Buying and selling quantity over the previous 24 hours surged by greater than 51% however bitcoin’s worth barely budged.

Quantity Surges however Bitcoin Struggles for Momentum

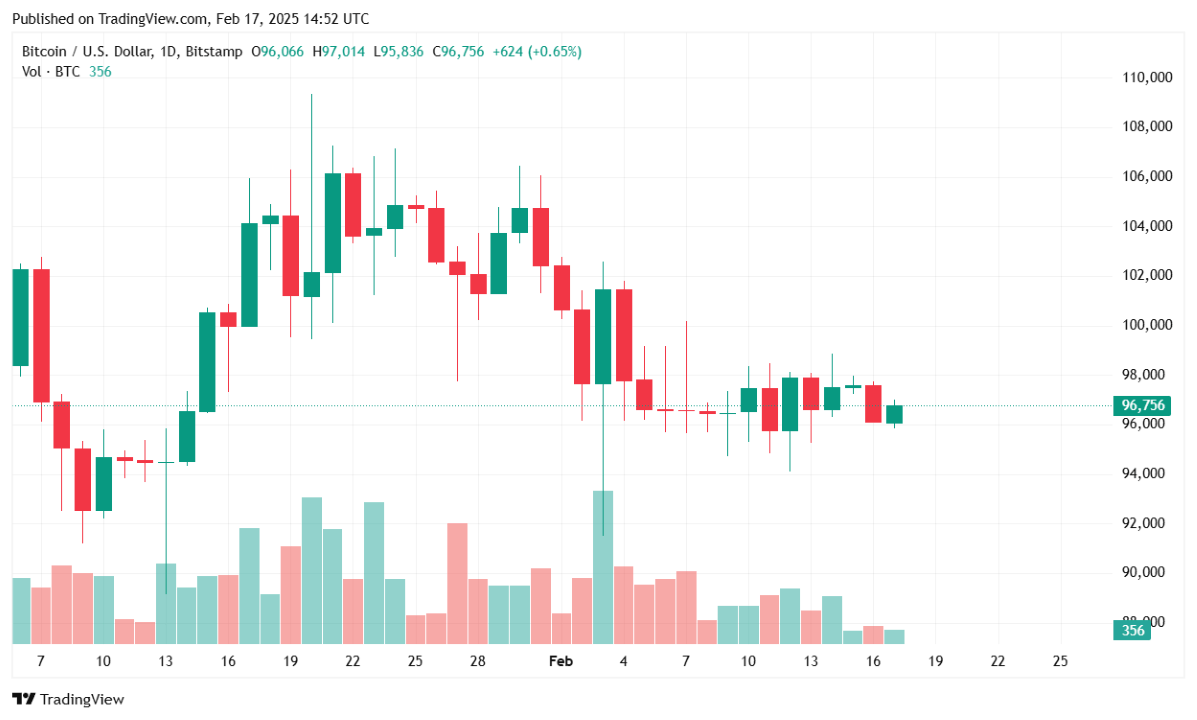

Bitcoin (BTC) is experiencing minor losses regardless of a surge in buying and selling quantity and an increase in futures market exercise. On the time of reporting, BTC is priced at $96,752.07, marking a 0.21% decline over the previous 24 hours and a 0.56% drop over the previous week. The cryptocurrency has fluctuated inside a 24-hour vary of $95,835.09 to $97,275.90, indicating a interval of consolidation as merchants assess market situations.

(BTC worth / Buying and selling View)

Buying and selling Quantity Surges however BTC Stalls

Bitcoin’s 24-hour buying and selling quantity jumped by 51.10% to $23.35 billion, a major improve that implies heightened market participation. Nonetheless, regardless of the rise in exercise, BTC has but to achieve robust upward momentum. In the meantime, market capitalization rose by 0.24% to $1.91 trillion, reflecting modest investor confidence.

BTC Dominance Drops Amid Altcoin Rotation

Bitcoin’s market dominance fell by 0.58% to 60.40%, with merchants shifting their focus towards ether (ETH) and different altcoins following the Libra debacle, which brought on capital rotation from solana (SOL) to ETH. This decline means that whereas bitcoin stays the dominant participant, market individuals are diversifying their portfolios looking for potential beneficial properties elsewhere.

Futures Market Sees Elevated Open Curiosity

Regardless of BTC’s worth stagnation, the futures market is displaying indicators of accelerating hypothesis, with open curiosity climbing 1.42% to $61.18 billion, in response to the newest Coinglass metrics. This uptick indicators that merchants are taking bigger positions, probably in anticipation of an impending worth breakout.

Liquidation Information Displays Bullish Leverage Dangers

Bitcoin liquidations over the previous 24 hours totaled $22.02 million, with lengthy positions accounting for $17.24 million and shorts making up simply $4.78 million. This imbalance means that overleveraged bullish merchants had been caught off guard by BTC’s lack of upward momentum, resulting in compelled liquidations that will have added to short-term promoting strain.

Bitcoin Market Outlook

Bitcoin’s present worth motion displays a market in transition. The surge in buying and selling quantity and futures open curiosity means that volatility might choose up quickly, however BTC’s declining dominance and liquidation imbalance trace at ongoing uncertainty.

The $97,500 resistance stage stays a key barrier for Bitcoin, and a break above this threshold might open the door for additional beneficial properties. On the draw back, BTC’s assist of round $95,500 can be essential in stopping deeper corrections. As traders watch broader macroeconomic traits and altcoin efficiency, bitcoin’s subsequent main transfer will probably rely upon whether or not bullish momentum can regain power within the coming days.