A research-heavy French funding agency has revealed a quantitative paper explaining the explanations Technique inventory outperforms bitcoin.

French Asset Supervisor Tobam: Three Causes Technique Outperforms Bitcoin

Paris-based asset supervisor Tobam has researched precisely why Michael Saylor’s Technique (MSTR) has continued to outperform bitcoin ( BTC), the very asset answerable for boosting its inventory worth. The agency revealed its findings on the analysis website SSRN in a March 2025 paper titled, “Accounting for the efficiency of Microstrategy.”

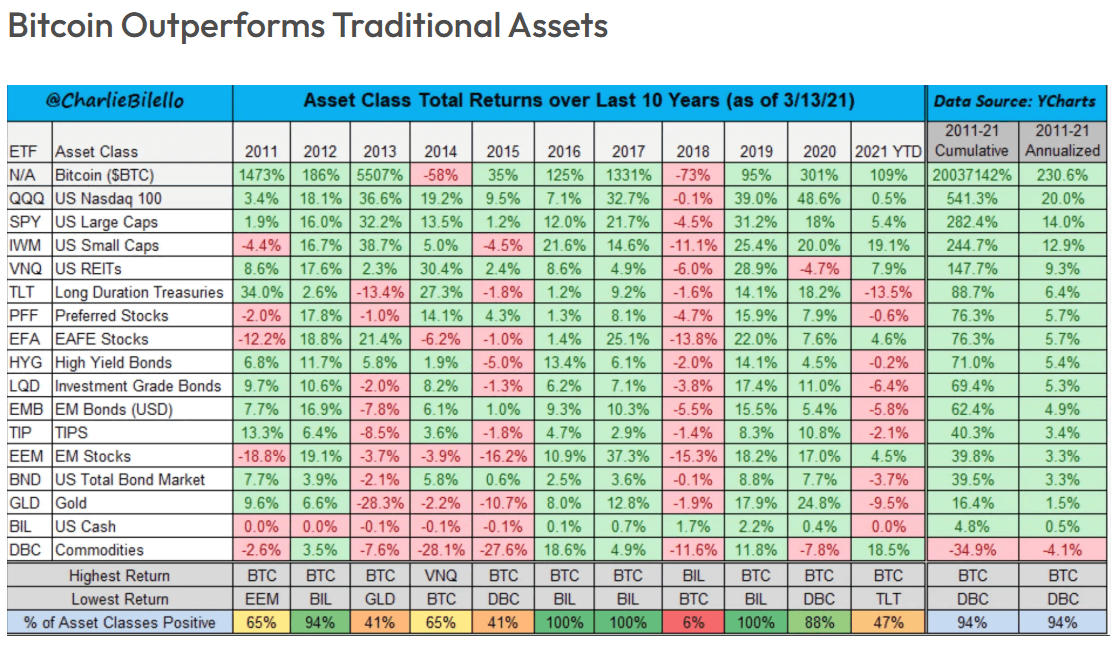

The dominant cryptocurrency is usually thought-about one of the best performing asset of all time. Bitcoin cumulative positive factors topped 20,000,000% between 2011 and 2021, however in August 2020, Technique (previously Microstrategy) initiated a radical pivot, transitioning from being a software program enterprise to a bitcoin treasury firm.

(10-year cumulative returns for bitcoin vs. conventional property / Charlie Bilello on X)

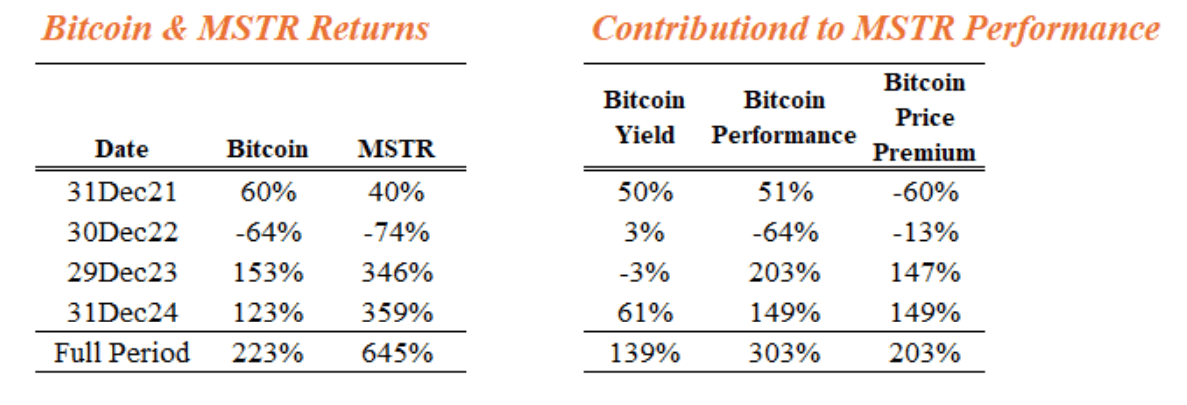

Traders who needed bitcoin publicity with out really holding the cryptocurrency started buying Technique inventory at a premium, and in keeping with Tobam, Technique’s inventory worth skyrocketed by an element of seven.5 whereas BTC solely grew by an element of three.2, lower than half of MSTR’s progress.

And now, after crunching the numbers, Tobam has distilled the meteoric success of Technique’s bitcoin treasury strategy down to 3 key causes.

“We offer a precise decomposition of those rewards into three sources,” Tobam writes. “First, the monetization of a big a part of the pre-existing premium into ebook worth. Second, making the most of the efficiency of bitcoin to which it has a rising publicity, and at last being topic to the variations in its bitcoin worth premium.”

Three Key Causes for Technique’s Success

Tobam explains that first, Technique takes benefit of the premium on its shares by promoting them and utilizing the proceeds to purchase further bitcoin. The objective is to extend the corporate’s bitcoin yield, or the proportion change of the variety of bitcoins held for every totally diluted share.

Secondly, because the agency will increase its bitcoin yield, its shares more and more amplify the cryptocurrency’s worth appreciation, what Tobam calls “bitcoin efficiency.”

Lastly, MSTR’s bitcoin worth premium, or the additional greenback worth per bitcoin held, has fluctuated in a manner that contributes to the inventory’s outperformance relative to bitcoin itself.

( BTC vs MSTR efficiency and the way every of Tobam’s 3 components contributes to MSTR’s efficiency / Tobam: “Accounting for the efficiency of MicroStrategy”)

Briefly, Tobam concluded that Technique has grow to be a leveraged guess on bitcoin, however its means to outperform the digital asset is a mixture of those three components and never merely as a consequence of passively holding bitcoin.

“The efficiency of MSTR can’t be summarized solely by the variations in its bitcoin holdings and ratio premium,” the paper concludes.