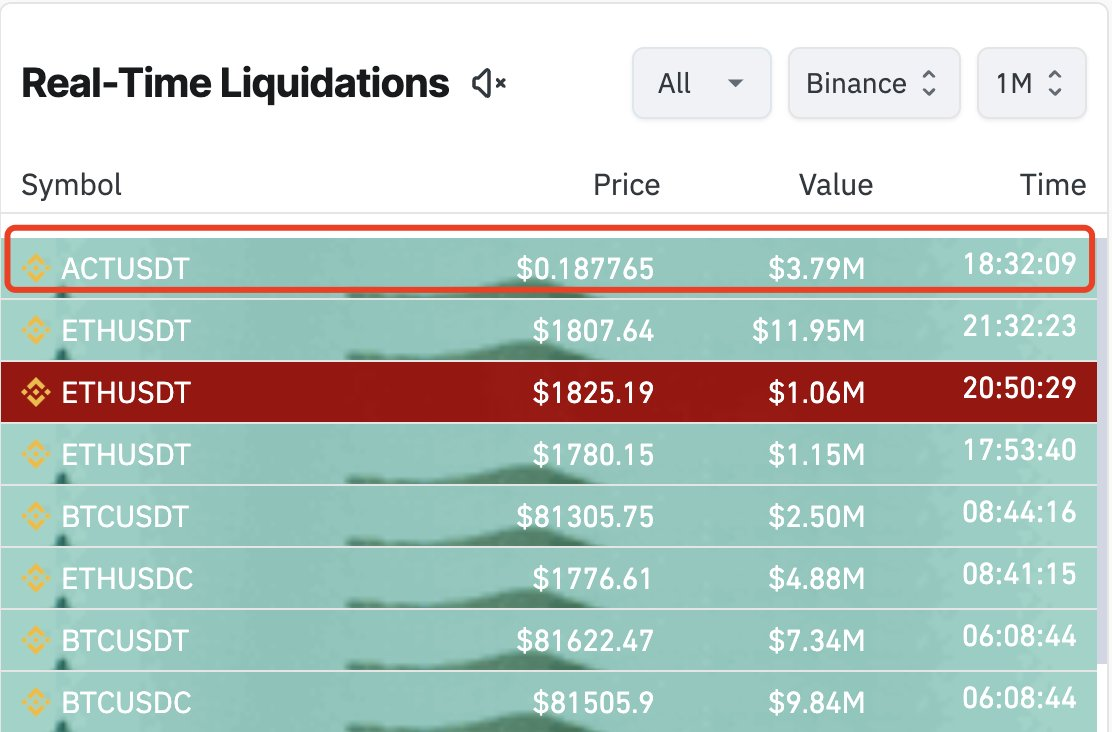

A cryptocurrency dealer suffered a $3.79 million loss after Binance unexpectedly up to date leverage and margin tiers for choose tokens.

One of many affected tokens was Act I (ACT), the place the dealer’s $3.79 million place was liquidated at $0.1877, based on the most recent on-chain knowledge retrieved by Finbold from Lookonchain on April 1.

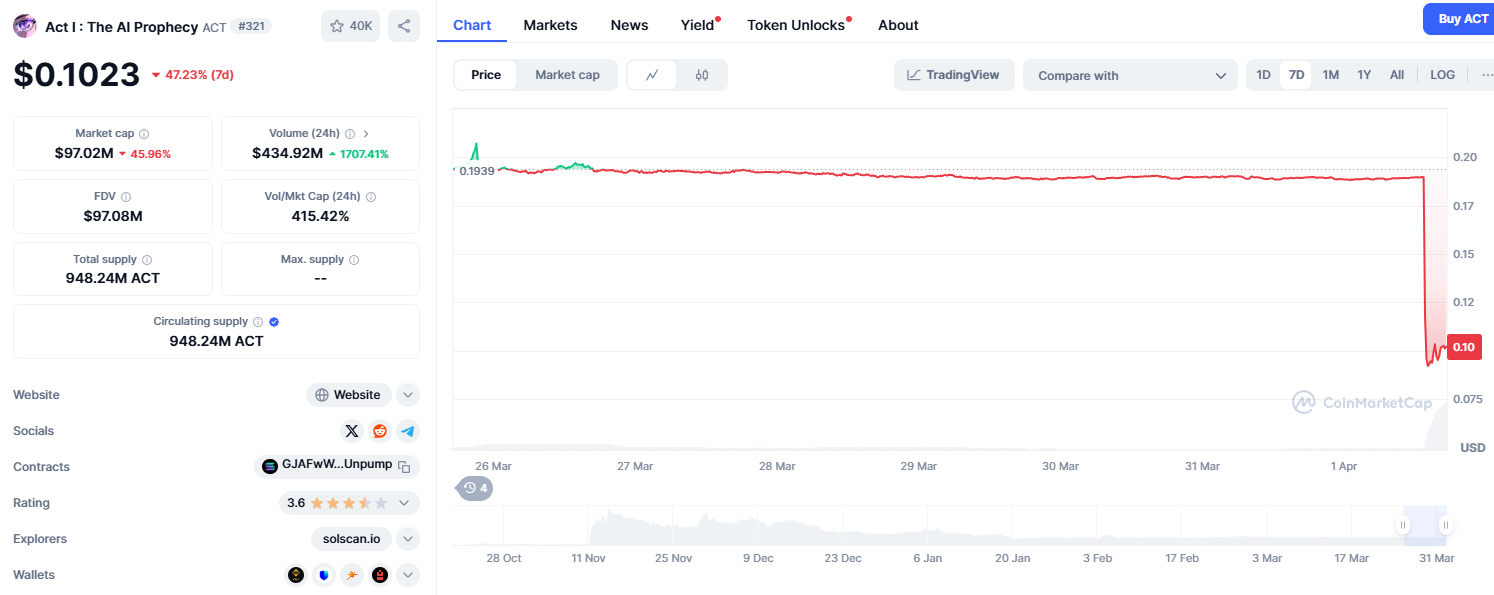

After the liquidation, one of many largest for the day, ACT skilled an enormous value drop. As of press time, the token was buying and selling at $0.1018, down 46% within the final 24 hours and practically 50% on the weekly timeframe.

This value collapse has compounded losses for these nonetheless holding leveraged positions.

Notably, the ripple results of the ACT liquidation prolonged past the token itself, impacting the broader altcoin market, particularly these tied to synthetic intelligence (AI) initiatives.

Binance futures replace

The buying and selling platform revealed the modifications in a weblog publish, saying updates to leverage and margin tiers for a number of USDⓈ-M perpetual contracts, together with 1000SATSUSDT, ACTUSDT, PNUTUSDT, NEOUSDT, NEOUSDC, TURBOUSDT, and MEWUSDT. Notably, the modifications aimed to regulate the danger parameters for futures buying and selling on these tokens took impact on April 1, 2025, at 10:30 UTC.

Nevertheless, the replace got here with a warning stating that present positions opened earlier than the replace can be affected, and futures operating on the grid would possibly expire because of the new leverage and margin tiers.

Apparently, the world’s largest crypto buying and selling change suggested customers to assessment and modify their positions to keep away from potential liquidations. Subsequently, it may be interpreted that the whale dealer in query was caught off guard.

It’s price noting that in crypto futures buying and selling, leverage permits merchants to regulate bigger positions with much less capital, however it additionally amplifies danger.

Margin tiers, alternatively, decide the required collateral primarily based on leverage and place measurement. When exchanges like Binance regulate these tiers, they have an effect on leverage limits and liquidation thresholds. If a dealer’s place not meets necessities, it might be forcibly liquidated, resulting in additional losses.

Featured picture through Shutterstock