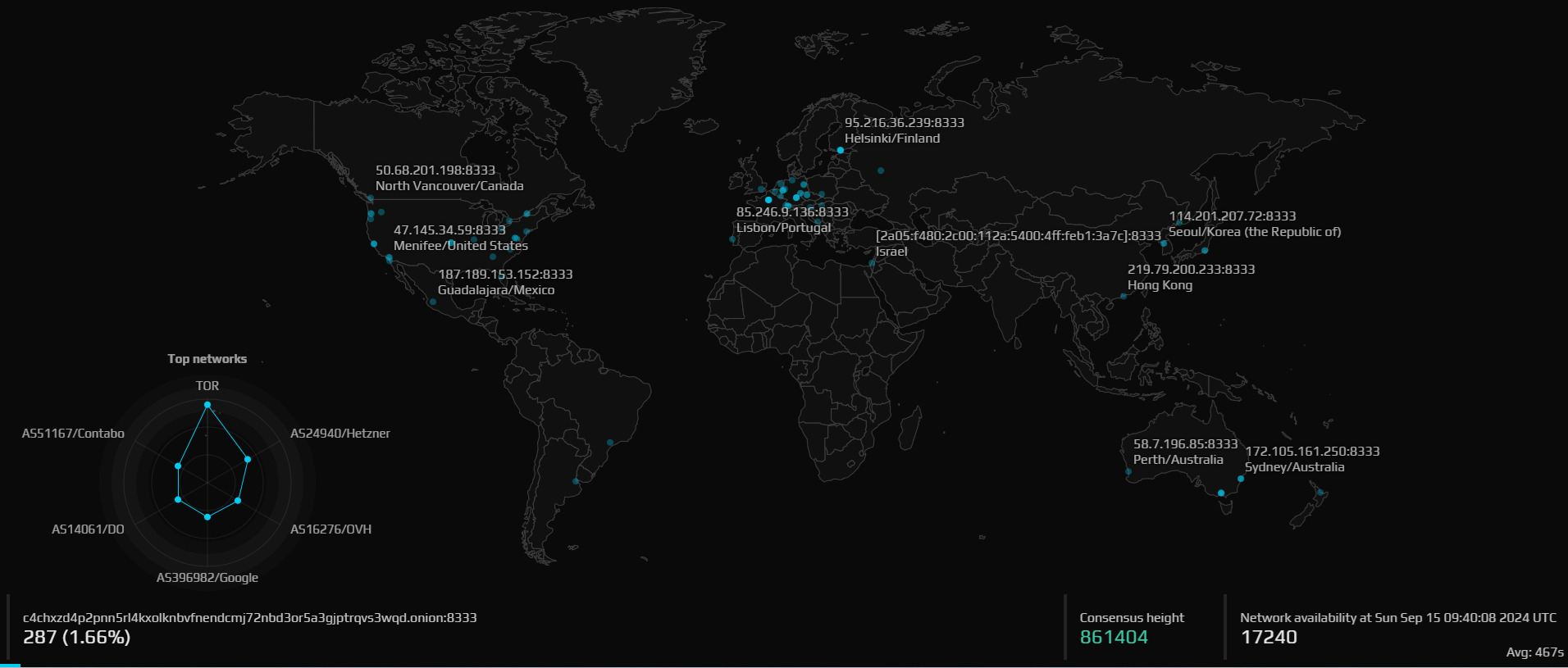

Miners even have one other job – to maintain monitor of the blockchain document and confirm transactions, broadcasting them to different node operators. The presence of miners is definitely visualized by way of the Bitnodes service, revealing the geographic distribution of Bitcoin’s community and the addition of latest nodes.

Bitcoin nodes are distributed worldwide, although some use cloud companies. | Supply: Bitnodes

Node propagation shouldn’t be rewarded, however requires some further sources. The Bitcoin blockchain in its unpruned state is greater than 200 GB. Working a node whereas mining requires further RAM and even an SSD for larger velocity. Storing a partial or pruned copy of the Bitcoin blockchain could require solely 20GB in further area.

Mining {Hardware} and Software program

Mining rigs concentrate on producing and testing potential block headers at an incredible velocity. They will try this energy-efficiently however can not uncover an indefinite variety of blocks. The objective is to provide a block simply 10 minutes aside, on common. If the time between blocks begins to shorten, the Bitcoin algorithm would require a block header that’s tougher to find. If time between blocks will increase, the issue will drop.

Shopping for a mining rig could be a main upfront funding, and the price of buying the {hardware} should be in comparison with simply shopping for BTC on the open market. Mining rigs additionally transfer by way of market cycles, with the newest fashions commanding the best charges.

Bitmain remains to be the largest producer of mining machines and aspect gear. The Antminer sequence all the time introduces new variations, normally launching at presale costs. As of September 2024, Bitmain’s S21 XP mannequin retailed at $8,289 per unit or $5,800 with a reduction. Shopping for the mannequin would additionally require some upfront purchases of crypto cash, as Bitmain sells its machines for BTC, ETH, or USDT.

Antminer S21 Professional is essentially the most highly effective SHA-256 machine in the marketplace and the one one aggressive sufficient to be worthwhile. | Supply: Bitmain

Having the latest mining rig can be no assure of receiving larger block rewards. By the point mining {hardware} hits the open marketplace for small-scale crypto miners, massive swimming pools and even the producer Bitmain has used the mannequin to front-run others. Moreover, even a high-capacity mannequin can differ of their everyday income and revenue.

Regardless of this, a brand new purchaser can rationally determine based mostly on presently obtainable {hardware} and its comparative profitability. The most effective method is to check {hardware} by way of the Hashrate Index instrument, selecting the most effective mixture of upfront price and revenue margin.

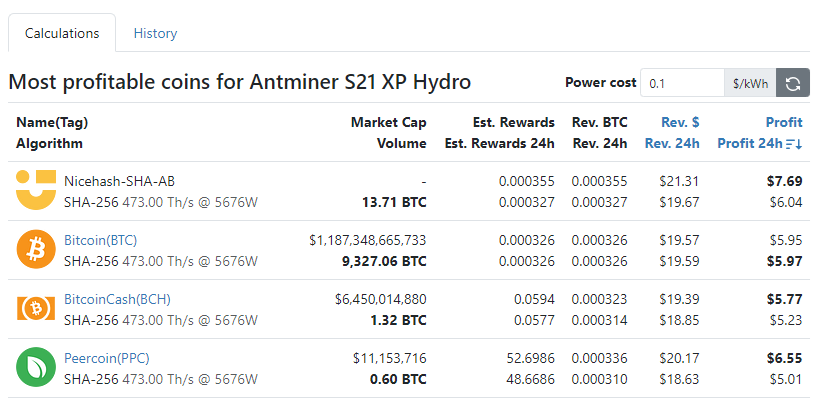

Bitmain S21 XP, the newest ASIC machine, has various revenues and earnings relying on market situations. | Supply: Hashrate Index

Mining software program for rig homeowners is solely a self-custodial pockets. Miners should all the time preserve their non-public phrase well-protected. Mining {hardware} for cloud mining shouldn’t be needed, and is probably not worthwhile. Mining rigs can even carry out based mostly on their newest firmware model from Bitmain, which is a key a part of their effectivity profile. Proudly owning a mining rig means additionally monitoring firmware upgrades.

Selecting a mining resolution may contain some type of cooling or air circulation, particularly if utilizing a couple of machine. Vitality effectivity can be key to decreasing mining prices.

Is Bitcoin mining nonetheless worthwhile?

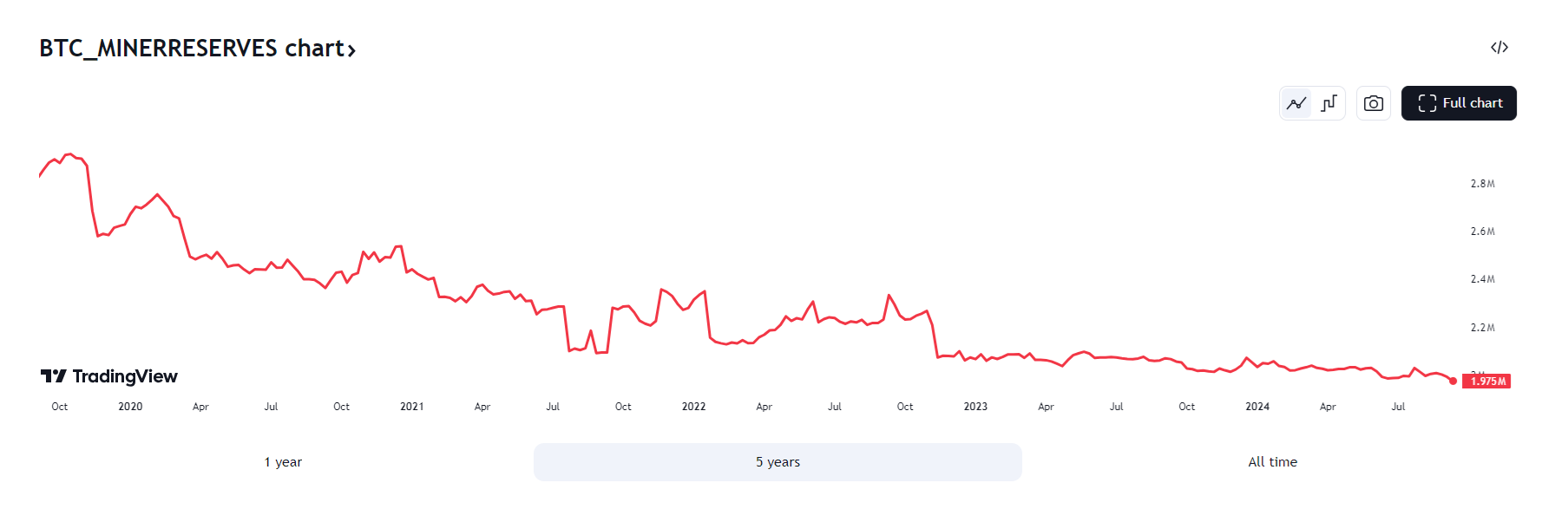

Bitcoin’s community went by way of three halvings, slicing the block reward to 25 BTC, then to 12.5, 6.25 and three.125 BTC. On the similar time, the value of BTC continued to develop, permitting miners to cowl prices and retain reserves. Crypto mining is simply worthwhile after promoting the rewards, in any other case the earnings from Bitcoin mining work are hypothetical. Crypto miners compete not solely to find blocks, but additionally to promote their cash at a positive worth.

Bitcoin miner reserves inched down, however are nonetheless near 2M cash. | Supply: Tradingview

Bitcoin solo mining remains to be doable, although not viable. A miner with a handful of machines has a greater probability of sharing the block reward as a part of a mining pool. Regardless of this, solo miners with ample hashing energy clear up a block each few months and retain the entire block reward. Nonetheless, mining with a pool could supply extra common rewards, with the flexibility to promote and canopy upfront and working prices.

Mining profitability will be re-calculated periodically, to keep away from mining throughout much less worthwhile situations. In the long run, Bitcoin profitability falls with every halving, however there are days or even weeks the place miners obtain barely larger rewards. If the profitability falls an excessive amount of, some mining operations will shut down briefly, till the issue metric turns extra favorable.

The opposite issue for miners is their means to carry onto the cash earned. In the long term, mining operations that weren’t worthwhile even at $6,000 ended up holding a reserve of cash. As of 2024, miner reserves stay near 2M cash.

Miners in 2024 have an estimated price foundation between $43,000 and $75,000. The associated fee foundation of mining one BTC varies for every operation and has risen considerably after the halving. The rationale for that’s that miners use the identical or larger hashing energy solely to provide 50% of the each day BTC.

Finest mining swimming pools to affix

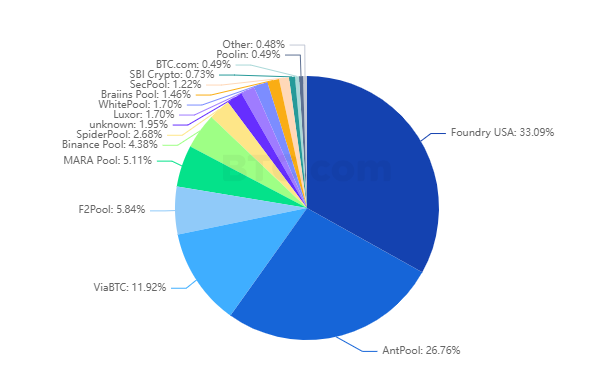

The panorama of mining swimming pools will change in 2024. Greater than 40% of blocks solved will go to miners based mostly within the USA. China remains to be a mining powerhouse, nevertheless it has misplaced its primacy as investments and know-how shift to US-based operations.

Bigger swimming pools have an even bigger probability to unravel a block, however break up the reward between a bigger variety of miners. | Hashrate Index

Mining swimming pools present their monitor document of manufacturing a share of the blocks on a each day or weekly foundation. Top swimming pools have the largest share of the block, however in addition they share it with the widest circle of contributors. A mining pool can mix computing energy from each small-scale miners and large amenities, with no limits to geographic distribution.

The payout from swimming pools varies in response to durations and is determined by what number of miners have joined, what number of blocks have been solved, and the pool’s payout coverage. Virtually all massive swimming pools can supply rewards over time.

The highest 5 swimming pools based mostly on blocks solved are Foundry USA, F2Pool, Antpool, ViaBTC, and Binance Pool. Smaller swimming pools clear up blocks rather more hardly ever.

Every pool additionally fees a withdrawal charge, starting from 0% to 4%. Some swimming pools supply further companies, similar to multi-coin mining or financial savings plans. ViaBTC has automated withdrawals by way of CoinEx.

The primary factor is to select a pool that doesn’t have simulated mining or require upfront investments or further funds. Some types of mining could also be non-viable and are in actual fact not actual mining, however a simulation.

Solo mining shouldn’t be viable at this level, besides for giant mining operations that additionally perform as a pool. A solo miner, even with highly effective rigs, can hope to unravel a block as soon as each few months.

Selecting the best mining {hardware}

Mining {hardware} or a mining rig is also referred to as ASIC, quick for Utility-Particular Built-in Circuit. The chips are tailor-made to fixing particular hashing duties for just one kind of cryptographic algorithm. Blockchain know-how can even use a graphics processing unit (GPU), however these are tailor-made to completely different cryptographic algorithms and different kinds of cash.

ASIC machines get rebuilt for effectivity each few years. The newer fashions typically have dramatically larger each day earnings and are extra environment friendly and aggressive. The potential earnings of every rig rely in the marketplace worth of BTC.

S21 can mine Bitcoin, but additionally different SHA-256 algorithm cash like Bitcoin Money and Peercoin. | Supply: Bitmain

The profitability of normal mining additionally is determined by electrical energy prices and the ASIC hashrate. As standard, mining shouldn’t be all the time viable and machines could also be shut down in periods of unfavorable problem and elevated competitors.

{Hardware} is the largest preliminary outlay, which might decide whether or not the funding in mining is viable. Even throughout worthwhile occasions, a small-scale miner should cowl the upfront price of the rig first.

One good metric for mining viability is the time interval to pay down the preliminary funding. All preliminary investments in mining will be checked for ‘days to payback’, protecting in thoughts that electrical energy and different prices should even be lined even earlier than the primary Satoshi is mined.

Mining operations have gotten extra aggressive

Mining operations are in no hazard of a capitulation occasion. The Bitcoin hashrate, an indicator of mining exercise, always prints all-time highs. Mining operations could have a skinny revenue margin, however as a substitute of giving up, miners are literally doubling down.

The extremely aggressive situations imply a single miner should hope for a small share of the overall rewards. Whereas mining could also be viable for small sums of cash, the underside line could not all the time work out. Mining doesn’t mathematically assure rewards and should take time earlier than offsetting the funding in a top-grade mining rig.

Mining operations are closely sponsored and paid with outsized earnings. The fixed addition of latest mining amenities with high-powered machines could make small-scale operations much less viable.

ASIC producers are additionally attempting to retain viability, attaining extra environment friendly hashing operations with decrease energy necessities. Nonetheless, small-scale miners are preventing for small and diminishing revenue margins. Whereas huge swimming pools or Bitcoin mining operations can soak up among the further bills, for a one-machine miner, the bills could simply surpass all potential positive factors.

Excessive vitality consumption and carbon footprint

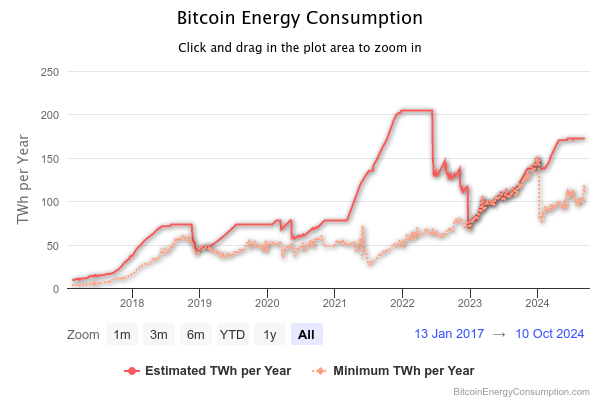

Mining Bitcoin has an estimated electrical energy utilization of 91 TW/h, roughly the vitality consumption of Finland. By 2027, the IMF estimates mining will make up 2% of worldwide electrical energy use and 1% of worldwide carbon dioxide emissions. Bitcoin mining has expanded its vitality consumption 10 occasions since 2018, ranging between 110 and 172 TW/h for This autumn, 2024.

Bitcoin vitality consumption expanded once more in the course of the 2023 market restoration. | Supply: Digiconomist

Bitcoin mining has slowed down throughout bear markets, however has not proven indicators of capitulation. Rising native and home electrical energy prices, with out different sources, could make private mining operations much less viable, however huge corporations can nonetheless soak up the prices.

Bitcoin mining authorized limitations can even stall the work of each huge operations and particular person miners. Native legal guidelines on home electrical energy utilization could ban mining cryptocurrency.

Miners can nonetheless select to mine Bitcoin, which remains to be accessible to small-scale miners. Nonetheless, bottom-line profitability could differ extensively, and new mining gear could not pay for itself for months and even years. But mining stays a well-liked instrument for buying new bitcoins, with ample sources and know-how obtainable to begin from zero.