This can be a section from the Ahead Steering e-newsletter. To learn full editions, subscribe.

The US financial system contracted within the yr’s first three months. It’s the primary quarterly decline since 2022.

At the moment’s superior GDP estimate for Q1 confirmed a 0.3% annualized decline, sending shares decrease, and Treasury yields and gold increased. Analysts had anticipated GDP to develop 0.4% within the first quarter.

The report comes a day after President Trump marked 100 days in workplace, throughout which era the S&P 500 notched its worst efficiency (-7.3% since Inauguration Day) because the first 100 days of President Nixon’s second time period. The Nasdaq Composite misplaced 11%, which is the largest drop since President Bush’s first time period in 2001.

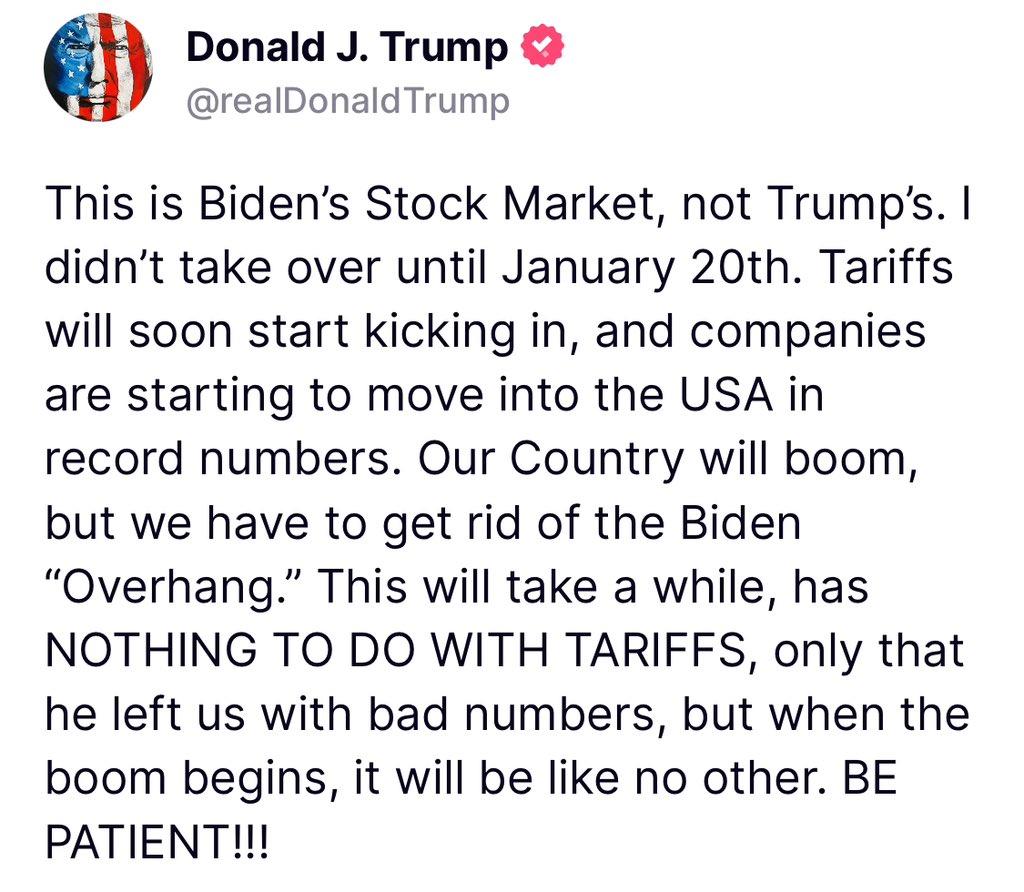

In a Reality Social submit Wednesday, Trump insisted that “That is Biden’s inventory market, not Trump’s.”

Whereas the “Liberation Day” tariffs got here firstly of the second quarter, the Q1 knowledge recommended that customers and companies began making ready for extra aggressive commerce insurance policies firstly of the yr. The primary quarter noticed a rise in imports alongside declines in client and authorities spending — the proper recipe for a adverse print.

Imports had been up greater than 41% in Q1, in contrast with a 1.9% decline within the final quarter of 2024. Items imports had been up greater than 50%, displaying that customers and companies had been in a rush to safe bigger purchases and enhance inventories forward of anticipated tariffs.

The GDP print, as anticipated, falls between projections from the Atlanta Fed’s GDPNow (-1.9%) and the New York Fed’s Nowcast (2.6%).

Additionally right now, the Treasury Division introduced plans to revamp its buyback program. There may very well be “potential enhancements” made to the acquisition quantities, scheduling and frequency, Treasury mentioned in a press release.

The replace comes after Treasurys bought off earlier this month, sending yields increased and elevating considerations a few slowing financial system and tightening monetary situations. The surge in yields, Trump mentioned, was regarding sufficient for him to pivot on a few of his tariff insurance policies; he issued the 90-day pause on most international locations only a week after Liberation Day.

Now traders are ready for indicators that the administration is inking commerce offers with different international locations. After feedback from Treasury Secretary Scott Bessent that the scenario with China is “unsustainable,” shares felt some short-term reduction, however have since faltered on the restoration path.