Crypto inflows prolonged their streak of constructive flows final week, with complete inflows over the previous three weeks reaching $5.5 billion.

It comes amid rising optimism available in the market, with macroeconomic information including to the checklist of tailwinds for the pioneer crypto.

Crypto Inflows Reached $2 Billion Final Week

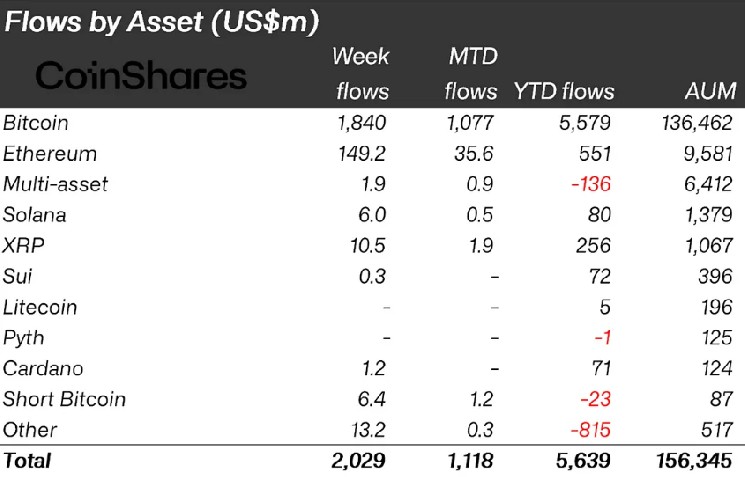

The newest CoinShares report signifies that crypto inflows reached $2 billion final week, marking the third consecutive stream of constructive flows.

The week prior, crypto inflows reached $3.4 billion as buyers turned to digital belongings for his or her haven standing. Earlier than that, inflows into digital asset funding merchandise have been $146 million, the place XRP bucked the development.

Final week, nevertheless, Bitcoin was the prime beneficiary, recording as much as $1.8 billion in inflows. Equally, Ethereum noticed the second week of strong inflows reaching $149 million. In the meantime, friends resembling Solana noticed minor inflows of $6 million.

CoinShares cites optimism available in the market regardless of Trump’s tariffs, ascribing the bullish sentiment to constructive US financial indicators final week.

Particularly, markets closed the week optimistically, pushed by sturdy employment information regardless of earlier weak GDP figures. Headline GDP fell 0.3%, impacted by export declines as a consequence of US tariffs. Nevertheless, core GDP, reflecting personal sector power, rose 3.0%.

Partially, CoinShares’ researcher James Butterfill ascribes this to companies preempting tariffs. Futures markets now anticipate 86 foundation factors (bps) of fee cuts in 2025, although sturdy payrolls (177k vs. 135k anticipated) and elevated core PCE inflation scale back the chance of an FOMC fee minimize on Wednesday.

“We consider the present information is probably going inadequate to immediate the Federal Open Market Committee (FOMC) to chop charges at subsequent Wednesday’s assembly,” wrote Butterfill.

Companies inflation reveals weak spot, suggesting cautious shopper habits. Equities and Bitcoin stay delicate to tariff developments, with employers delaying job cuts.

Towards these backdrops, digital asset funding merchandise proceed to register constructive sentiment, with Bitcoin’s momentum trying constructive, notably within the US.

“Our newest Digital Asset Supervisor Fund Survey displays this evolving sentiment: investor desire for Bitcoin has strengthened post-U.S. election, with 63% of respondents now holding it—a 15 proportion level improve since January. Digital asset weightings have risen to 1.8%, the very best degree in a 12 months, pushed by each worth appreciation and enhancing sentiment. Institutional allocations have climbed to a median of two.5%,” Butterfill defined.

But, regardless of Bitcoin’s enhancing sentiment, CoinShares highlights that each new and seasoned buyers proceed to quote volatility as their high concern.

In keeping with Butterfill, this highlights a persistent disconnect between perceived danger and precise market habits.

Bitcoin Value Efficiency. Supply: BeInCrypto

BeInCrypto information reveals BTC was buying and selling for $93,997 as of this writing. It was down by virtually 2% within the final 24 hours, having slipped beneath the $94,000 vary on Monday.