- Within the final 24 hours, Ethereum whale wallets have moved greater than $174 million again to wallets off main exchanges.

- Whale addresses now management 46% of ETH provide, which is seen as a rise in centralization.

- Ethereum is approaching the realized value level, which suggests deep worth shopping for or selloffs.

Ethereum’s whale exercise has risen considerably previously few weeks, pointing to indicators of accumulation on the a part of the whales. In line with Lookonchain knowledge, three main wallets have withdrawn 85,668 ETH, or the equal of $174,503,634, out of exchanges since February.

One of many Metalpha pockets addresses moved their Binance storage and exchanged $48.73 million 29,000 ETH from the alternate after April 1st. One other tackle, 0xd81E, pulled 46,577 ETH, valued at $97.26 million, from Gate.io beginning mid-February. The third pockets, 0x6034, took 10,091 ETH from Bybit, roughly $18.8m, inside a month since March twelfth.

Whales are accumulating $ETH!

A pockets linked to Metalpha has withdrawn 29,000 $ETH($48.73M) from #Binance since Apr 1.

0xd81E has withdrawn 46,577 $ETH($97.26M) from #Gateio since Feb 15.

0x6034 has withdrawn 10,091 $ETH($18.8M) from #Bybit since Mar 12.… pic.twitter.com/yUXpsLTjQm

— Lookonchain (@lookonchain) April 18, 2025

These massive actions additional present that accumulation amongst Ethereum whales, typically seen as early buyers, establishments, or hodlers funds, is a risk. These transactions happen at a time when Ethereum has approached a key technical worth, which is its realized value.

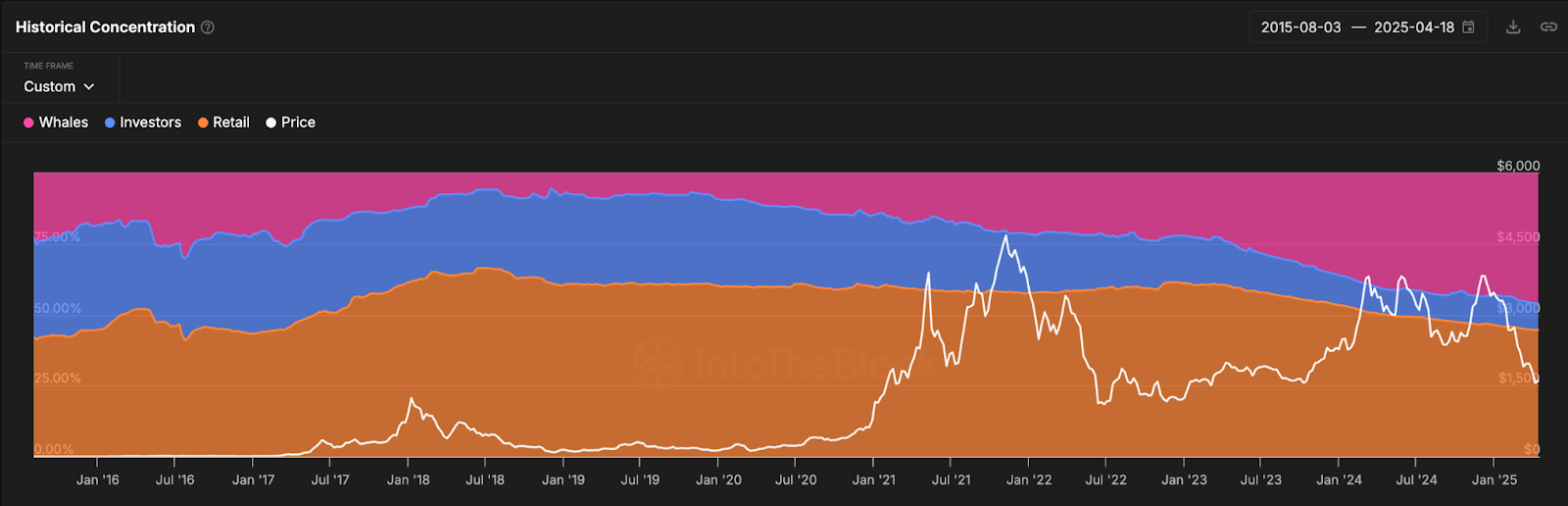

Focus Rises as Retail Shrinks

The whale dominance of ETH managed by whale addresses has risen to 46%, the very best stage seen since 2015, in accordance with IntoTheBlock. These long-term investor wallets, holding over 1% of the circulating provide, have solely continued to extend. Alternatively, smaller buyers and retail holders addresses’ actions have decreased total possession.

Supply: IntoTheBlock

This variation within the retail-to-whale possession ratio dramatically shifts Ethereum’s possession construction. Massive buyers corresponding to whales surpassed particular person buyers on March 10. Since then, they’ve elevated their share by 3%, elevating considerations in regards to the networks’ centralization.

In line with the brand new holdings matrix, whales with between 1,000 and 100,000 ETH personal $59 billion value of the asset, amounting to 25.5% of the full circulating provide. These addresses additionally don’t embrace the centralized alternate wallets, suggesting that extremely funded gamers are outdoors the centralized alternate atmosphere.

Such a stage of concentrated management may result in publicity to organizational vulnerabilities. If main holders rotate capital or dump holdings, that might set off a series response in a market that lacks relative participation by the one lively participant, retail buyers.

Ethereum Approaches Historic Worth Ground

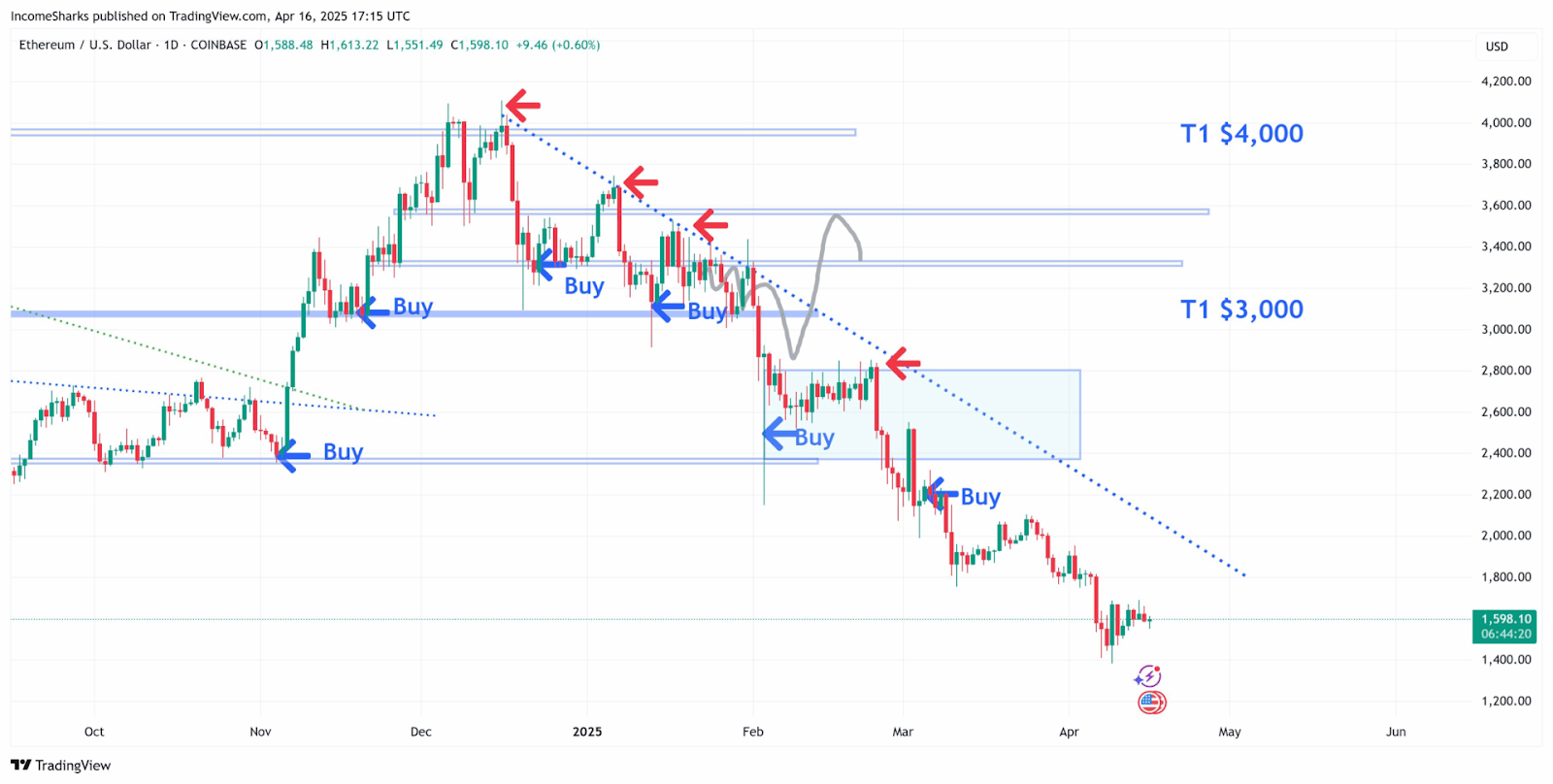

As Ethereum nears its realized value, technical analysts are monitoring indicators for indicators of reversal or breakdown. As identified by analyst Abramchart, the ETH is on the decrease Bollinger Bands, that are characterised by macro bottoms and the start of bull phases.

Supply: CryptoQuant

“If the development continues downward, it may sign deep-value accumulation,” Abramchart mentioned. Nevertheless, in addition they famous that getting under this stage could delay the bearish pressures and affirm extra losses.

Brief-term sentiment stays fragile. Standard dealer IncomeSharks famous that some bearish traits from the sooner dip-buying makes an attempt have been additionally non-profitable. “Shopping for each dip doesn’t all the time work,” they wrote, urging warning amid ongoing volatility.

Supply:X

Strategic Strikes or Purple Flags?

Whereas the whales’ enhance reveals their confidence in Ethereum’s long-term potential, it additionally poses questions on future market traits. With ETH whale addresses holding over 25% of the full provide, the market could quickly be extra fragile to massive holders’ actions.

Massive-scale actions such because the $100 million ETH switch by Galaxy Digital additionally show the extent of possession by these entities. Whether or not these actions are indicators of strategic posturing to liquidation is, nevertheless, not clear.