In right this moment’s dynamic financial panorama, seasoned buyers are reevaluating their portfolios and contemplating the potential of Bitcoin as a substitute for conventional belongings like actual property. With a finite provide and transformative development potential, Bitcoin presents a compelling case for forward-thinking funding methods.

Actual Property: The Phantasm of Stability

Actual property has lengthy been thought to be a secure haven for preserving wealth. Nevertheless, the housing market isn’t resistant to systemic dangers corresponding to rate of interest hikes, authorities intervention, and financial downturns. Furthermore, property investments typically require important upkeep prices, taxes, and liquidity sacrifices.

Bitcoin, in distinction, presents unparalleled portability, resistance to confiscation, and immunity from native financial or geopolitical disruptions. In contrast to property, Bitcoin has no upkeep prices or bodily constraints.

The Rise of Bitcoin as a Retailer of Worth

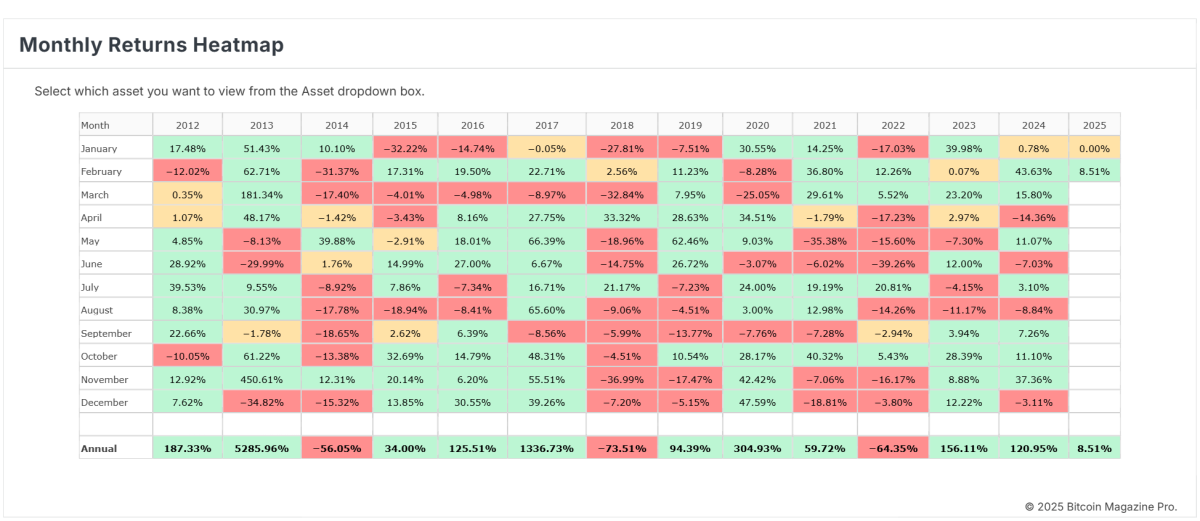

Bitcoin’s restricted provide of 21 million cash establishes it as “digital gold” for the twenty first century. Over the previous decade, Bitcoin has constantly outperformed different asset courses, delivering exponential returns regardless of volatility.

Determine 1: Bitcoin Month-to-month Returns Heatmap displaying share month-to-month and annual returns over the previous ten years. Supply – Bitcoin Journal Professional

Compared, actual property’s appreciation is commonly tied to inflation and authorities financial coverage, which may diminish its true worth over time. Bitcoin, however, operates on a deflationary mannequin, making certain shortage and preserving buying energy.

Liquidity and Accessibility

Actual property investments typically require prolonged transactions, excessive charges, and important regulatory hurdles. Promoting a property can take months, tying up capital and lowering agility. Bitcoin, nonetheless, presents on the spot liquidity and could be traded 24/7 on world exchanges. This accessibility empowers buyers to maneuver their wealth seamlessly throughout borders.

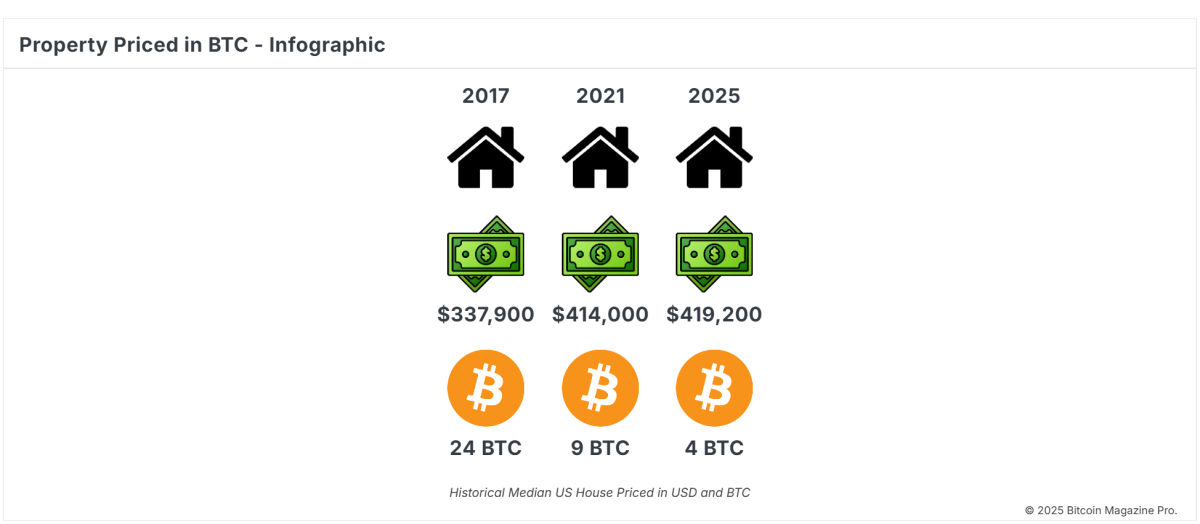

Determine 2: Property Priced in BTC infographic Illustrating the declining quantity of Bitcoin required to buy the median U.S. dwelling over time. Supply – Bitcoin Journal Professional

The information underscores Bitcoin’s skill to protect and develop wealth extra successfully than conventional property investments.

Hedging Towards Inflation

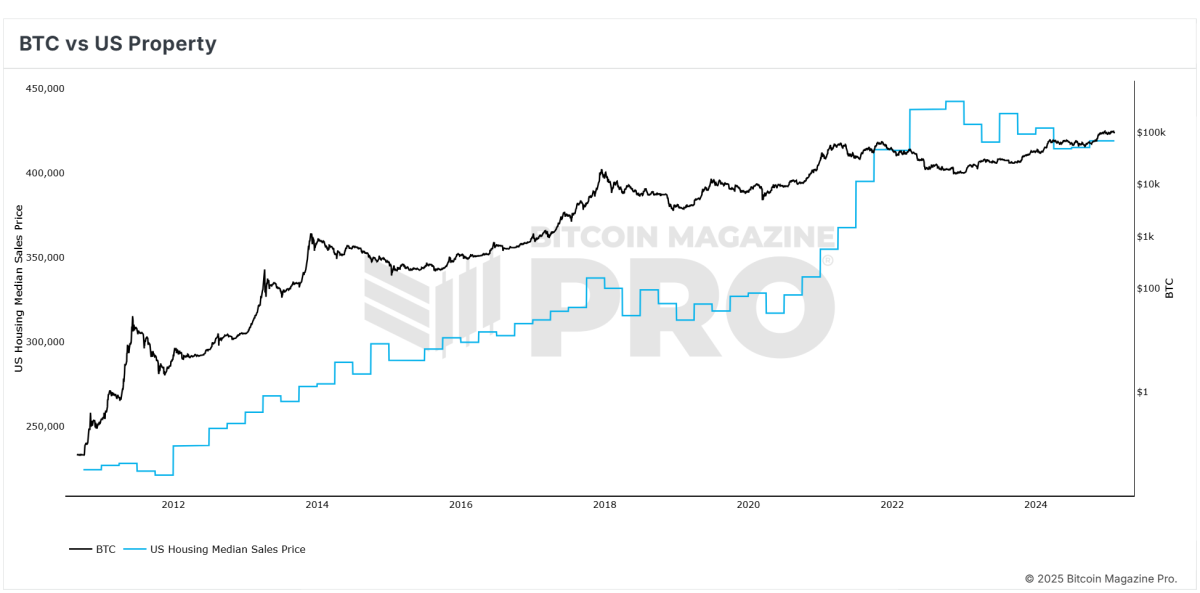

Actual property costs typically mirror inflationary developments however fail to outpace them considerably. Bitcoin, designed as a hedge towards fiat foreign money devaluation, has demonstrated its resilience in inflationary intervals. As central banks proceed to print cash at unprecedented charges, Bitcoin’s finite provide ensures its worth is protected against financial debasement.

Determine 3: Property Priced in BTC displaying how Bitcoin has constantly gained buying energy relative to actual property. Supply -Bitcoin Journal Professional

Flexibility for Trendy Traders

At present’s buyers prioritize flexibility and world entry. Actual property is a localized, illiquid asset that limits mobility. Bitcoin, in contrast, is borderless and permits for decentralized possession with out reliance on conventional monetary methods. This function is very enticing to youthful, tech-savvy buyers who worth freedom and management.

A Daring Imaginative and prescient for the Future

Bitcoin is greater than only a speculative asset; it’s a monetary revolution. By embracing Bitcoin, sensible buyers place themselves on the forefront of this paradigm shift. As Bitcoin adoption grows, its worth proposition turns into more and more clear: a sturdy, deflationary asset designed for the fashionable financial system.

Determine 4: BTC vs. US Property demonstrating Bitcoin’s trajectory as a superior funding automobile in comparison with actual property. Supply – Bitcoin Journal Professional

Conclusion

Whereas actual property has traditionally been a cornerstone of funding portfolios, Bitcoin presents a transformative different that aligns with the calls for of a quickly evolving world financial system. For these looking for to protect wealth, hedge towards inflation, and capitalize on groundbreaking know-how, Bitcoin is the asset of alternative. The query is now not “Why Bitcoin?” however reasonably “Why not Bitcoin?”

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.