Ethereum has suffered yet one more blow this week, sliding to a contemporary low of round $1,380 — a degree not seen since March 2023. The continued downtrend has left traders more and more involved, with many now questioning whether or not ETH’s long-term bullish construction remains to be intact. Market situations stay harsh, pushed by persistent macroeconomic tensions, rising world instability, and uncertainty stemming from U.S. commerce and financial insurance policies.

Sentiment throughout the crypto house continues to deteriorate, and Ethereum’s worth motion displays that unease. After months of struggling to carry key help ranges, the breakdown under $1,500 has added to fears {that a} deeper correction could also be unfolding.

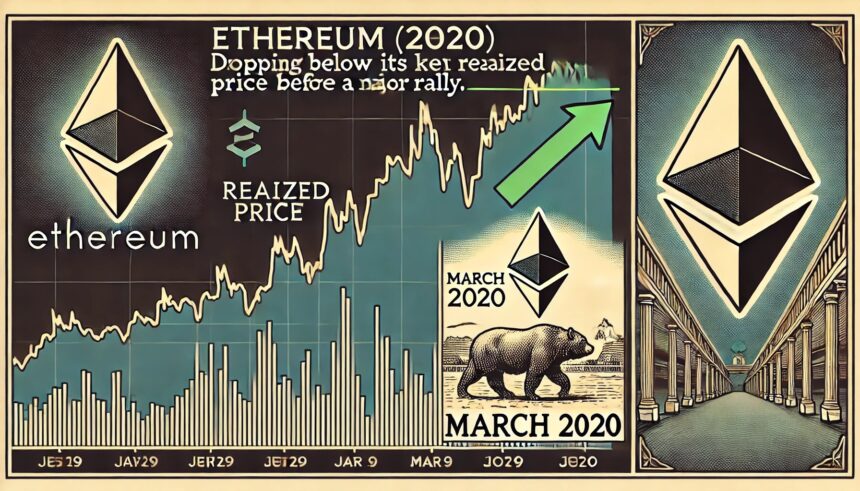

Nevertheless, amidst the gloom, there could also be a silver lining. In response to CryptoRank knowledge, Ethereum is now buying and selling under its realized worth — a uncommon prevalence traditionally related to market bottoms and powerful restoration phases.

Whereas the near-term outlook stays unsure, such uncommon on-chain alerts might point out that Ethereum is getting into a key accumulation zone. The approaching days and weeks can be crucial in figuring out whether or not that is simply one other leg down — or the start of a long-term reversal.

Ethereum Sinks Under Realized Value As Concern Takes Over The Market

Ethereum has now misplaced over 33% of its worth since late March, triggering deep concern amongst traders and analysts alike. The worth plunge has introduced ETH all the way down to ranges not seen in over two years, sparking panic and despair amongst holders who as soon as anticipated 2025 to be a breakout yr for altcoins. As a substitute, Ethereum has turn into a logo of market fragility because the broader macroeconomic panorama continues to worsen.

Commerce struggle fears, inflationary stress, and a possible world recession are shaking monetary markets to their core. On this local weather, high-risk belongings like Ethereum are among the many first to endure. As capital exits speculative belongings in favor of safer havens, ETH’s selloff has solely accelerated — and investor confidence has taken a severe hit.

Nevertheless, there could also be a glimmer of hope within the knowledge. Prime crypto analyst Carl Runefelt not too long ago identified on X that Ethereum is now buying and selling under its realized worth of $2,000 — a uncommon prevalence that has traditionally signaled main turning factors in ETH’s worth trajectory.

Runefelt emphasised that the final time ETH dipped under its realized worth was in March 2020, when it crashed from $283 to $109 — solely to recuperate strongly within the following months. Whereas the present setting is stuffed with uncertainty, such on-chain metrics trace on the risk that ETH is getting into an accumulation part as soon as once more.

Nonetheless, confidence stays fragile, and worth motion should stabilize earlier than any actual bullish narrative can return. Ethereum’s subsequent strikes can be crucial in figuring out whether or not this degree marks a real backside — or simply one other cease on the way in which down.

ETH Struggles Under $1,500 With No Clear Help in Sight

Ethereum is presently buying and selling under the $1,500 degree after struggling a brutal 50% decline since late February. The aggressive selloff has erased months of positive factors and left traders in a state of uncertainty, as ETH reveals no indicators of restoration. Market sentiment stays overwhelmingly bearish, and there may be little indication {that a} backside has been reached.

At this stage, Ethereum lacks a clearly outlined help zone. Bulls have misplaced management, and worth motion continues to float decrease with weak demand and rising concern. For a significant reversal to start, ETH should first reclaim the $1,850 degree — a zone that beforehand served as a key help and now stands as main resistance.

Till that occurs, any upside try is prone to be met with robust promoting stress. The state of affairs turns into much more precarious if Ethereum loses the $1,380 degree, which has to date acted as a psychological threshold. Falling under this space might open the door to a deeper correction towards the $1,100–$1,200 vary.

With macroeconomic tensions nonetheless excessive and volatility anticipated to persist, merchants and traders can be watching intently to see whether or not Ethereum can stabilize — or proceed its sharp decline.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.