Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised to proceed its value drop as a result of present market sentiment and bearish value motion. Immediately, February 19, 2025, a 3.5% value drop up to now 24 hours has pushed Ether to an important stage, the place a slight additional decline might carry the asset close to the $2,000 mark.

Ethereum Value Motion and Present Momentum

With a 3.5% value drop up to now 24 hours, ETH is at the moment buying and selling close to $2,620 and has been attracting notable curiosity from merchants and buyers, leading to a ten% soar in buying and selling quantity.

In keeping with professional technical evaluation, ETH has been buying and selling inside a consolidation zone between $2,565 and $2,800 for the previous two weeks. Nevertheless, with the latest value drop, the asset has reached the decrease boundary of this vary, making it extra susceptible to additional declines.

Based mostly on latest value motion and historic patterns, if ETH fails to carry this consolidation and falls under the $2,560 stage, there’s a sturdy chance it might drop by 15% to achieve $2,120 within the coming days. In any other case, the value will possible proceed to consolidate within the close to time period.

Nevertheless, the sentiment stays bearish, and buying and selling under the 200 Exponential Shifting Common (EMA) confirms a downtrend.

Merchants’ and Buyers’ Blended Sentiment

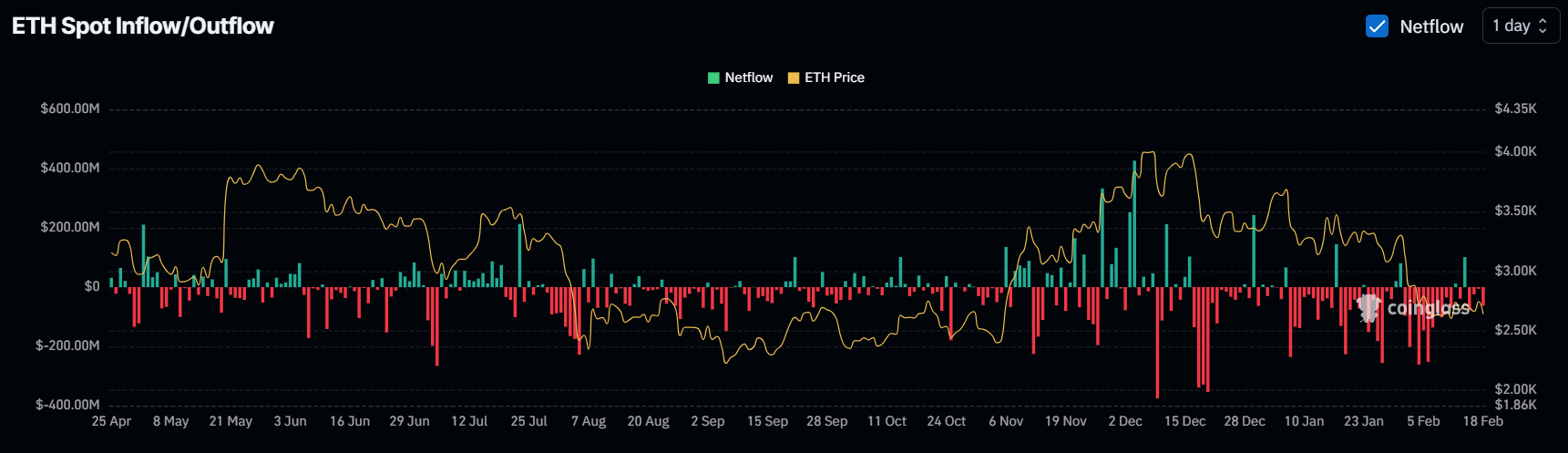

Regardless of this bearish outlook, buyers and merchants could also be accumulating the token, as noticed by the on-chain analytics agency Coinglass. Knowledge from spot influx/outflow reveals that exchanges have witnessed an outflow of over $68 million value of ETH up to now 24 hours, indicating potential accumulation.

Consultants and analysts see this outflow as a bullish signal, as it may well create shopping for stress and drive additional upside momentum. Nevertheless, this time, sentiment has shifted towards the bearish facet.

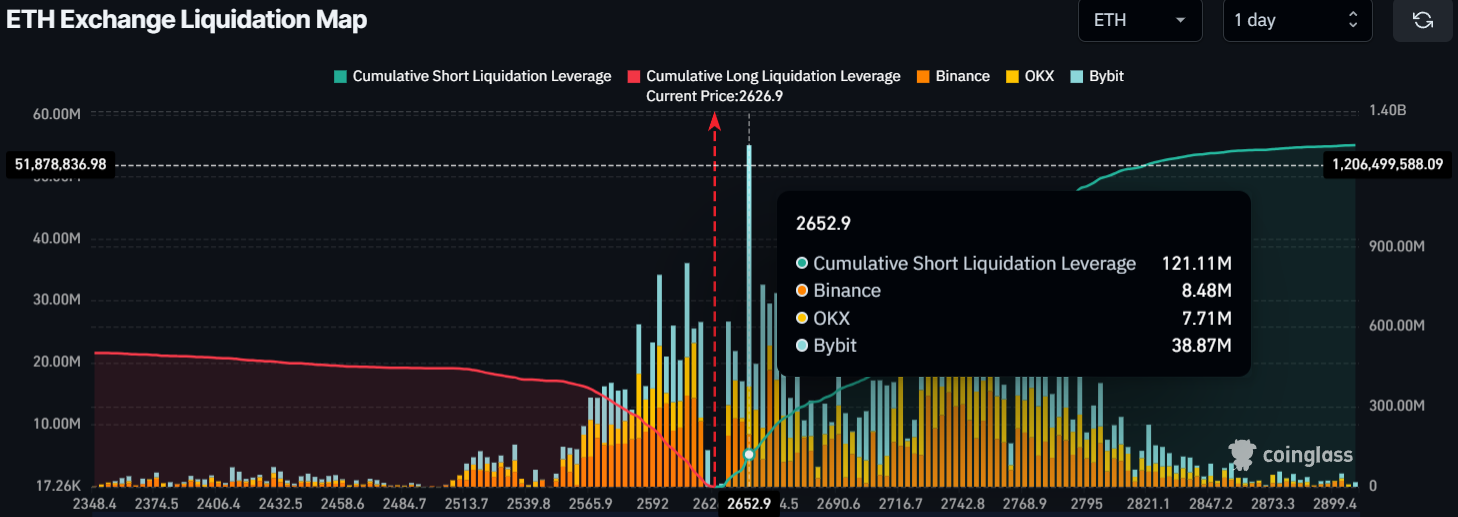

In the meantime, intraday merchants are specializing in the bearish facet, as their bets have considerably elevated. Knowledge reveals that bears are over-leveraged at $2,650, holding $121 million value of brief positions. However, $2,605 is one other key stage the place bulls are over-leveraged, holding over $90 million value of lengthy positions, decrease than the brief positions.

When combining this information, it seems that bears are dominating and are possible trying to push the asset under the breakout stage.