Actual Imaginative and prescient’s chief crypto analyst Jamie Coutts believes one catalyst may catapult Bitcoin (BTC) to almost double its worth in months.

Coutts says the whole international liquidity has reached a brand new all-time excessive stage of just below $140 trillion after a decades-long interval of contraction.

In line with Coutts, international liquidity is what has “traditionally fueled explosive asset worth rallies.”

Supply: Jamie Coutts/X

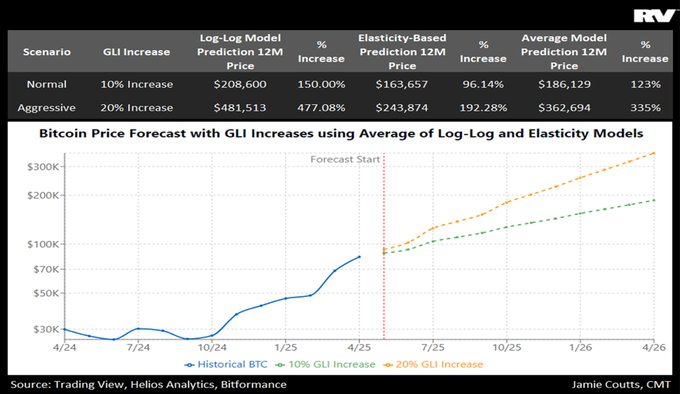

Actual Imaginative and prescient’s chief crypto analyst says the whole international liquidity is about to proceed climbing and this might set off a rise of round 98% within the worth of Bitcoin.

“With central banks clearly behind the curve, we may see international liquidity rise by roughly 10% or $13 trillion over the following 12 months. This might equate to $186,000 BTC utilizing a blended regression mannequin.

Those that held regular and collected throughout latest market turbulence must be higher for it in what comes subsequent.”

Supply: Jamie Coutts/X

Bitcoin is buying and selling at $93,772 at time of writing.

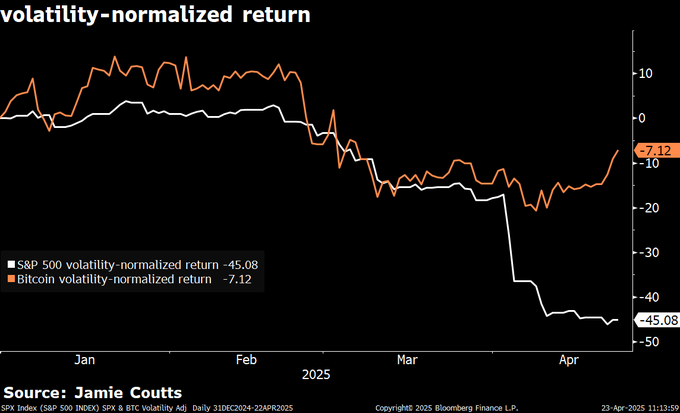

The crypto analyst additional says that Bitcoin’s volatility ranges are shifting in an inversely correlated method relative to conventional property.

“It has been patently clear to me since 2022 that whereas Bitcoin’s volatility is reducing, what’s extra hanging is that conventional property have gotten extra risky. Volatility isn’t the enemy, by the best way, supplied you’re being compensated by greater returns.

That’s not the case for Bonds and Equities relative to Bitcoin. And this has large implications for asset allocation and portfolio building going ahead.”

In line with Coutts’ chart, based mostly on knowledge from the final 4 months, Bitcoin has recorded a volatility-normalized return of -7.12 in comparison with the S&P 500 index’s -45.08. The volatility-normalized return is a efficiency metric that compares the return on funding of an asset to its volatility – the upper the determine, the higher the risk-adjusted return.

Supply: Jamie Coutts/X

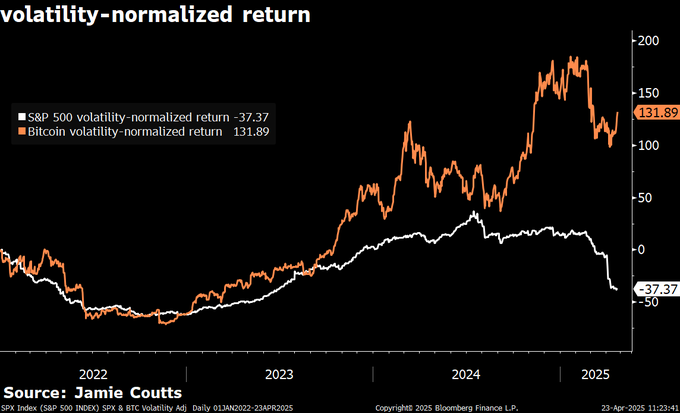

Since 2022, Bitcoin has recorded a volatility-normalized return of 131.89 in comparison with the S&P 500 index’s -37.37.

Supply: Jamie Coutts/X

Generated Picture: Midjourney