In January 2025, bitcoin exhibited modest volatility but clung steadfastly above the $100,000 threshold via a lot of the month’s closing weeks. Inside this era, dormant holdings totaling 3,422.29 BTC—equal to $348.11 million at prevailing valuations—stirred into movement after years of inactivity.

3,422 Bitcoin From 2011–2017 Wallets Reallocated

To start out 2025, a mess of long-dormant bitcoin addresses—untouched since their inception—instantly pulsed with transactional vitality. A cohort of 89 legacy P2PKH (Pay-to-Public-Key-Hash) addresses—originating from wallets created between 2011 and 2017—transferred bitcoin held since their inception. Transactions involving unspent transaction outputs (UTXOs) from 2009 or 2010 remained fully absent all through January.

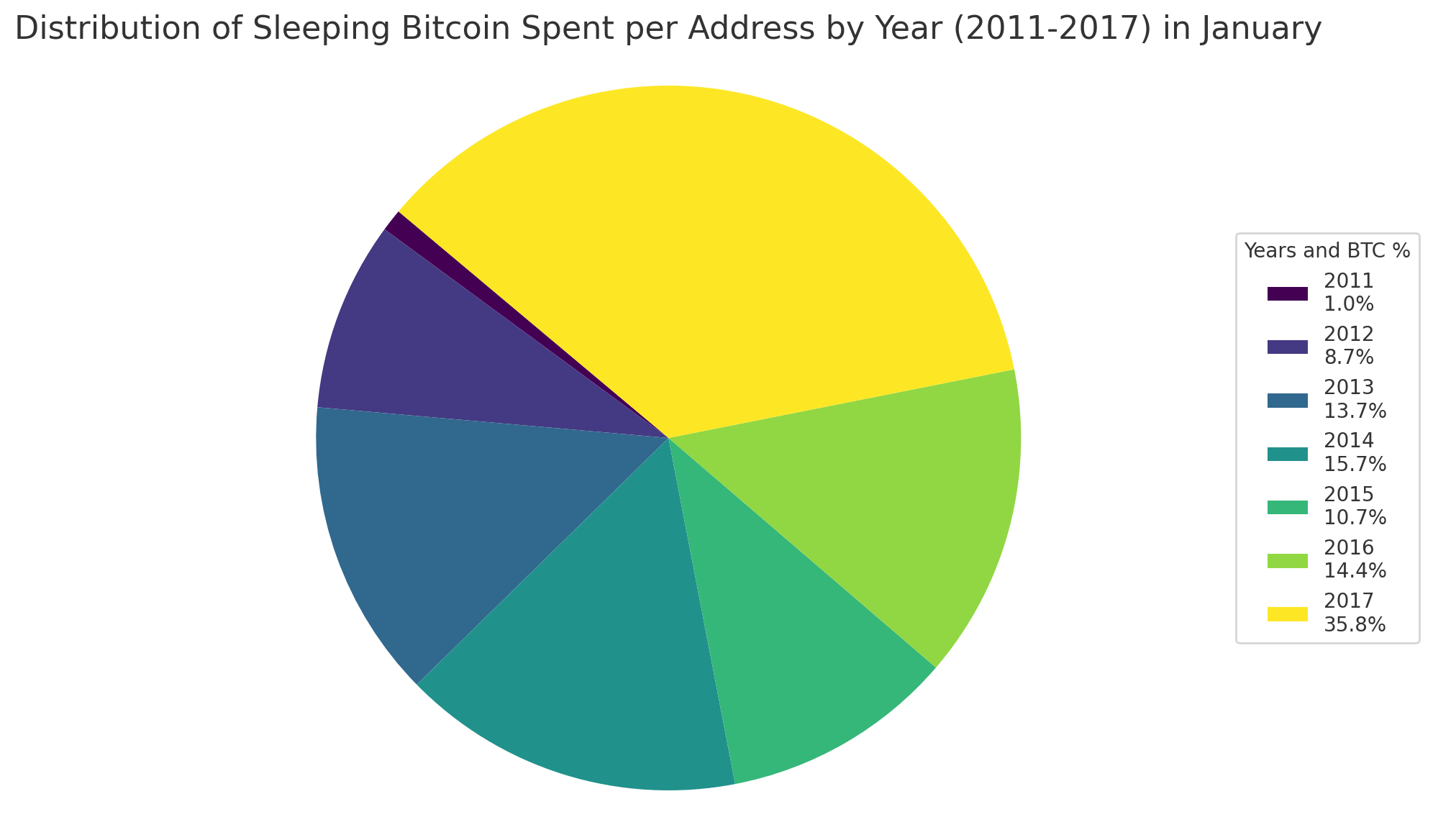

The 89 wallets reallocated 3,422.29 BTC, valued at $348.11 million as of this evaluation. Wallets originating in 2017 dominated transactional exercise, with 20 distinctive P2PKH (Pay-to-Public-Key-Hash) addresses relocating 1,224.08 BTC to newer wallets. Notably, the time period “spent” on this context refers strictly to fund motion—not definitive liquidation. Blockchain parsing sourced from btcparser.com reveals that a number of 2017-era transactions concerned relocations of 100 BTC or higher.

A single pockets, initially established on June 14, 2017, executed a switch of 396 BTC at block peak 880,377. Wallets from 2014 emerged as secondary contributors by quantity, redistributing 536.890025 BTC through 19 distinct transactions. Amongst these, an tackle generated on Jan. 10, 2014, moved 185.01 BTC on Jan. 23, 2025. P2PKH wallets from 2016 subsequently redistributed 493.23 idle bitcoins. Crucially, sure transactional clusters—evident within the information—possible signify singular entities orchestrating a number of transfers.

Addresses from 2013 trailed carefully, redistributing 469.891 dormant bitcoin, whereas wallets created in 2015 facilitated transfers of 365.5601 bitcoins, and classic 2012 addresses reallocated 297.64000888 bitcoin. As well as, three transactions orchestrated the motion of 35.00001641 BTC from wallets relationship all the best way again to 2011. Whereas the intent behind these actions stays ambiguous, every transaction is calculated. The coordinated motion of long-inactive bitcoin throughout a number of blocks final month implies strategic repositioning by legacy holders or outright gross sales.