Bitcoin (BTC) stays consolidated in a decent buying and selling vary between $94,000 and $100,000, struggling to ascertain clear momentum amid lingering market uncertainty.

At press time, BTC is buying and selling at $96,907, posting a modest 0.16% acquire. Nonetheless, investor sentiment stays fragile, with U.S. spot Bitcoin ETFs recording a $430 million web outflow final week, marking a decline in institutional demand and including stress to BTC’s worth motion.

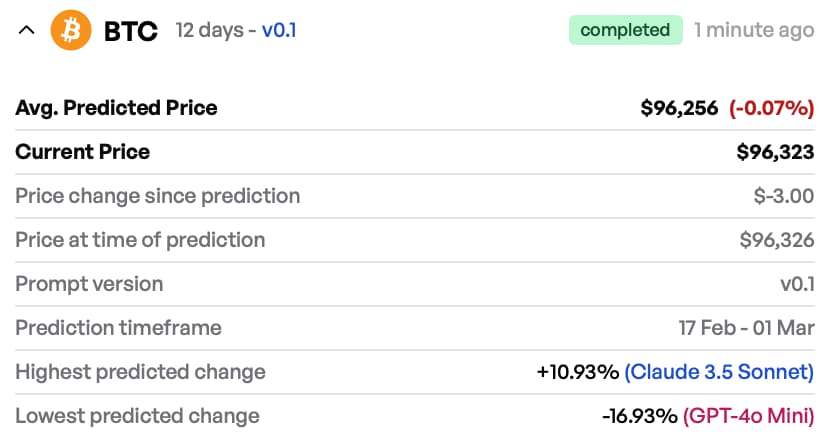

Finbold AI predicts Bitcoin worth goal for March 1

As Bitcoin struggles to interrupt free from its present vary, Finbold’s AI-powered prediction instrument has offered an up to date outlook for its trajectory main as much as March 1, 2025. Factoring in technical indicators and market information, the mannequin forecasts a mean BTC worth of $96,256 for the beginning of subsequent month, a 0.07% decline from its present stage of $96,323.

Regardless of this near-flat projection, AI fashions stay sharply divided on Bitcoin’s subsequent transfer. Probably the most optimistic outlook, generated by Claude 3.5 Sonnet, foresees a ten.93% rally, suggesting BTC may take a look at $106,800 within the coming weeks.

Conversely, GPT-4o Mini presents a bearish case, predicting a 16.93% drop, which may see Bitcoin fall as little as $80,000—a situation possible tied to macroeconomic headwinds or elevated promoting stress.

Analysts’ tackle BTC worth

Whereas AI fashions paint a blended image for Bitcoin’s trajectory, technical analysts are intently monitoring BTC’s worth motion inside a well-defined vary, with resistance at $106,800 and help close to $91,700.

BTC is struggling to reclaim its mid-range stage at $99,048, which aligns with the 50-day Exponential Transferring Common (EMA)—a key resistance zone that has already rejected a number of makes an attempt of a breakout

A decisive transfer above this stage may validate the optimistic worth projection, in keeping with CrypNuevo.

On the draw back, Bitcoin’s present worth of $96,227 leaves it weak to a pullback. A breakdown beneath $91,764 would strengthen the bearish outlook predicted by GPT-4o Mini, opening the door for a possible drop towards $90,000 and decrease.

Past technicals, macroeconomic elements are additionally in focus. The upcoming Federal Reserve minutes and jobless claims information may add volatility, with merchants intently looking forward to any shifts in financial coverage. Persistent inflation considerations have already pushed again expectations of rate of interest cuts, an element that might affect danger urge for food within the crypto market.

Featured picture through Shutterstock