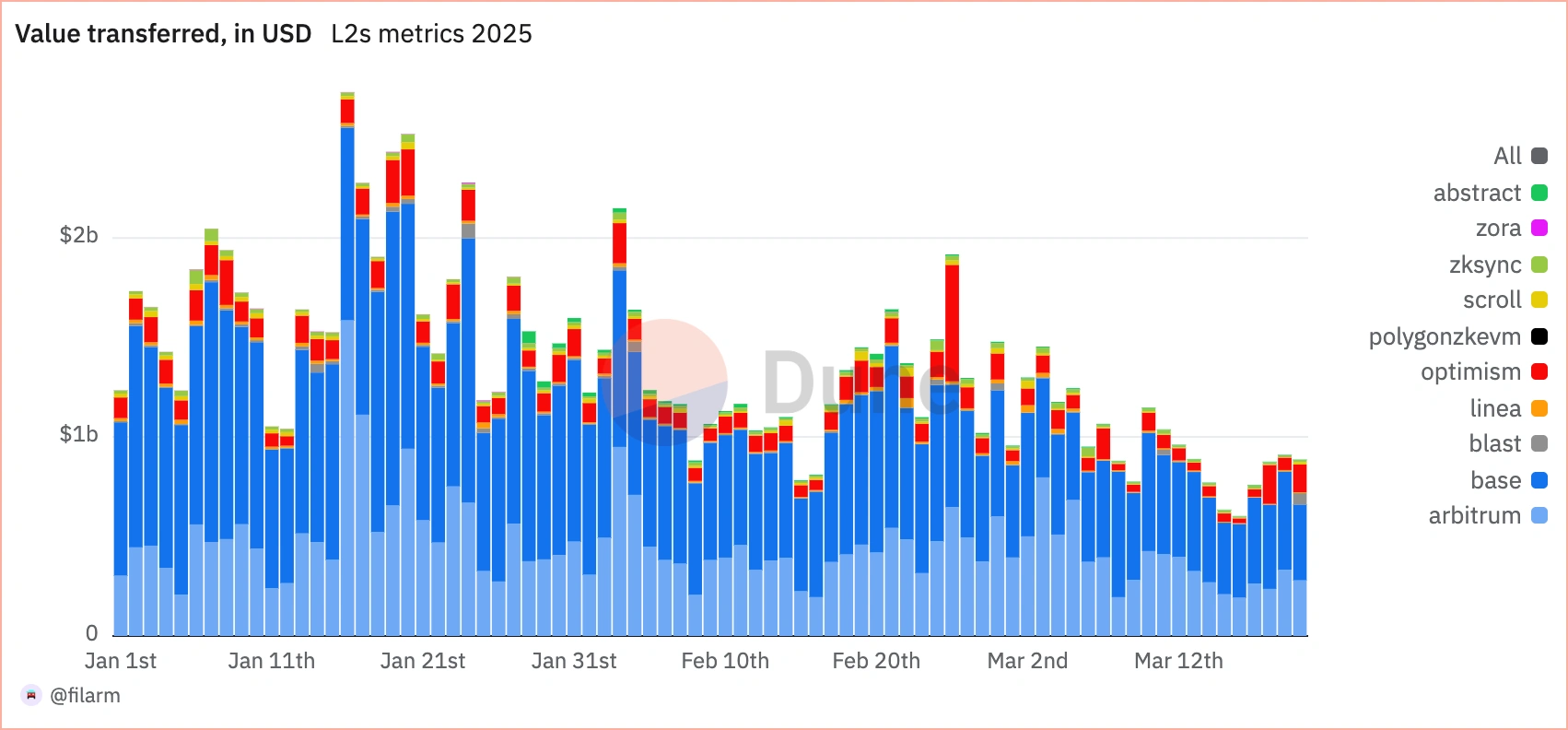

A brand new metric knowledge report by Dune, a platform specializing in on-chain knowledge evaluation, reveals that Base and Arbitrum are the main layer-2 (L2) blockchains by on-chain actions and income technology.

By way of worth transferred, Base and Arbitrum dominate the area with market shares of 55% and 35%, respectively, with Optimism coming at a distant third.

Base and Arbitrum lead L2s by way of worth transferred in 2025. Supply: Dune Analytics

Nevertheless, the brand new knowledge supplied info on the actions of L2 blockchains apart from Base and Arbitrum, that are additionally main in particular metrics equivalent to worth transferred by transaction and fuel unit.

In keeping with Dune, excessive worth per transaction usually signifies significant utilization, like DeFi trades or massive transfers, over spammy or low-value interactions. It might replicate the blockchain’s potential to assist real-world use instances that require important worth motion, whereas worth transferred per fuel unit displays the financial density and the effectivity of the blockchain in dealing with beneficial actions relative to sources.

On this space, the info reveals that blockchains equivalent to Skoll, Zksync, and Arbitrum take the lead by way of their effectivity.

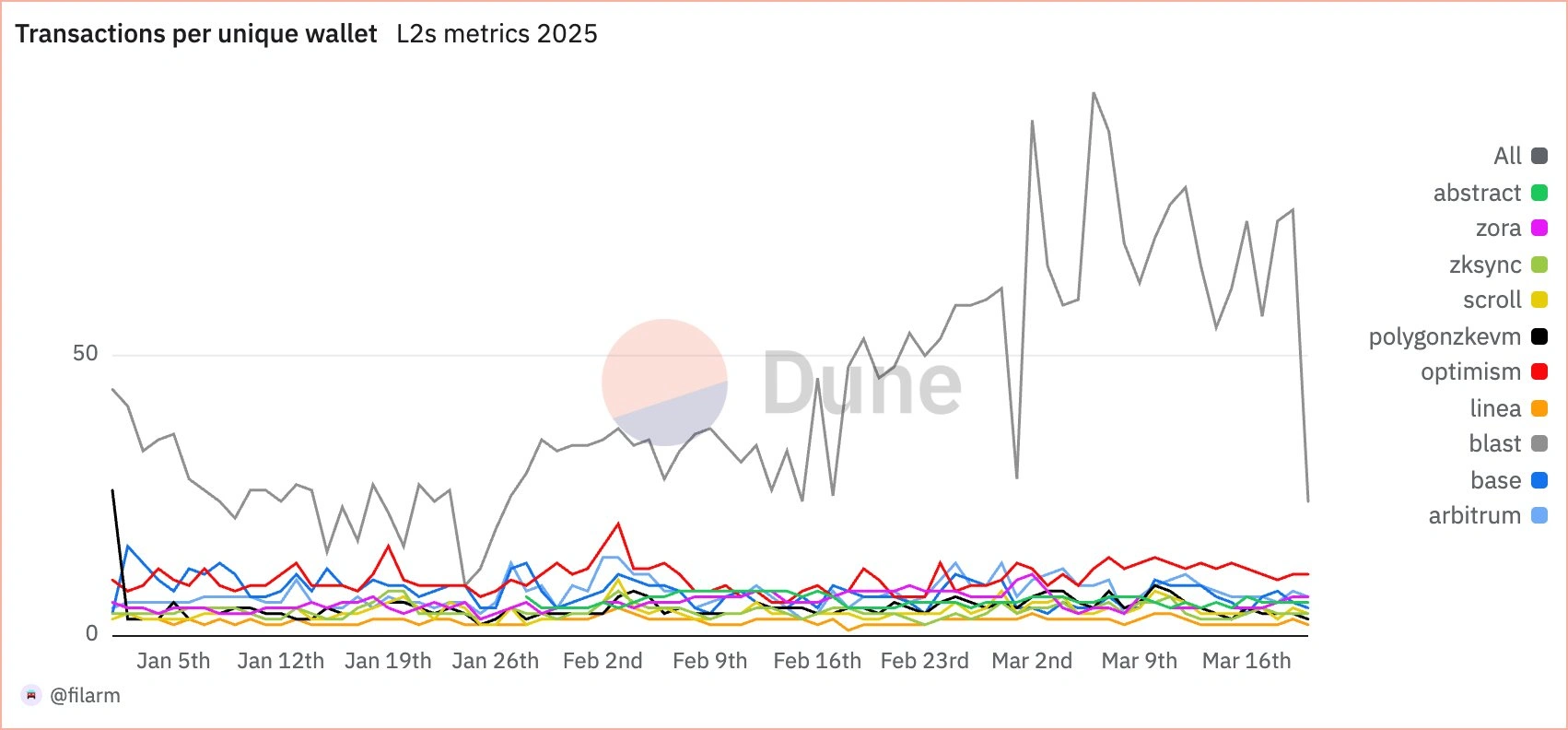

In a put up on X (previously Twitter), Filippo (@filippoarman) experiences that the most important winners by way of the worth of transactions per distinctive pockets are Blast and Optimism. Nevertheless, Dune additionally identified that this metric can generally be deceptive as a result of it’s vulnerable to distortions that are principally attributable to Sybil assaults.

Blast and Optimism are the most important L2s winners by way of worth of transactions per distinctive pockets. Supply: Dune Analytics

The gulf between the blockchains turns into more and more clear within the income (aka transaction charges) part, which in keeping with Dune, is a good metric as a result of it represents the income (transaction charges), prices (L1 charges), and revenue (L2 charges).

Base takes a serious share by way of transaction charges, accounting for over 80% of the market share. Arbitrum strikes between 5 to 10% and is adopted by Summary and Optimism at roughly 5 to three% of the market share.

In analyzing this knowledge, Filippo talked about that by way of income per transaction, a metric that sheds gentle on how a lot revenue the layer 2 blockchain generates on common from every transaction processed on a given day, Linea leads and is then adopted by Base, zkSync, and Polygon zkEVM.

Nevertheless, in relation to general revenue (revenue = income – L1 prices), Base comes on high once more and is adopted by Arbitrum on the chart. Each blockchains lead by way of revenue and revenue per transaction.

Ethereum nonetheless dominates with 50%+ share almost about DEX quantity. As for the L2s, Base and Arbitrum lead the cost, with Base taking roughly 25 to 30% share and Arbitrum claiming 15%, whereas others path far behind.

Ethereum nonetheless dominates NFT buying and selling quantity, with a share of over 80%. zkSync is second within the L2 entrance, with a ten% – 15% share, adopted by Base (3.5%) and Blast (2.5%).

Base has confirmed to be a excessive performer in income and revenue, whereas Arbitrum has maintained a positively constant metric throughout almost all metrics. Because the report reveals, Base and Arbitrum aren’t alone on the high; a number of L2 blockchains, equivalent to zkSync, Scroll, Linea, Blast, and Optimism, excel at sure metrics.

The way forward for L2 blockchains on Ethereum

The report additionally displays a rise within the efficiency and utilization of L2 blockchains, echoing the emotions of Joseph Lubin, Ethereum co-founder, who mentioned that the way forward for the Ethereum blockchain is tied to L2 scaling options.

Lubin mentioned this on the Digital Asset Summit, including that Ethereum’s safety and developed infrastructure make it one of the best basis for enhancing networks, permitting builders to construct with out the necessity for a brand new layer-1 community.

Nevertheless, there’s no absolute settlement with Lubin’s place as buyers contemplate L2 blockchains as parasitic to the Ethereum L1 blockchain, citing that L2 blockchains provides little worth to the L1 blockchain in comparison with the worth they derive from Ethereum.

Given the utilization knowledge and metrics out there, there’s little question that L2 blockchains on Ethereum are right here to remain, and the one method ahead might be for each layers to forge a mutually useful pact.