The variety of publicly traded firms shopping for and holding Bitcoin (BTC) has surged to 80 in 2025, a 142% enhance from simply 33 firms in 2023.

This development displays the rising acceptance of Bitcoin as each a strategic reserve asset and a hedge towards inflation.

Why Public Firms Are Holding Bitcoin in 2025

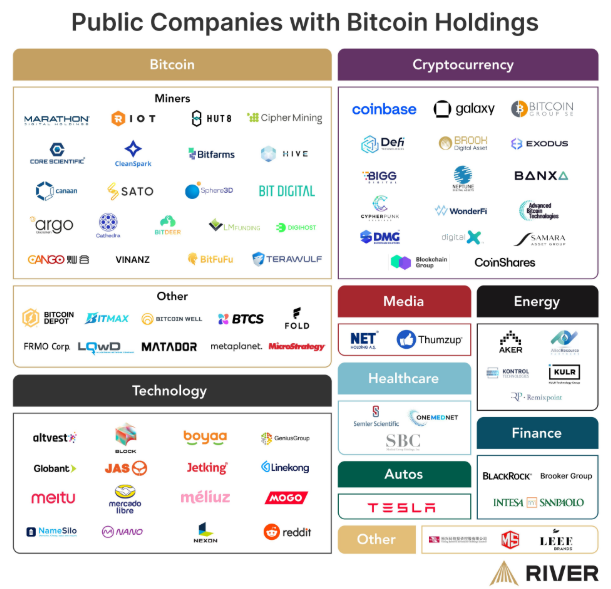

Digital asset brokerage agency River revealed that 80 public firms maintain Bitcoin, up from simply 33 two years in the past.

“80 public firms are actually shopping for Bitcoin. Two years in the past there have been 33. Two years from now there will probably be…?,” River posed.

Public Firms Holding Bitcoin. Supply: River on X

The businesses embracing Bitcoin span a number of industries, with a powerful focus in know-how and finance. The know-how sector accounts for half of the general public firms holding Bitcoin. Bitcoin Treasuries knowledge exhibits companies like MicroStrategy (now Technique), Tesla, and Block stand on the forefront of integrating Bitcoin into their monetary methods.

Monetary establishments comprise 30% of the overall, together with Fold Holdings and Coinbase World, which have oblique publicity through ETFs (exchange-traded funds). The cryptocurrency mining business represents 15%, with mining giants resembling Marathon Digital and Riot Platforms holding vital Bitcoin reserves.

The remaining 5% contains firms from different sectors, together with retail and vitality. These companies experiment with Bitcoin holdings for transactions and stability sheet diversification.

A number of key components are driving the adoption of Bitcoin amongst public firms. Inflation hedging has change into a significant consideration as companies search for various shops of worth past conventional belongings.

“Bitcoin is the forex of freedom, a hedge towards inflation for middle-class Individuals, a treatment towards the greenback’s downgrade from the world’s reserve forex, and the off-ramp from a ruinous nationwide debt. Bitcoin may have no stronger advocate than Howard Lutnik,” US Well being and Human Companies Secretary Robert F. Kennedy Jr stated not too long ago.

Many firms have additionally adopted Bitcoin as a treasury reserve technique, betting on its long-term appreciation. On this matter, companies like Technique prepared the ground.

Moreover, investor stress has performed a job as institutional buyers and shareholders more and more push firms to diversify into digital belongings. Regulatory readability and pro-crypto insurance policies in some areas have additional inspired company adoption.

Cumulative Bitcoin Holdings Proceed to Rise

In the meantime, public firms have been accumulating Bitcoin at an unprecedented price. Between 2020 and 2023, they collectively held roughly 200,000 BTC. In 2024 alone, a further 257,095 BTC was acquired, doubling the overall from 5 years in the past.

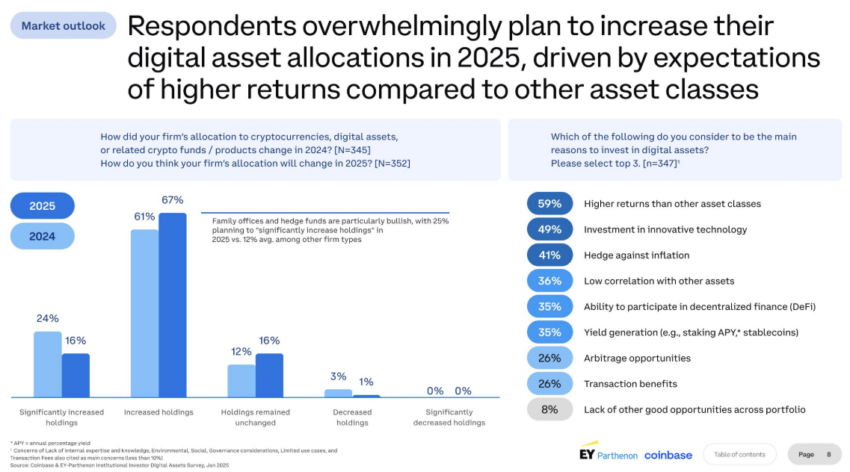

Within the first quarter of 2025, an estimated 50,000 to 70,000 BTC has already been added. Noteworthy, MicroStrategy and Fold Holdings lead the acquisitions. Coinbase’s latest institutional investor survey additionally indicated that 83% of establishments plan to extend their crypto asset allocation by 2025.

Institutional Bitcoin Investor Survey. Supply: Coinbase report

The surge in Bitcoin adoption by public firms coincides with a brand new wave of crypto-related IPOs (preliminary public choices). Notable companies, together with Gemini and Kraken, plan to go public, highlighting elevated institutional confidence within the digital asset area. These IPOs present contemporary capital inflows and additional legitimize the broader crypto market.

Bitcoin has additionally change into a monetary lifeline for struggling firms in search of to spice up their inventory costs. Some companies with declining revenues have turned to Bitcoin investments to draw new buyers and strengthen their market place. Because of this, Bitcoin is taking part in an more and more vital position in company methods.

Regardless of the spectacular progress in company Bitcoin adoption, public crypto firms nonetheless symbolize solely 5.8% of the overall crypto market capitalization, based on a CoinGecko report. This means that there’s nonetheless vital room for enlargement.

Past company treasuries, Bitcoin’s rising adoption additionally influences monetary planning in different areas. Mother and father more and more select Bitcoin as an alternative choice to conventional school financial savings plans, betting on its long-term progress potential to fund schooling bills.

With 80 public firms now holding Bitcoin, the development exhibits no indicators of slowing. If the present progress trajectory continues, institutional adoption will deepen as extra firms flip to Bitcoin.