Ethereum has been experiencing a wild crash over the previous few days, breaking beneath a number of vital assist ranges. Traders are actually questioning when this downtrend will finish.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Every day Chart

On the every day chart, the asset has been dropping quickly since breaking beneath the 200-day shifting common, situated across the $2,900 mark.

The $2,700 and $2,350 ranges are additionally damaged to the draw back, as the value is presently testing the $2,100 assist zone. If this stage additionally will get damaged to the draw back, a deeper decline towards the $1,750 stage may very well be anticipated within the coming months.

The 4-Hour Chart

Wanting on the 4-hour chart, issues usually are not trying good in any respect for ETH, because the asset has been making decrease highs and lows constantly over the past couple of months.

Presently, the $2,100 assist stage is holding the value. A short lived restoration may very well be possible if ETH breaks above the $2,400 stage. Nevertheless, if the $2,100 space can also be misplaced, a a lot worse drop could be doubtless for Ethereum.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Open Curiosity

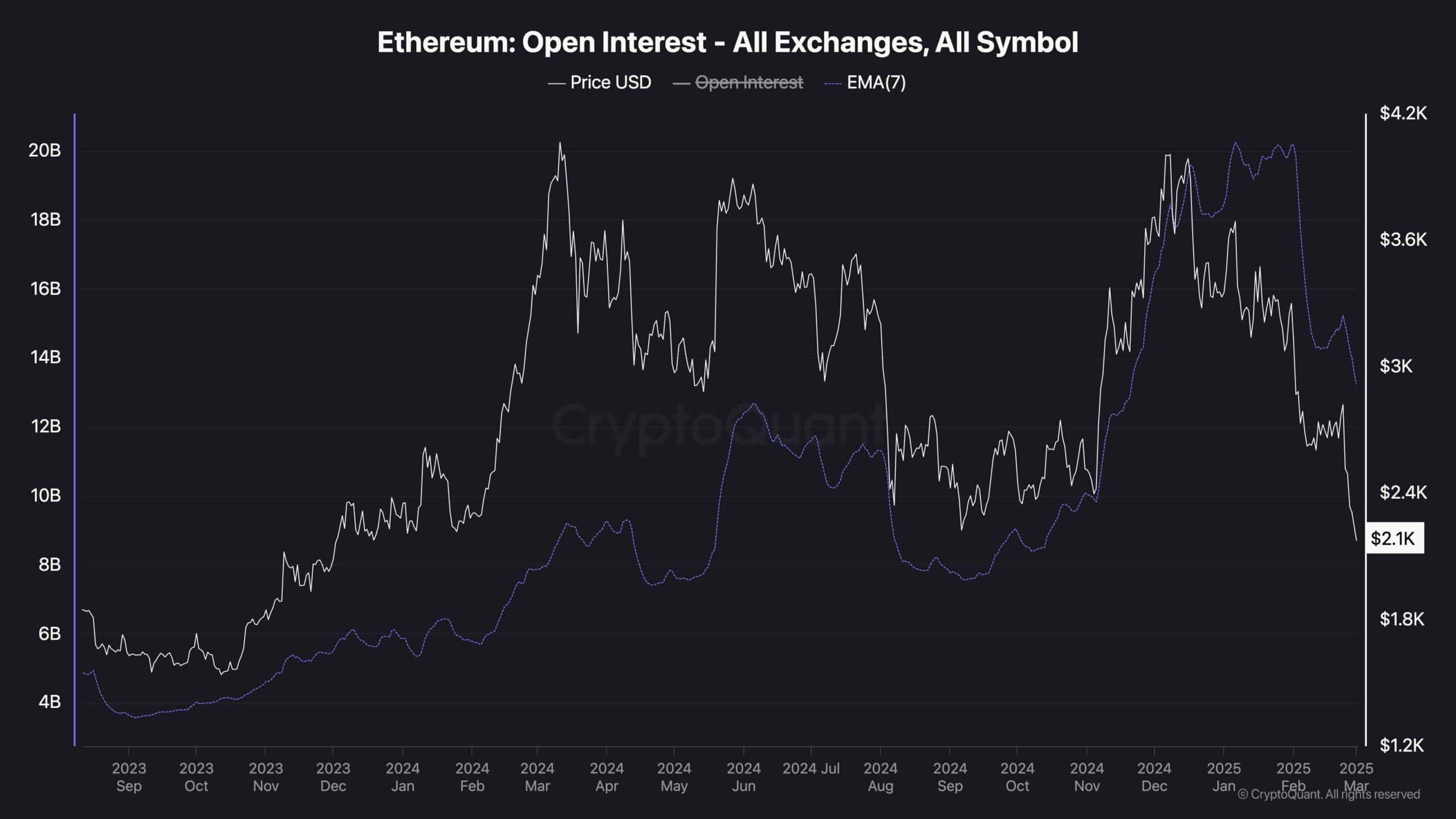

Many analysts and traders are blaming the futures marketplace for Ethereum’s huge crash over the latest weeks. Nevertheless, analyzing the open curiosity metric signifies this may not be the case this time.

This chart demonstrates the open curiosity metric, which measures the variety of open futures contracts. Because the chart suggests, whereas the value has skilled a major drop, the open curiosity just isn’t declining appropriately and continues to be lagging.

This means that the latest value motion just isn’t completely as a result of lengthy liquidation cascades, and many of the promoting strain comes from the spot market. Additionally, it warns traders that issues might get a lot worse in case a a lot larger liquidation occasion happens.