Bitcoin ETF outflows have practically amounted to $750 million within the final two days because the crypto market constantly fell. BlackRock, the most important issuer, has offloaded round 2,000 BTC within the earlier 24 hours.

Collectively, the ETF issuers offered off sufficient BTC that they collectively maintain lower than Satoshi. They surpassed him three months in the past and continued shopping for enormous quantities of Bitcoin, indicating actually huge gross sales.

Bitcoin ETF Outflows Proceed

Because the Bitcoin ETFs first bought SEC approval final yr, they’ve had a transformative affect in the marketplace. Recently, nonetheless, they’ve been turning bearish.

In the direction of the tip of February, the market noticed $2.7 billion in outflows, and this development continued. The final 4 consecutive weeks had outflows, and the market already misplaced practically $750 million this week alone.

Bitcoin ETF Web Outflow. Supply: SoSoValue

This marks the seventh consecutive day of outflows for this ETF market. IBIT, BlackRock’s product, led these losses with $151 million within the final 24 hours.

In mid-February, some analysts started speculating that BlackRock would start promoting its Bitcoin, and ETF analyst Shaun Edmondson observed how giant of a development it’s changing into:

“I do know the markets are very ‘danger off’ in the intervening time with the Tariff uncertainty, however that is yet one more outflow day from the US Spot ETFs, collectively now falling beneath Satoshi once more. Given the bullish narrative from the SEC, Technique elevating 21 billion, State [Bitcoin Reserve] race and Nationwide [Bitcoin Reserve] invoice, I discover this just a little shocking,” Edmondson claimed.

BlackRock alone has offloaded round 2,000 BTC since Edmondson posted yesterday’s every day tallies. It’s unclear how far the ETF issuers need to take this development, however these Bitcoin gross sales are very regarding.

These issuers surpassed Satoshi’s Bitcoin holdings in December, so these outflows have already eaten up three months’ price of vociferous buying.

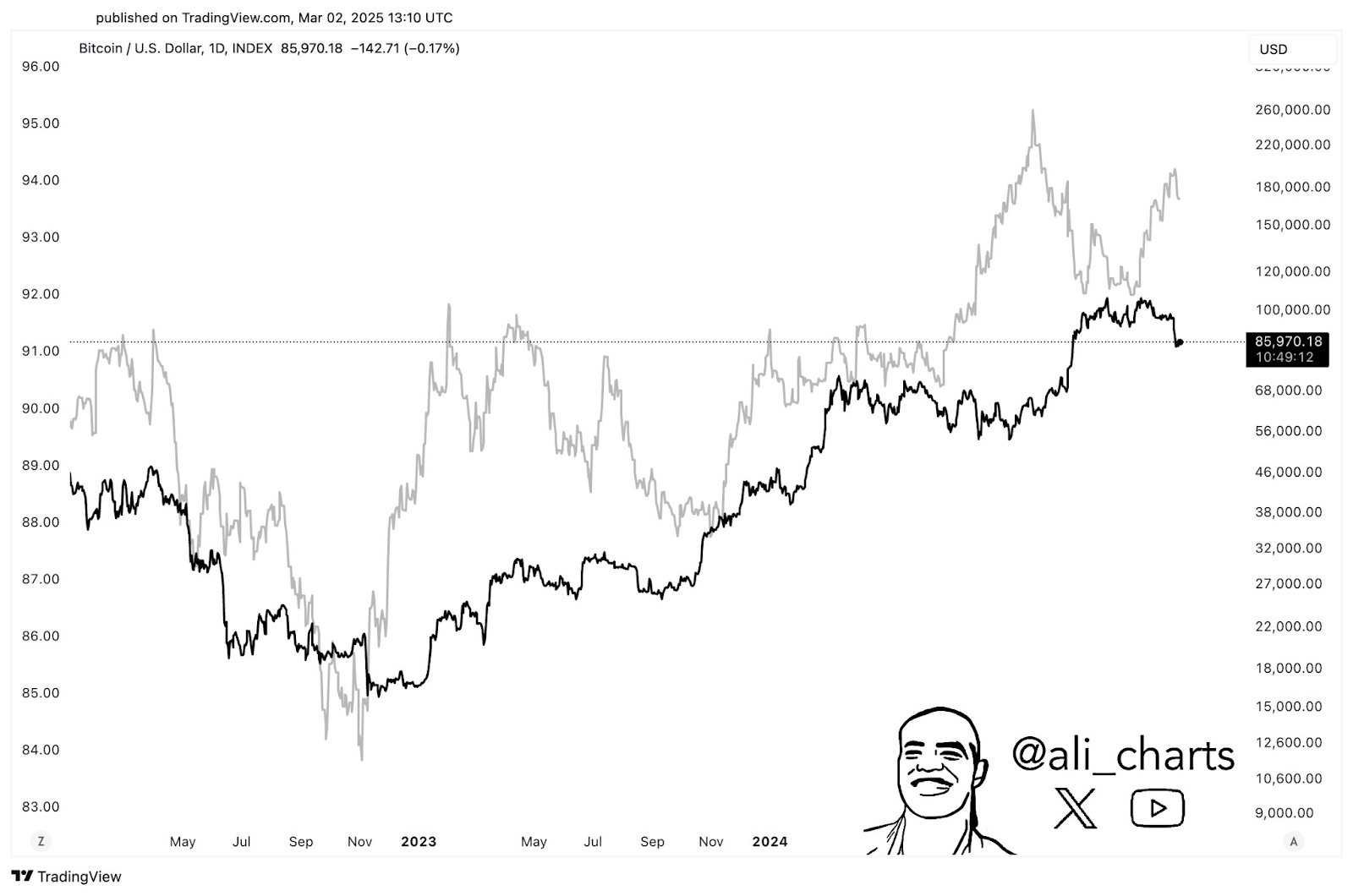

Nonetheless, regardless of this ETF pessimism, Bitcoin’s precise worth may very well be doing loads worse. The complete crypto market has been hit with huge outflows, and BTC fell accordingly.

Nonetheless, the US CPI report this morning was higher than anticipated, which allowed Bitcoin just a little respiration room. It’s anybody’s guess, nonetheless, how lengthy this reprieve will really final.