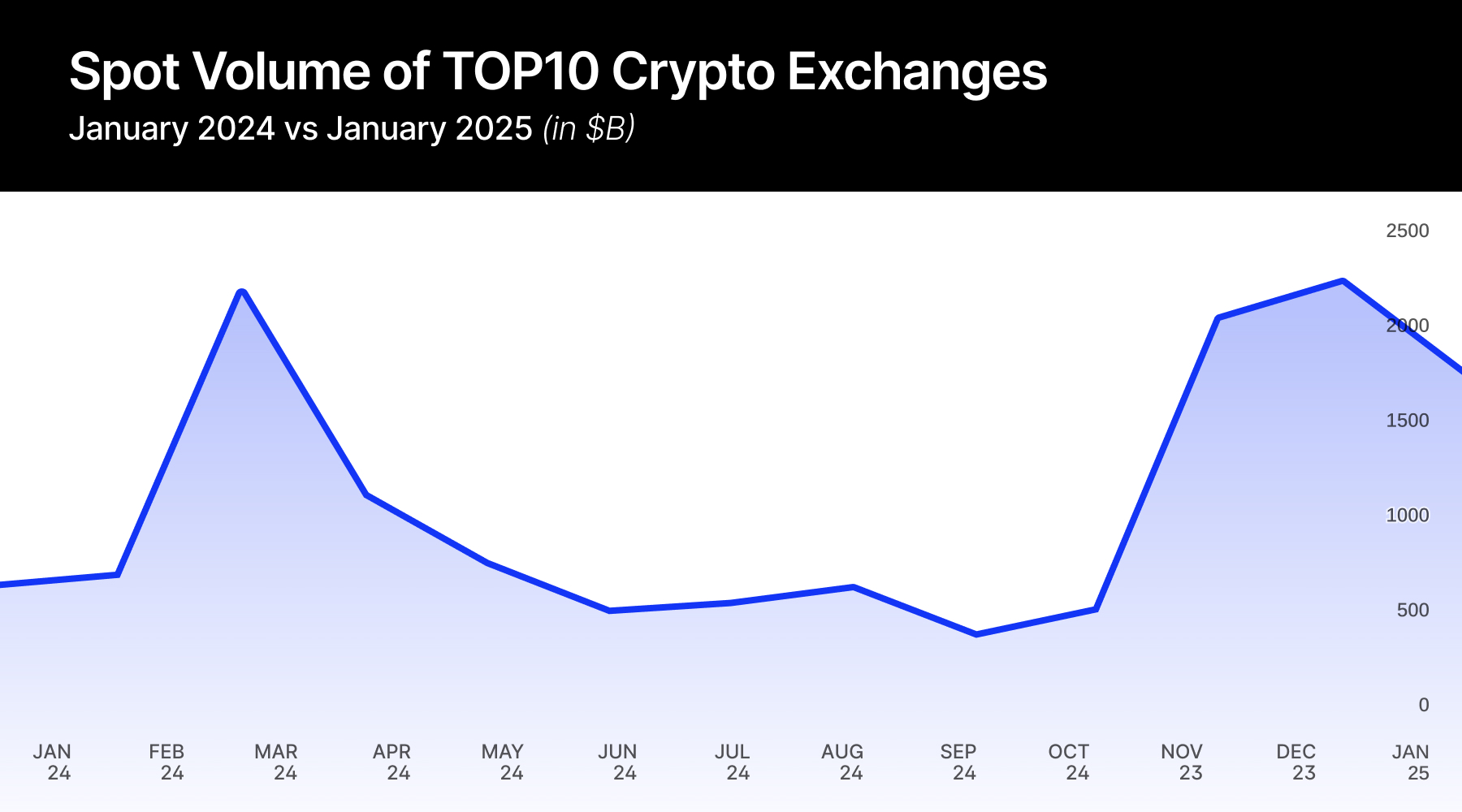

International cryptocurrency trade spot volumes skilled a big cooldown in January 2025, dropping 19.5% to $1.73 trillion from December 2024’s record-breaking $2.14 trillion.

The decline occurred despite the fact that in January the market was reaching historic highs on the Bitcoin (BTC) chart; nonetheless, it quickly transitioned right into a correction. The end result can be decrease than that of November.

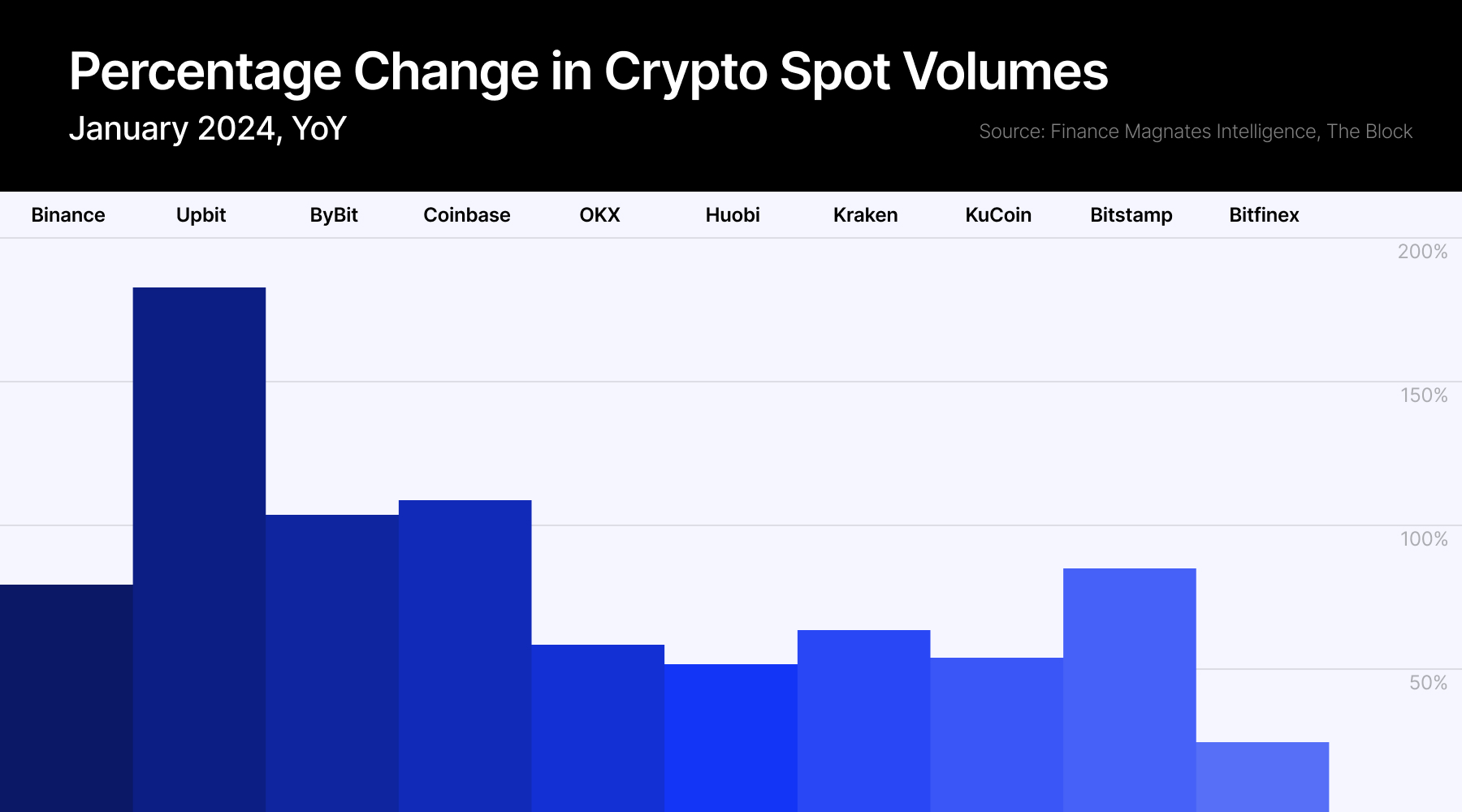

Asian exchanges confronted explicit strain, with South Korea’s Upbit and Hong Kong-based OKX seeing volumes decline 34% and 24%, respectively. U.S.-based platforms confirmed comparatively higher resilience, with Coinbase’s 17% lower matching the broader market pattern.

It’s value noting that in November, the market was pushed by the euphoria surrounding Donald Trump’s election victory, which peaked in December when Bitcoin examined a brand new all-time excessive above $108K. Though January noticed a correction of this transfer, the market proved to be overheated, resulting in a downward correction towards $95K. Whereas buying and selling volumes remained excessive, they declined from the report ranges of the previous two months.

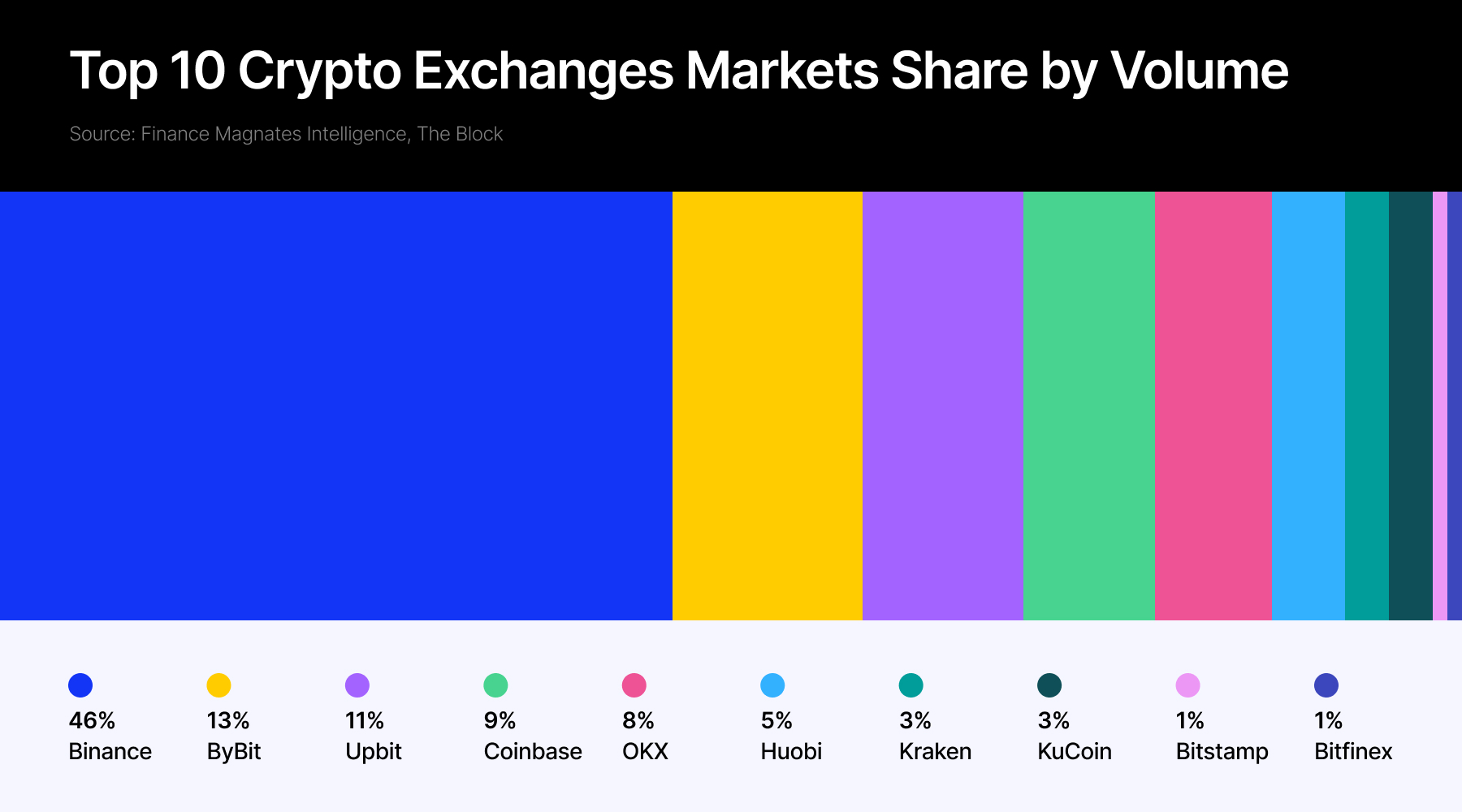

Nonetheless, the info suggests a market consolidation section quite than a elementary shift in buying and selling patterns, with the highest three exchanges sustaining their collective 71% market share regardless of the amount decline.

Binance Holds Its Prime Place

Binance maintained its dominant market place with a 46% share regardless of seeing volumes fall 20% to $801.1 billion. ByBit and Upbit rounded out the highest three, commanding 14% and 11% market share respectively.

Notably, Upbit skilled the steepest decline amongst main exchanges, with volumes dropping 34% month-over-month.

Annual Progress Stays Robust

Regardless of the month-to-month decline, year-over-year comparisons paint a extra optimistic image. Complete buying and selling quantity throughout main exchanges surged 87.9% in comparison with January 2024. ByBit led the annual progress charts with a outstanding 184% improve, whereas Coinbase and Upbit each greater than doubled their volumes from the earlier yr.

Trump continues to shake up the cryptocurrency market, making it tough to foretell what February will deliver. His current resolution to impose a 25% tariff on metal and aluminum had a adverse affect on token costs at first of the week, together with XRP.