Ethereum’s worth is experiencing consolidation following its deep correction over the previous month. Nonetheless, key helps nonetheless stay in entrance of the value, making a bullish retracement stage potential.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum has undergone a deep correction over the previous few months, finally reaching the vital $2K help vary. This stage holds important significance, because it has acted as a powerful help zone since December 2023 and aligns with the essential Optimum Commerce Entry (OTE) ranges.

If ETH breaks beneath this help, a notable downward pattern might comply with. Nonetheless, given the historic demand at this stage, the market is more likely to consolidate, with a possible for short-term bullish retracements.

The 4-Hour Chart

On the decrease timeframe, Ethereum’s bearish market construction stays intact. It’s characterised by decrease lows and decrease highs, signaling continued vendor dominance. Just lately, the asset has seen heightened volatility across the $2K area, resulting in giant liquidations of leveraged positions.

Nonetheless, a bullish divergence is rising between Ethereum’s worth and the RSI indicator, suggesting a gradual improve in shopping for strain.

Given these elements, additional consolidations throughout the $2K-$2.5K vary are seemingly within the quick time period, with the opportunity of heightened volatility and short-term worth rebounds.

Onchain Evaluation

By Shayan

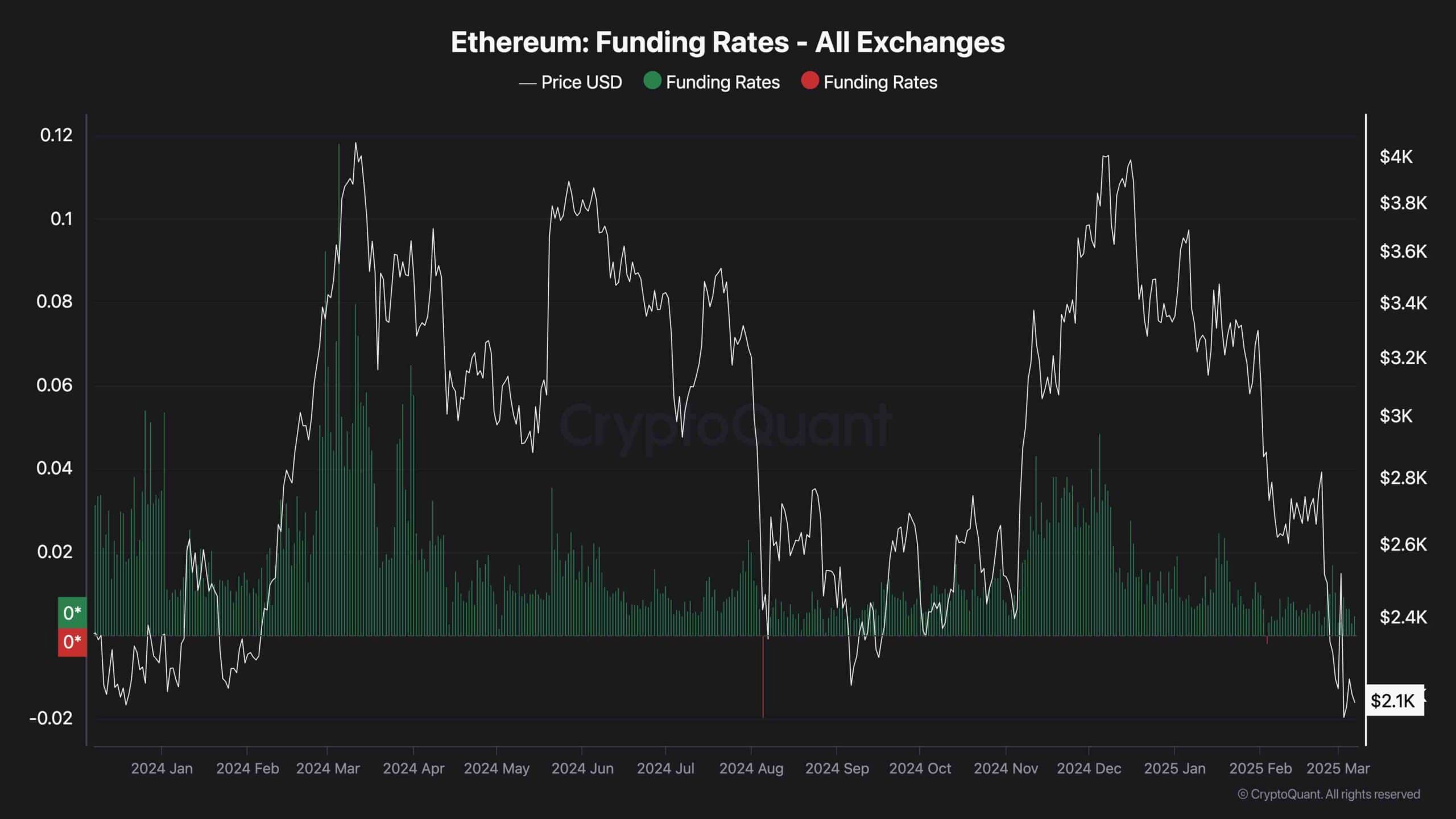

The funding charges metric is a vital indicator of purchaser vs. vendor dominance within the Ethereum futures market. Since ETH’s current peak at $4K, funding charges have been declining, indicating an increase briefly positions and total bearish sentiment. This will increase the chance of a continued market correction within the quick time period.

Whereas unfavorable funding charges sometimes sign vendor dominance, in addition they increase the possibilities of a short-squeeze occasion. If Ethereum experiences even a modest bullish rebound, a wave of liquidations of quick positions may set off a fast worth surge, pushing the market greater.

Ethereum’s potential to carry above the $2K help zone shall be vital in figuring out the subsequent main transfer. If ETH stabilizes, it may pave the best way for a bullish reversal, with $2.5K and $3K as key resistance ranges. Nonetheless, continued promoting strain may drive the value beneath $2K, signaling a deeper downtrend. The following few days shall be essential in figuring out Ethereum’s short- to mid-term trajectory.